It is tempting to dump stocks that move sideways for a couple of months, assuming that they have nowhere to go. You just become bored with the stock.

Such an attitude may not be a productive one, though. Looking for stocks that have done nothing may be beneficial. I am referring to stocks with a market cap of say, at least £100m, maybe £150m. I exclude very small-cap stocks from this behaviour.

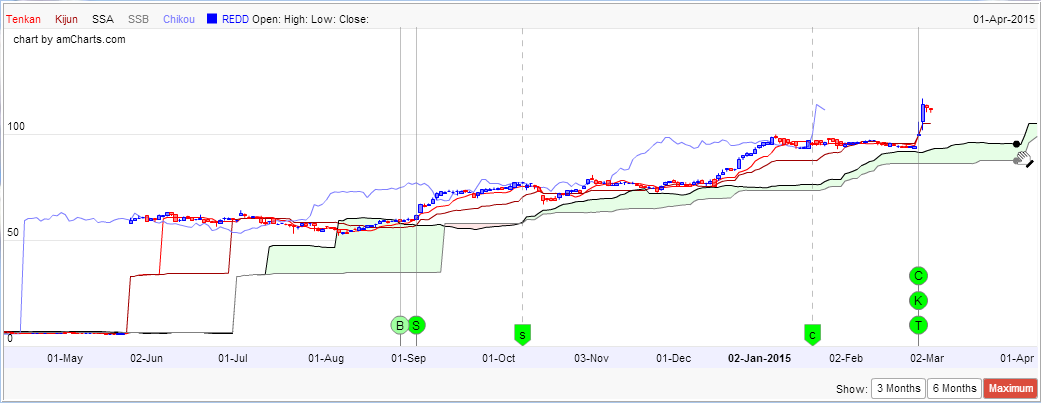

An example that springs to mind is Redde (LON:REDD). It recently reported its interims, sending the shares up 20% over 2 days. Prior to that, the shares had been consolidating for a couple of months, as you can see from the chart below.

I had previously seen this chart pattern before in RGS (Regenersis), which paused before its continued upwards ascent. The prior trend may continue, or may reverse. You have to make your own judgement based on fundamentals. SGP (Supergroup) was a company I invested in at the time when the market had dumped them due to their logistic issues, and a period of consolidation followed. The company then issued a bullish trading statement, and the shares rocketed.

Trading statements seem to be what often trigger re-ratings. It happened in all three companies I mentioned. The shares seem to “mark time", as the market was looking for information in order for it to make its next move. The trick is, you've got to buy before a major move, not after. You also need to consider valuation levels and whether you expect the story to be positive or negative in order to know if it's a buy, or not. If you had looked at REDD, for example, it had a Stockopedia value rank of 75. Positive news was also building in their RNS releases, so if you had bought, say, in mid-February, you would be sitting pretty. You probably would have seen your purchase in an initial loss, though. Sometimes you have to be a bit patient in order for your ideas to work out.

Note that when a share does make a move, it tends to either be overbought or oversold. You can see in REDD, for example, at the start of its latest consolidation, the share price was well above its 50dma. Investors might therefore want to think about…