The UK’s fourth largest toymaker, Character Group, has enjoyed a strong run this year. The price jumped 9% yesterday after the company was tipped in the Investors Chronicle. However, Paul Scott has warned of the dangers of stock tips. They can trigger short-term spikes before the prices revert to their previous levels. Indeed, for these reasons, Paul sometimes sees tips as a selling opportunity.

It is impossible to judge what Character Group will do over the next few days. But to assess the company's longer term prospects, it is useful to analyse whether the firm is exposed to factors which have historically driven share price returns.

Quality minus Junk:

Ben Hobson mentioned Character Group in a recent article on the size-effect - the theory which holds that small stocks outperform larger stocks. Academic research suggests that good quality small stocks tend to outperform good quality large stocks, at least over the long-run. Small caps may be small because they are unprofitable companies, which are unable to grow, and offer unattractive returns to investors. But if you dump the junk and focus on a basket of good quality small companies, the size effect becomes more pronounced. Small tends to beat big.

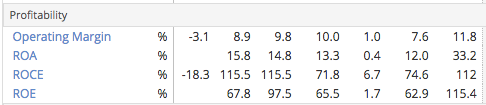

With a market cap of £91.9m, Character is amongst the smallest companies in the stock market. But is Character Group a high quality small cap? The company has a QualityRank of 99 out of 100. Firms with a higher QualityRank are usually stable, growing, cash generative businesses with high returns on capital. They may also be companies with a strong balance sheet and improving fundamentals. For example, you can see from the table below that Character Group has trended higher in previous years, with wider profit margins and a stronger return on capital.

Character Group also has the traits of a growth stock. Brokers expect earnings to grow more than 50% in 2015, supported by the launch of new product ranges, including a new ‘food play’ collection. Revenues have already grown steadily since 2013, thanks in part to its portfolio of iconic toy brands, including Scooby Doo and Fireman Sam. The strength of these brands means that revenues are perhaps less susceptible to the fads and fickle tastes of the highly competitive toy market.

High Piotroski Score

The Piotroski F-Score is…