Over the past two years, there’s been a quite understandable sense of unease among investors. Confidence has been knocked by the unpredictability of Brexit and the trajectory of economic growth at home and abroad. Like the dull thud of a mild headache, you might sometimes forget about it, but that nagging pain is always there.

But while the outlook is - as always - uncertain, there are some stocks that are so far resisting these concerns. For some of the market’s fastest moving growth shares, it seems to be business as usual.

Before we look at the traits of some of these fast growing firms, what is it about the market that suggests that sentiment is wavering? Well, at just over 4,000 points, the FTSE All Share index - a rough, market-cap weighted cross-section of the UK market - is virtually unchanged from where it was a year ago. In fact, while there have been some gentle swings, the index is actually very little changed on where it was two years ago. So in many ways, the market has been drifting for months.

But of course, the index is just the average. It’s as close to a barometer as we’ve got for measuring investor confidence, but it doesn’t tell the whole story. Dig a little deeper and it’s possible to find fast growing stocks that are holding up well well in these drifting conditions.

This of course is the classic territory of growth investors. Looking for fast moving stocks with the power to electrify investment returns has been the bread and butter strategy of investors ranging from the American legends Philip Fisher and T. Rowe Price to more modern day heroes like Peter Lynch and Jim Slater.

In search of growth

The job of the growth investor is to find companies that are at an early stage in the growth cycle. Firms need to be growing their earnings quickly but they also need some kind of edge that will protect them from competition. Growth can evaporate quickly if a business isn’t strong enough to protect itself.

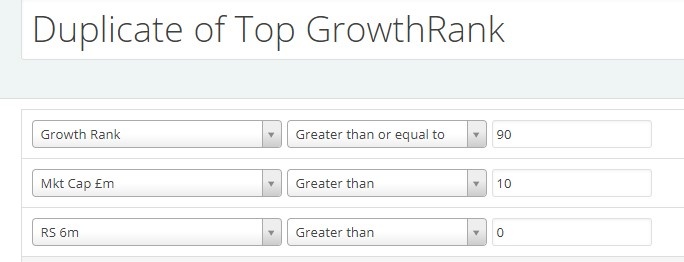

To find them, growth investing strategies tend to look at two key factors: historic growth and forecast growth. Typically, the early signs of a growth stock will be a track record of earnings-per-share growth - certainly over the previous three years. Some investors will even want to see…