Whilst most sectors have been adversely affected by the consequences of the global pandemic and will continue to suffer the effects for the foreseeable future, the outlook for the Health Care sector is much more promising.

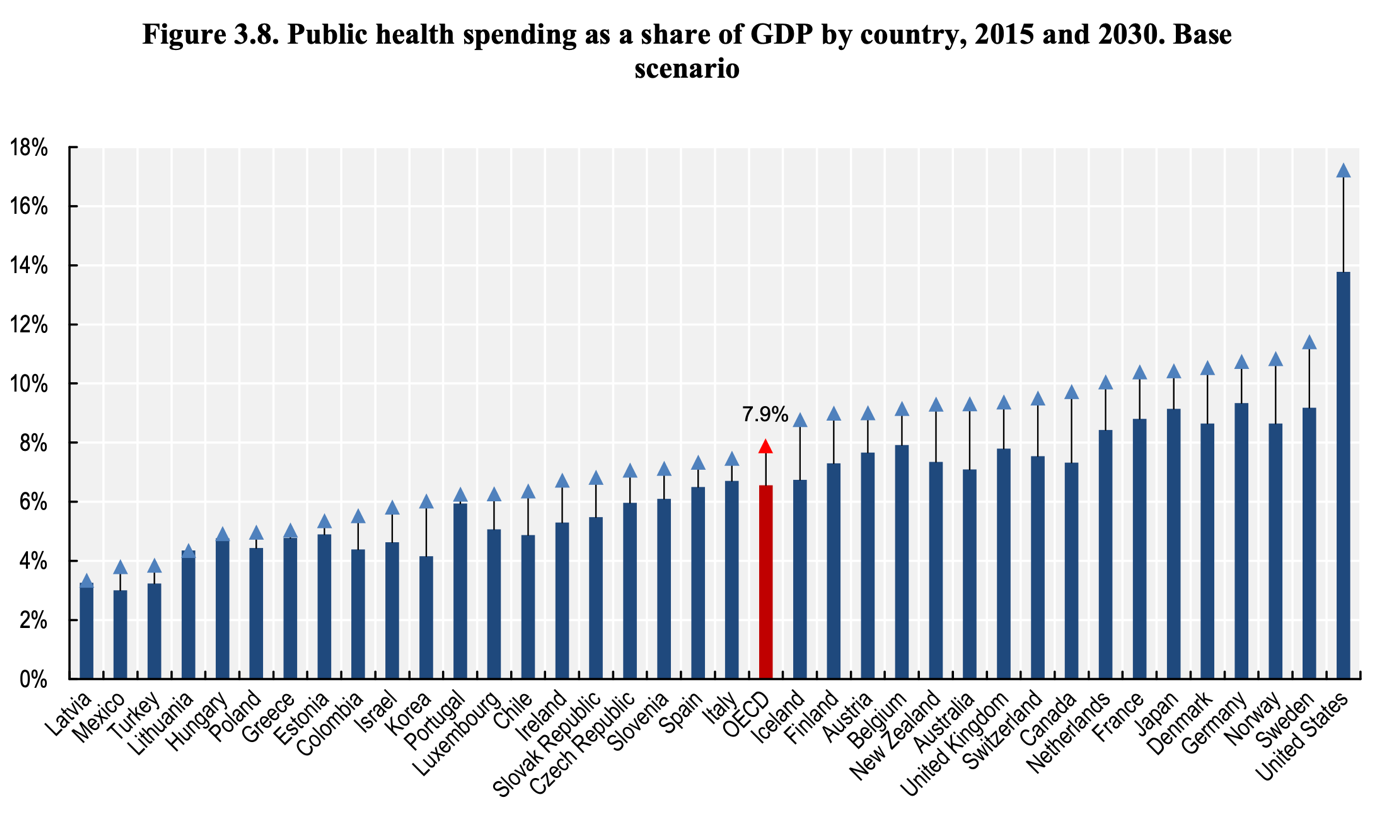

Research carried out by Deloitte showed that global health care spending is expected to rise at a compound annual growth rate of 5% over the period from 2019-2023, and the OECD estimates that public health spending as a share of GGP will grow from 6.6% in 2015 to 7.9% in 2030. This trend is likely to accelerate as a result of Covid-19.

Source: OECD

Naturally, a global pandemic, which has now infected over 11.5 million people in more than 200 countries, has meant that the Health Care sector has significantly outperformed most sectors of the economy. Though a return of -0.85% is not what one might perceive as strong performance, it is when compared to a -18.89% return of the FTSE All Share over the same time frame.

Interestingly, the overall negative performance of the Health Care sector can be attributed to one industry in particular, the Healthcare Equipment & Services industry. This article will examine the reasons for this and discuss the performance of the industries within the Health Care sector in more detail. The article will also assess the industry groups from a valuation perspective and evaluate how the top-ranking stocks in the sector are responding to the surging demand for diagnostics, medical equipment, treatment and vaccine solutions to cope with Covid-19.

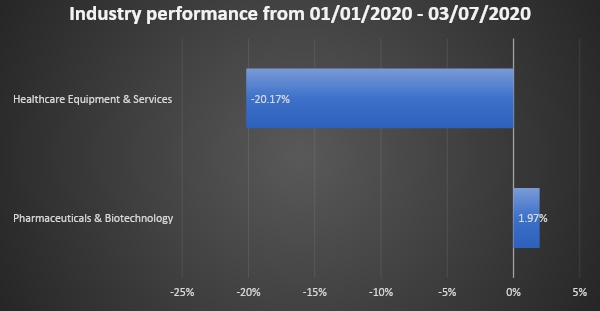

Performance of the Industry Groups

The FTSE All Share Health Care sector benchmark is comprised of two industry groups. As can be seen by the chart above, the Healthcare Equipment & Services industry has experienced a sharp deterioration in performance since the start of the year, dropping -20.17%. On the other hand, the larger Pharmaceuticals & Biotechnology industry has managed to appreciate by 1.97% over the same period.

Each of the 7 constituents in the Healthcare Equipment & Services industry has seen their share price decline over the past 6 months, and this has been due to a variety of factors. The worst performers have been independent hospital group Spire Healthcare and private healthcare service provider Mediclinic International, which have respectively lost -37.7%…