While the rest of the economy is in lockdown, UK gaming is in rude health. The global market is forecast to grow at c9% annually for years into the future, and next gen consoles are set to be released in late 2020. Because of this positive outlook, I’ve been covering the sector in a little more detail recently.

I’ll take a break from UK gaming after this article, but the long term growth trends that underpin this market aren’t going away anytime soon.

So far, I’ve looked at Keywords here, TM17 here, and Sumo here. There are three other companies currently on my list: Frontier Developments, Codemasters, and CD Projekt. I haven’t managed to take a look at CD Projekt yet but it is by far the largest of the set and looks to have a differentiated business model - so definitely worth investigating in future.

Of the remaining two, Frontier Developments says that lockdown-related demand for games is having a positive impact on sales globally, while Codemasters has also reported strong trading. Given the continuing market volatility, strong current trading is a big plus in my view.

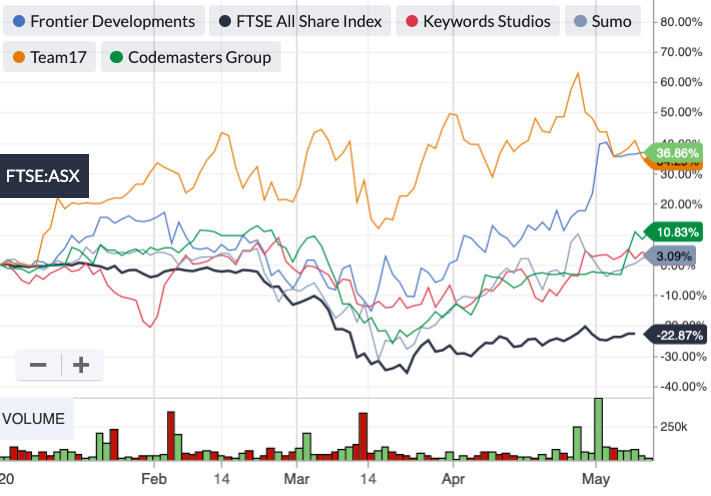

The wider UK gaming set continues to outperform the market year-to-date.

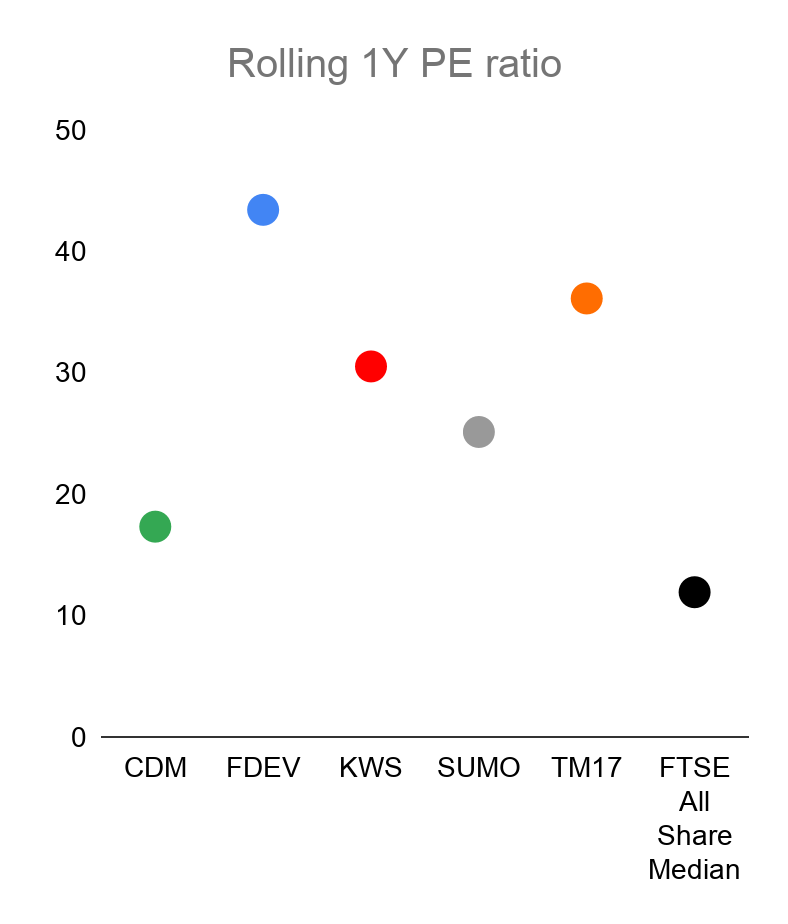

As with all the video games companies I’ve encountered so far, Frontier Developments (LON:FDEV) and Codemasters Group (LON:CDM) are both high QM stocks - ie. “highly profitable and growing, but expensive”. Their market outperformance comes despite decidedly punchy trailing twelve month PE ratios for all involved.

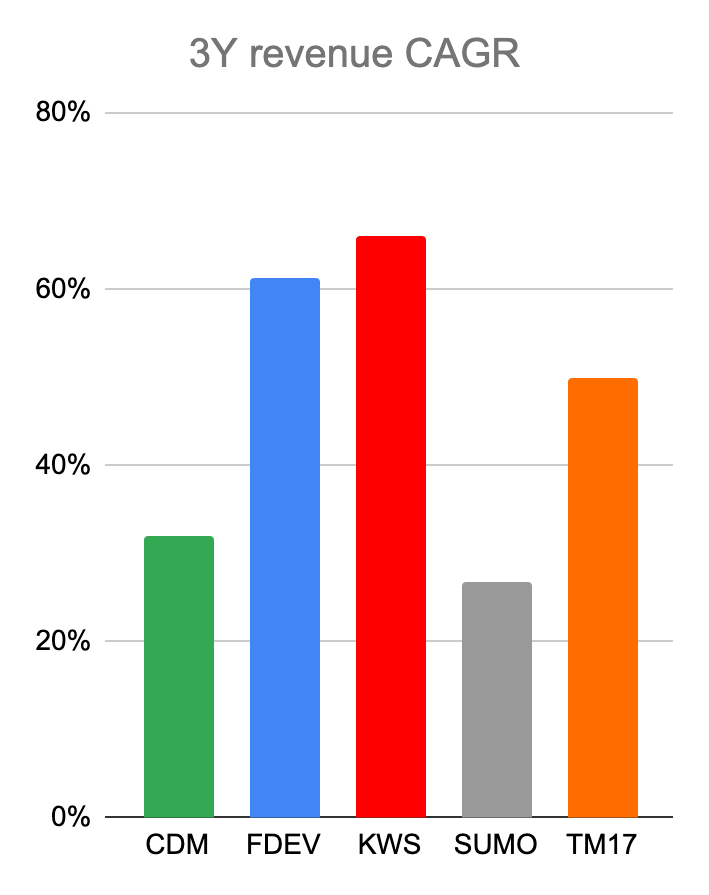

High relative valuations can be justified by strong growth rates and large market opportunities. Here are the 3Y revenue CAGRs for all of the companies:

Strong market growth prospects and government tax breaks

Thematically, as a long term investor, I like the idea of having exposure to UK gaming. This sector alone is worth c£4bn - more than the UK music and TV sectors combined - and it is expanding all the time. I can see a couple of key growth drivers.

Video games’ tax relief (VGTR) was introduced in 2014 and has supported the growth of the sector. The EU commission is committed to this scheme until at least 2023. All five companies in the sector benefit from the policy. It will be a helpful…

.jpg)