Capita (LON:CPI) the next Carillion?

what about interserve, theyre share price is in freefall

Capita (LON:CPI) the next Carillion?

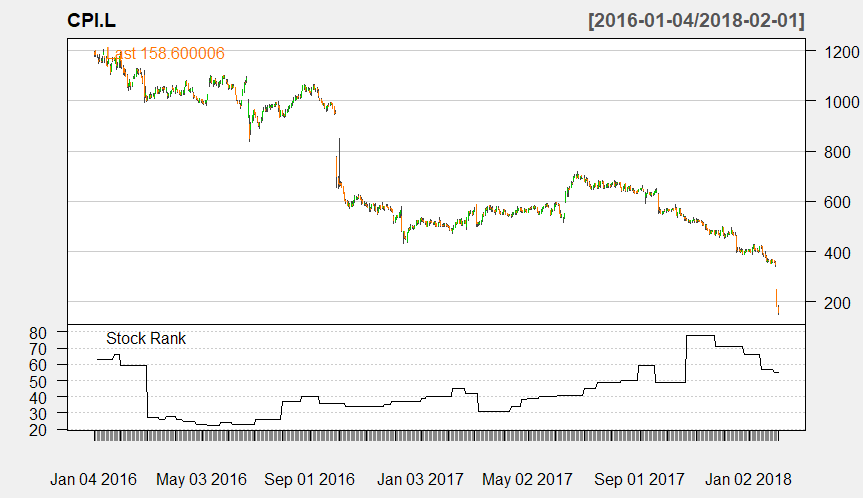

because I don't have a subscription. Stockopedia have recently published article suggesting that their Stock Ranks system is a useful sell signal, and this would be another interesting test case.

It'd be interesting to know what the Stock Rank on this one was before the share price collapse.

Not hugely indicative I would say:

There is an interesting 'hump' in the SR from about late sep 17 to Feb 18.

As a subscriber you do get access to historic SR on a monthly basis

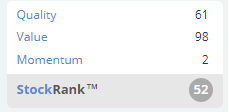

| Date | Q | V | M | SR |

|---|---|---|---|---|

| 2 Sep 17 | 52 | 67 | 52 | 58 |

| 7 Oct 17 | 74 | 89 | 42 | 81 |

| 11 Nov 17 | 76 | 91 | 25 | 74 |

| 2 Dec 17 | 77 | 92 | 18 | 70 |

| 6 Jan 18 | 60 | 94 | 11 | 57 |

| 4 Feb 18 | 61 | 97 | 6 | 54 |

(all errors are mine)

You can see M fall, V rise - i.e. the SP is collapsing and the PER is ~3

Nick has collected the historic ranks over time himself.

See https://www.stockopedia.com/co...

This was one of his points in that post - a high value rank is not necessarily an indicator of high value, it may be that the SP is simply collapsing and no announcement on profits / divi has been made.

Now the divi has been suspended and the profit forecast cut, I expect the Q and V values to fall.

My takeaway is that a good SR is correlated with a good future return (in the uk so far...)

But it should never be forgotten that all the ranks are based on historic data (yes, they do refer to broker estimates, but it looks at relative historic changes over time and not the actual values)

In times of stress or fast change, the ranks will lag.

Back on CPI - holders of this share look to be Woodford (not doing too well for himself) and me (share options) - and everyone else thinks it is either going under or is totally evil.

Shareholders need to be reminded hat a dividend is money that is not needed by the company.

Things will be difficult in the short term - and I think it has further to fall - but - imo - this is heading towards a value opportunity.

As Andrew said I had to create it myself from records of historical Stockrank. (Seasoned R users might recognise the brutalism of a "chartSeries" plot.)

Andrew's table is very good. If you were looking for a "time to sell" trigger I might venture that Value rising above about 75 is a warning sign.

Capita (LON:CPI) in fact had a sudden dramatic rise in Value around Sep-Dec 2016 from 32 in Sep-2016 to 68 in November and 73 in December following a 29-Sep trading update. The Quality barely changed.

After that shift, Capita (LON:CPI) settled into a new regime of Value in the 60s-70s until Sep 2017 when Value lurched up to the low 90s where it remains to this day.

