It’s been just over a year since I published “Didn't buy Warpaint? Why clear uptrends are the best uptrends” which turned out to be one of the most popular pieces of 2025. In the article, I summarised some exciting research that private investors are well-placed to capitalise on, and offered a list of twenty stocks to consider based on the research findings.

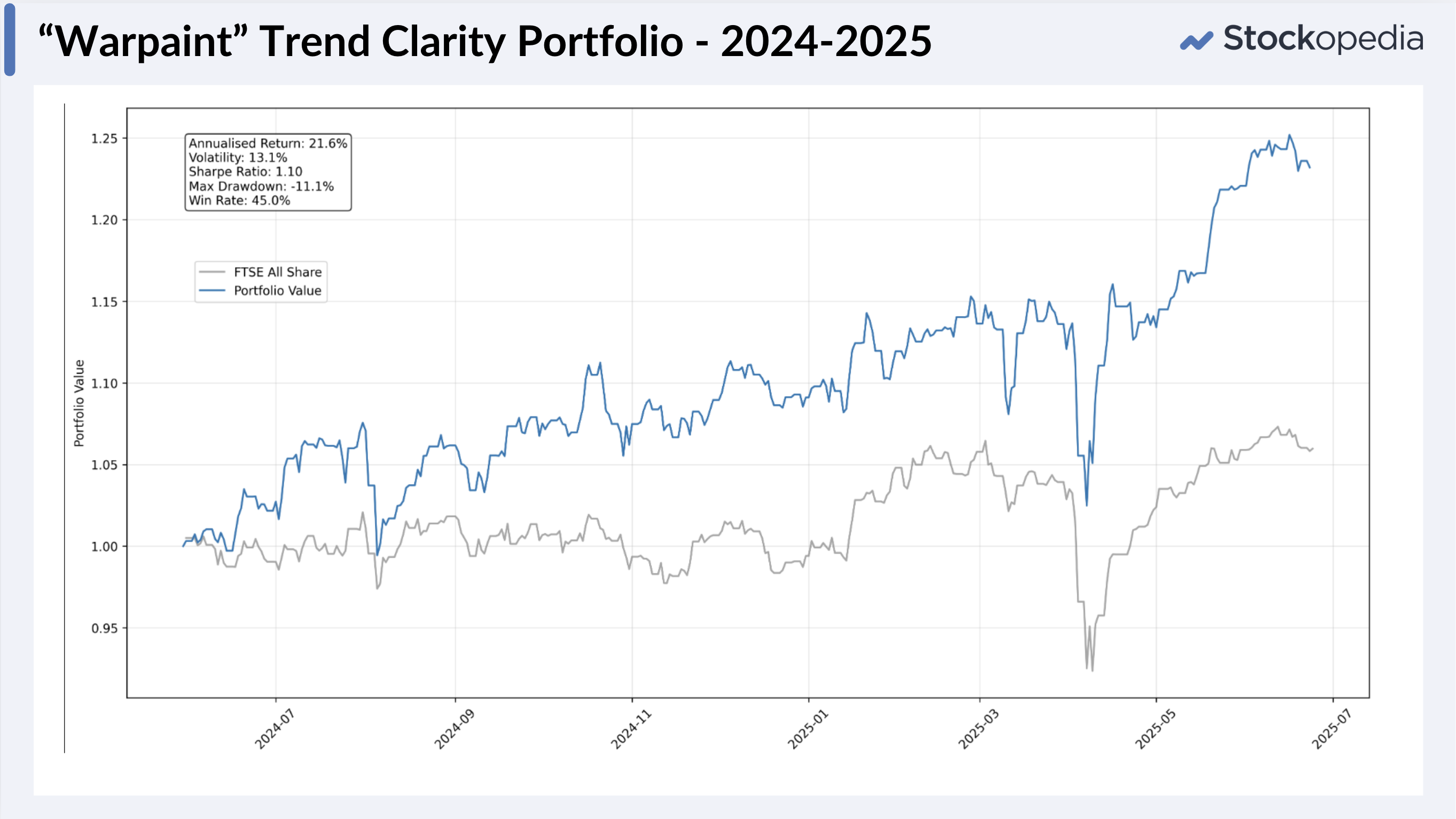

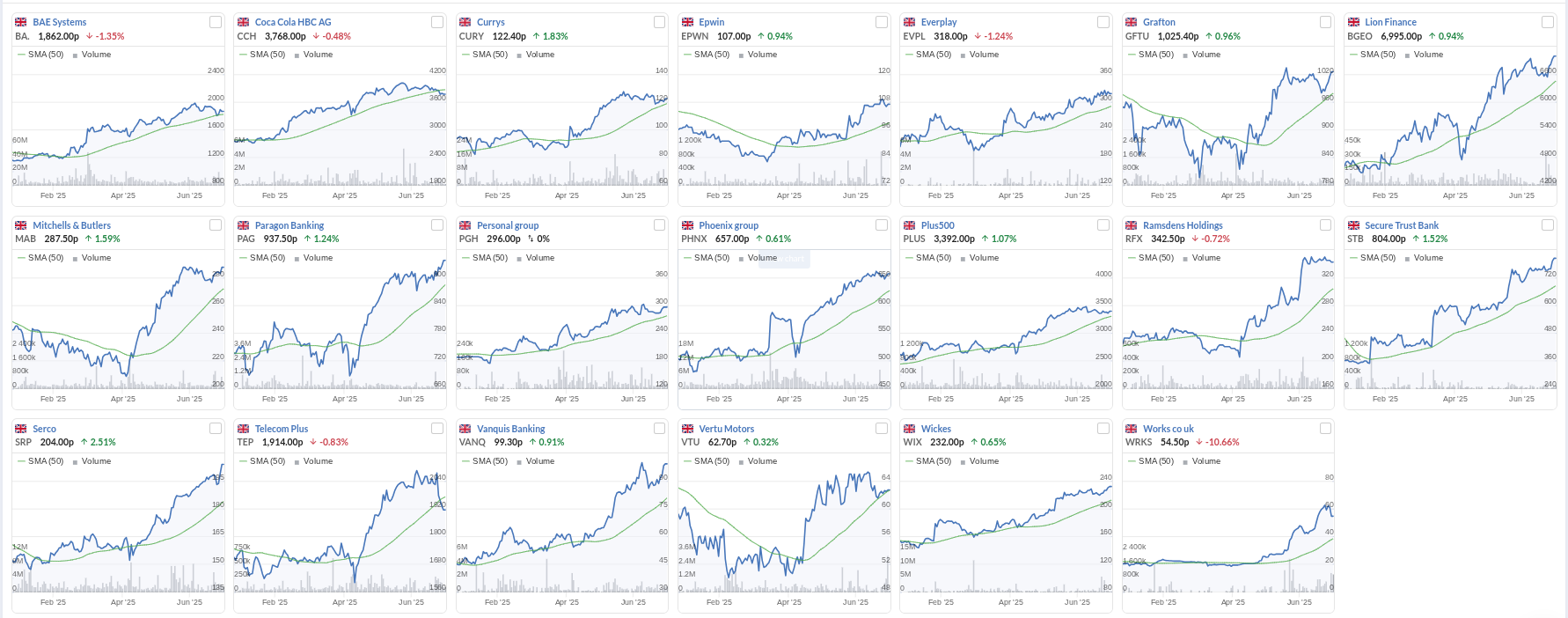

Given the interest, I thought I’d recap the research, update you on how the 20 stock portfolio has performed, and share another twenty stocks using the same process.

Let’s go.

Quick recap on clear trends

In March 2024, a group of UK academics published a paper called Trended Momentum. It discovered something surprisingly powerful: the clearest uptrends tend to deliver the most consistent returns.

They found that when a price chart shows a smooth, steady rise - what they called high “trend clarity” - those stocks often continue to outperform. You don’t need complex models to spot them either as most people can eyeball a good trend.

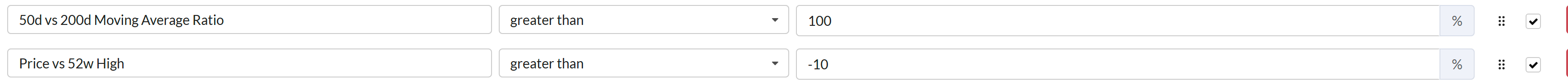

