Suppose I proposed to you that instead of picking stocks this year, you could have a lucky dip and pick a ball from one of two hats, Hat A or Hat B. Each hat is full of several balls which are coloured either green or red and have a percentage printed on them, where green balls have positive numbers and red balls have negative numbers. The result of the draw is equivalent to your investing performance for the year.

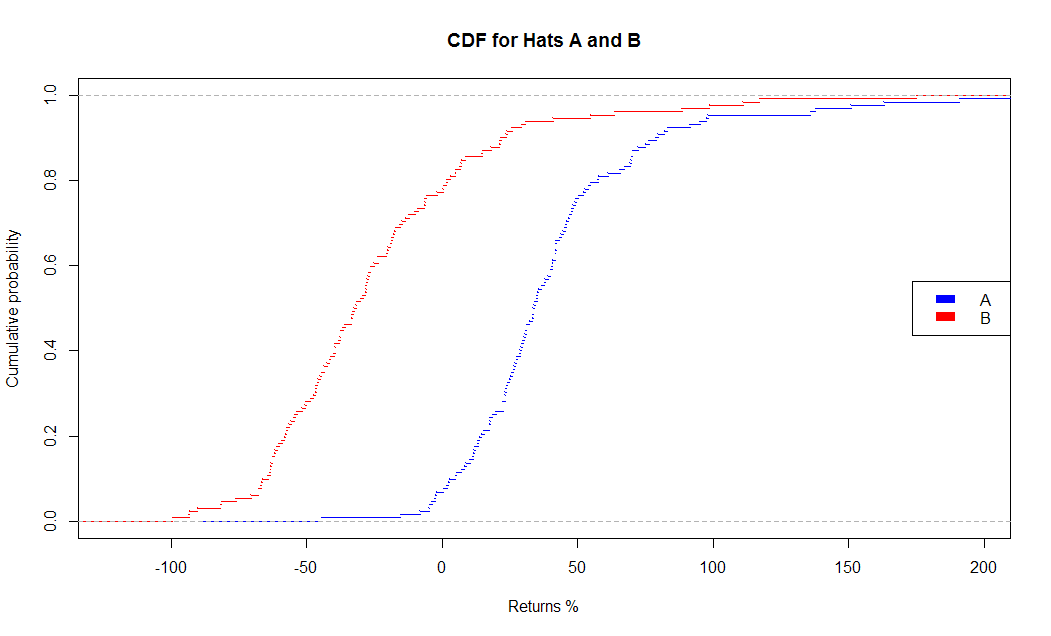

First things first, you need to choose your hat. To help you decide I tell you that 71% of the balls in Hat A are green, whereas only 46% of the balls in Hat B are green. However the big attraction of Hat B is that there is almost a 7% chance of picking a green ball with a value greater than 100%, whereas in Hat A there is a only a 3.5% chance of picking a green ball with a value greater than 100%.

Still undecided?

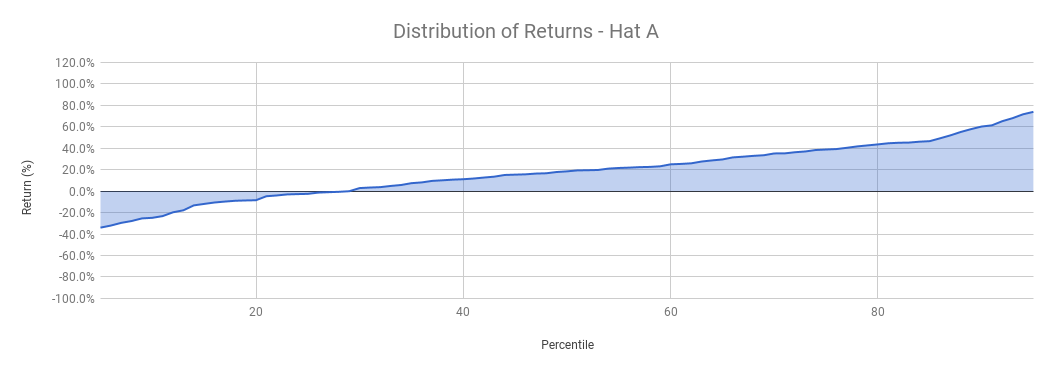

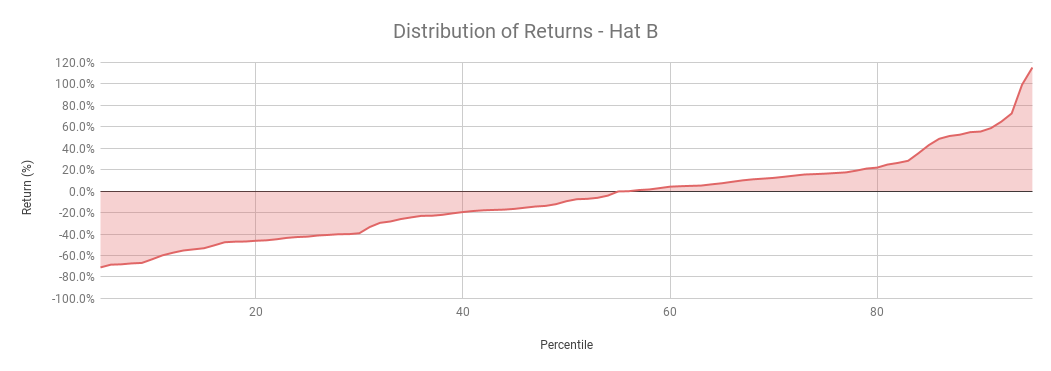

How about I show you the 5% - 95% (5% lowest to 5% highest) distribution of values printed on the balls for each of the hats.

