Edit: Nothing to see here. My misunderstanding. Please move along.

I used to take comfort from steadily rising consensus forecasts, however, there is an element of historical revision. I think visibility of how erratic they can be reduces the importance of the trend, especially if for a point in time, the trend can be subsequently revised, several months after the fact.

I spotted this because I sold in October Vitec (LON:VTC), after tightening stops as a result of a falling broker consensus. In March my historic notes and a review of why I exited suddenly didn't make sense until I reviewed the history.

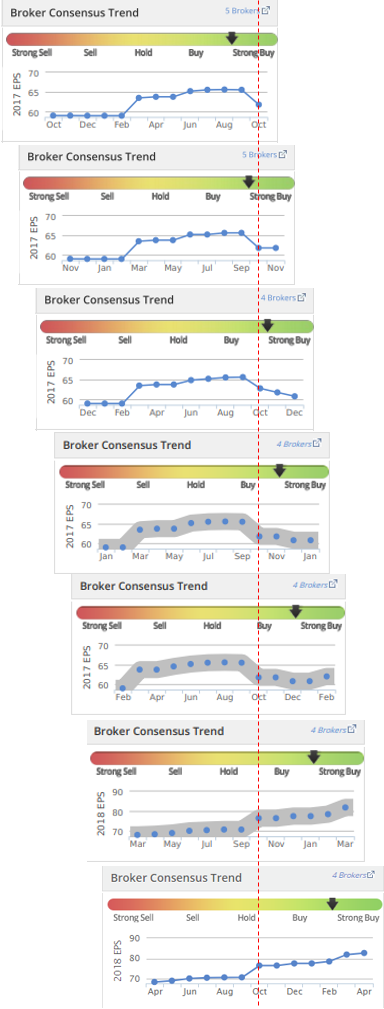

Below is what happened to the trend as we roll forward one month at a time.

I'm wondering how this affects calculations based on the movement in forecasts?

The revision occurs as a result of a transition between 2017 EPS and 2018 EPS, however, this only highlights the cause and doesn't reflect the figure that was forecast at that point in time.