Thanks Nick / Andrew. I see I have some reading / understanding to do!

I'd not seen your discussion post Nick. I seem to be missing out on some great work. Thank you.

Any thoughts/rumours/blind guesses on where Capita might price the rights issue?

I think it will need to be at quite a discount. If they price it at say £1.05, in order to raise £700 mil, the company will need to issue a (rather pleasing) 666.666 million shares. With the result then being a rough doubling of the shares in issue.

The full year's earnings release is due today and as it is now ~1pm, and no sign of it, not looking good.

This is quite a delay in reporting, wonder what's going on behind the scenes causing things to take this long?

I am guessing two things, which to some extent are contradictory

1 the new CEO wants to kitchen sink all the bad news he can find. This is so he can have a clear run into the future but it does have the effect of reducing profitability and apparent financial strength.

Some of these issues may not have been announced I.e. managers on the ground knew a contract was at point of failure in June 17 but this has not yet formally happened

Can that failure be placed in the 16-17 year (I have no idea)

This means in the short term the sp will be badly hit.

2 they need to raise 750m at the best possible price so they need the sp to be as high as possible to reduce dilution.

.... or it may be that they are unable to raise at any price

Reuters 27 March :

..Capita Capita (LON:CPI) will

publish a five-year transformation plan and details of a rights issue with its annual results on April 26, a person familiar with the matter said, giving the services group a clean slate after a raft of profit warnings.

...

Chief Executive Jonathan Lewis, on board since December, aims to simplify and unify an unwieldy structure in which more than 250 different business units have operated "like separate silos," the source told Reuters late on Tuesday. Capita will publish results with the overhaul plan aimed at paying down debt, giving markets a clear basis on which to invest, the source said.

Lewis sees potential in the fact Capita is only selling more than one service to just 4 percent of its customers, and cost-savings potential in implementing an overarching structure which was lacking up to now.

....

-----------------------

...So 26 April

Given today's 8.3% slide cf a 0.42% rise in the FT 250, the market is not feeling too optimistic about this.

You can check stock reports for past dates by pressing an arrow down button next to grey Print button on top right hand. For 06 Jan 18 stock report the rank was not too bad at 57, but Altman score was in Distressed, and Magic formula score was poor at C-, which would be the warning signs that it's very high risk stock.

The stockrank @23/04/18 - actually all stockranks

reflect historic knowledge for the most part (if it really could see into the future we would have private islands by now).

Most of the time new knowledge (new results, share price movements, announcements) are not too different from the last published set - or too different from broker expectations - so these values change gradually.

In the case of Capita (LON:CPI) we know the unknown future will be very different from the past. Not least the balance sheet will be strengthened and the dividend discontinued.

Under these circumstances, I think the Altman Z score and Stock ranks etc should be viewed as (quite reasonably) wrong - at least until the next interims are published.

----

In other news, it does look like the rights issue will succeed, and there is institutional support for it.

At the moment it does look like it is the right time to sell a business (which is what they need to do)

Writing down goodwill by 500m - especially where there is no real goodwill there is a good move.

IMO, it should be clear by now that Capita is not going under. How bright the future is is the question.

10 May 2018

Capita plc

Admission of Nil Paid Rights

Further to the announcement made on 23 April 2018 by Capita plc ("Capita" or

the "Company") regarding the Rights Issue, the Company confirms that

1,001,032,281 New Shares of 2 (1)/(15) pence each will be admitted, nil paid,

to the premium listing segment of the Official List of the FCA and will be

admitted, nil paid, to trading on the London Stock Exchange’s main market

for listed securities at 8.00 a.m. (London time) today.

The Prospectus is available at www.capita.com/investors.

The defined terms set out in the Prospectus apply in this announcement.

Enquiries

Capita plc

---

I think the reported fall is due to the rights issue - i.e.

In rough form

yesterday close

shares in issue x sp + new shares x 70p = 667.4m*200.4 + 1001m*70.0 = 2042.36m

and

today lunchtime

shares in issue x sp = (1001.0m + 667.4m) * 126.4 = 2108.85m

so no change really.

Just wondering how I add these new shares as a transaction in my Stockopedia portfolio? Any ideas?