You would choose Hat A, right? Although if you are lucky enough to pick a high value winner it will be lower return than for Hat B, more of the balls have positive numbers and the loss given a negative number is significantly reduced.

So why not do the same when picking stocks?

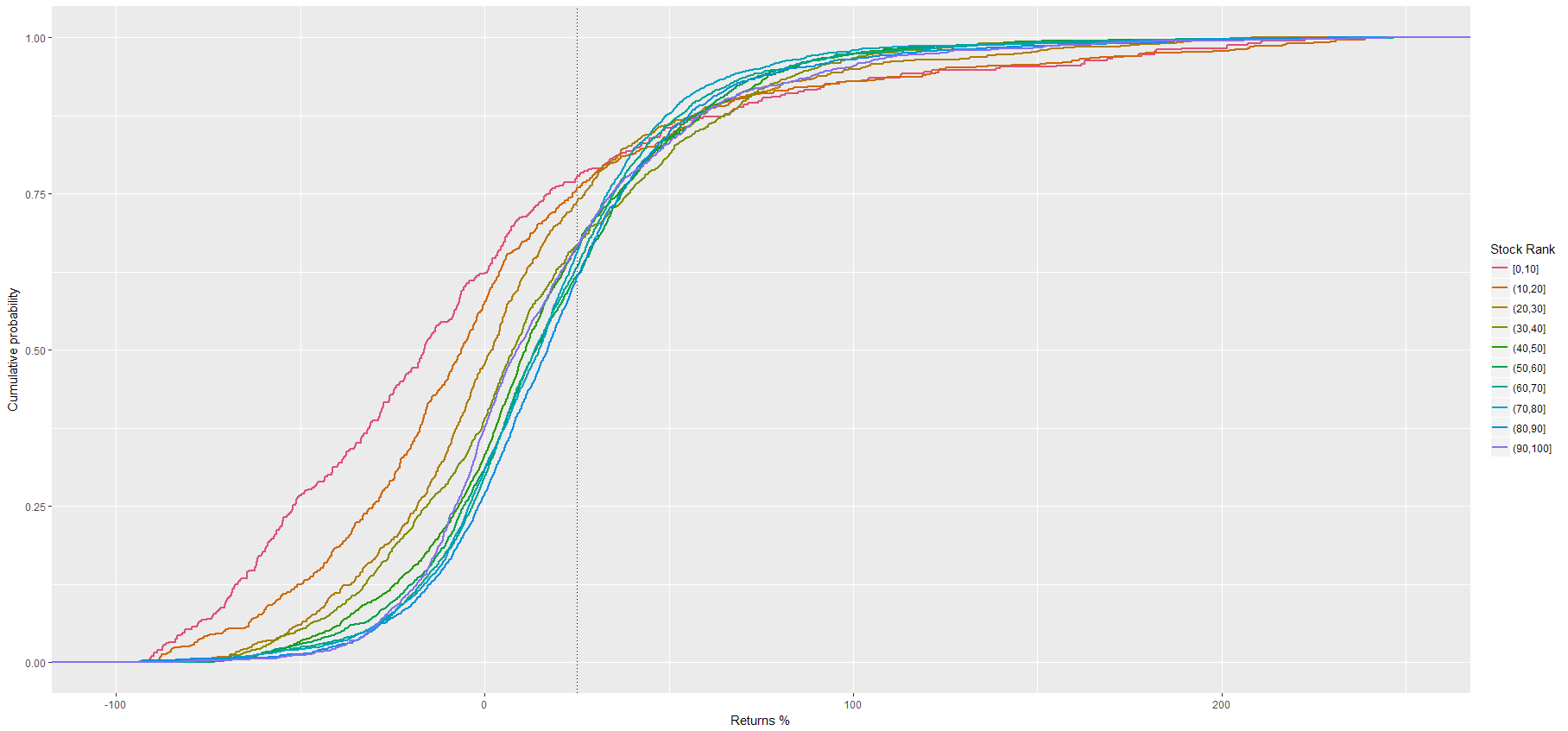

As you may have guessed, the distributions shown above are not for balls in a hat but actually the performance of stocks in 2017. Hat A is the distribution of performance for stocks from within our top decile of StockRanks in 2017, that is the good, cheap improving stocks with the highest exposure to Quality, Value and Momentum, whereas Hat B is the distribution of returns for the bottom decile.

As previously mentioned, you could have been lucky enough to pick a great winner from the bottom decile of StockRanks - congratulations to those who picked Falcon Oil & Gas or Oxford Biomedica - but the skew is certainly against you.

Choosing a top ranked stock from the universe wouldn’t have guaranteed a positive return either, as many as 29% were losers in 2017…