Britain’s blue chip stocks have been under pressure in 2018. Prices have trended down since the start of the year, slicing a noticeable 6.5 percent off the FTSE 100. But one of the potential upsides of these declines is that forecast dividend yields on some of the country’s biggest companies have risen quite markedly in places.

One of the best known approaches used for picking out high-yield large-caps is called Dogs of the Dow. It’s a strategy based on the work of Michael O’Higgins and John Downes in their book, Beating the Dow.

The aim of their strategy is to buy the 10 highest yielding stocks in a large-cap index like the Dow Jones or the FTSE 100. Part of the appeal of this method is that it really is a very straightforward set of rules.

In theory, the highest yielding stocks are usually out of favour for some reason, and their depressed share prices push the yields up further (hence why these are ‘Dogs’). But the trade-off is that their size and financial muscle ought to mean they’ll recover and come back into favour over time.

Critics of the strategy point to the fact that, beyond the financial strength of large-caps, there aren’t many safety nets in the Dividend Dogs approach. After all, blue chips aren’t immune from cutting dividends, and this strategy does demand you buy companies usually with negative price momentum.

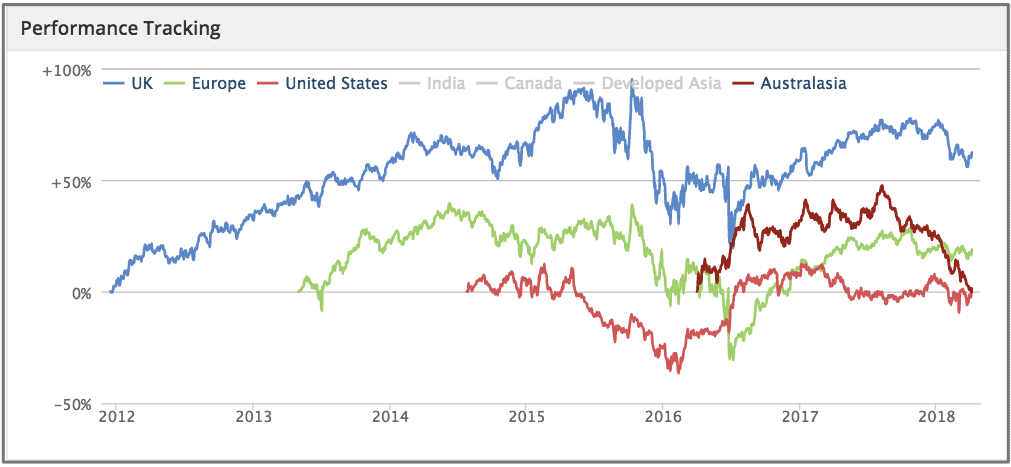

Despite the drawbacks, high yields are obviously appealing. There are two versions of this strategy - one that uses current yield (here) and another called the Forecast Dividend Dogs, which uses 1 year forward rolling yields. This second version is quite interesting because Stockopedia’s latest tracking shows some pretty lacklustre price performance (not accounting for dividends).

The chart below speaks volumes - the most recent trends among high yield large-caps in the UK, Europe, U.S. and Australia, are pretty negative. It shows that larger, high yielding shares have been under pressure over the past year or so - but the forecast yields have been rising.

So what names is this this strategy coming up with at the moment? The top 10 stock are listed below...

(Note that the screen includes forecast yields one year ahead. It also considers forecast dividend cover, which is a measure of how well the dividend payout is covered by earnings.)

Name | Mkt… |