Over the past few weeks, Keelan has been looking at the mining sector. Commodity stocks can be like Marmite; investors either love them or hate them, and for good reasons. They are usually geared plays on the underlying commodities, meaning that the potential to generate outsized returns exists. Companies where the primary assets are in development or even the exploration phase can be even more geared to the commodity, and the management's skill in developing and financing the project. However, such ventures are risky, even before you add in overoptimistic or even promotional management teams. The majority of pre-production mining stocks generate poor returns for long-term investors. After all, Mark Twain defined a mine as a hole with a liar standing at the top!

Personally, I don't get involved with any company that is pre-production, in the same way that loss-making technology companies don't interest me. There are simply too many things that can go wrong and blow an investment case out of the water. However, I believe producing commodity stocks may interest the more adventurous value investor. The reason is that it is possible to gain an edge over the market in this space, for two reasons:

Edge 1 - The Capital Market Cycle

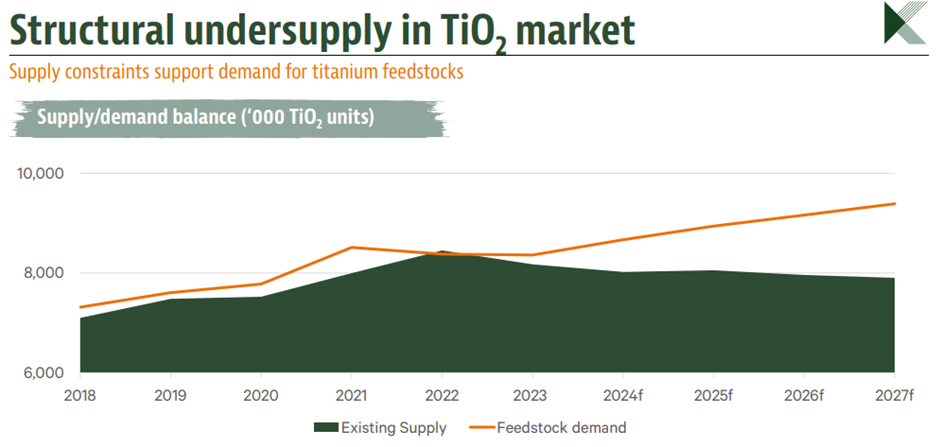

As Keelan has discussed in his articles, commodity pricing is a function of supply and demand. Companies and investors can generate very high profits if they spot where demand is likely to exceed supply for a commodity. For example, the following chart from Kenmare Resources (LON:KMR) , may indicate that pricing for Heavy Mineral Sands may remain elevated for many years:

The reason is that mines take many years to develop. For many products, a demand increase is met by a rapid production increase. A rise in commodity prices will encourage existing companies and new investors to put capital into the sector. However, those new mines won't produce that commodity any time soon. It may be up to a decade before they are producers. The high prices can exist for many years, especially when there is no easy substitute for the commodity and the existing mine capacity is maxed out. Eventually, prices will rise so much that many new projects become viable, a massive amount of capital will flow into the sector, and there will be an oversupply, and prices will return to…