Nonetheless, the clarity of the trend can be measured using a simple statistic from a scatter plot called the R-squared, which tells you how well a straight line fits the share price path. Higher scores indicate smoother trends - and obviously Price Path A on the left is a clearer trend than Price Path B.

What’s exciting is just how effective this is: stocks with clear trends doubled the returns of normal momentum strategies in their tests. The outperformance lasted well over a year, and these stocks were also more likely to beat analyst expectations.

So last May we put together a 20 stock portfolio based on these results - let’s see how they did.

How did 2024’s “Warpaint” portfolio perform?

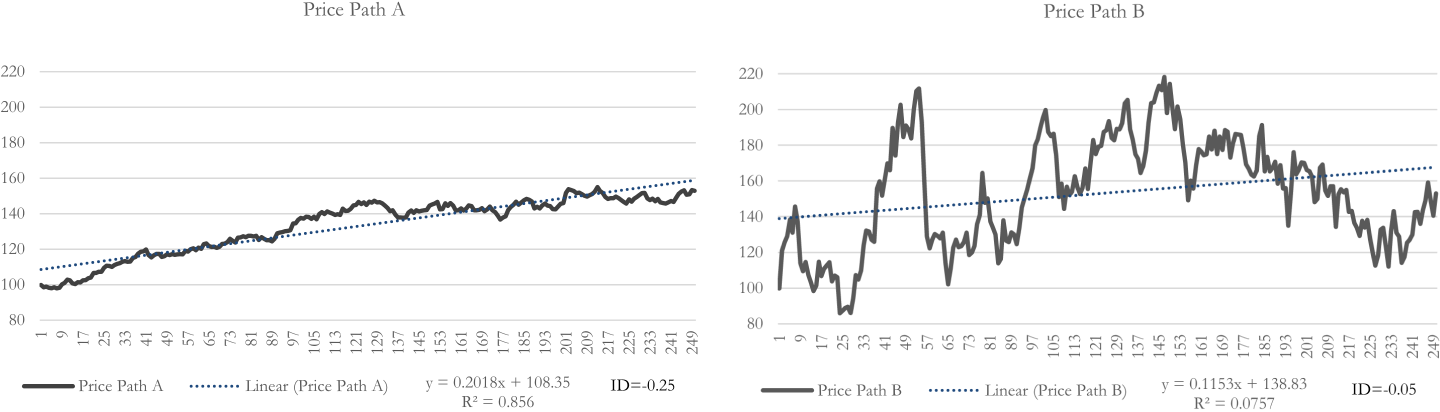

The May 2024 “Warpaint” portfolio delivered a strong 23.3% return over the almost 13-month period from 30th May 2024 to 23rd June 2025, significantly outperforming the FTSE All Share’s 6%. The standout performer, Serabi Gold (LON:SRB) , gained 174%, while Dewhurst (LON:DWHT) was the worst performer with a -32.5% loss.

As is typical in equity portfolios, a small number of strong winners drove a large portion of the gains. Out of 20 holdings, 9 were winners, 1 sideways and 10 losers, which was a win rate of only…

.jpg)