Or more specifically...in The Most Important Thing, Marks says an investor needs either superior information or superior analysis to consistently outperform.

My question is, what advantages does an amateur investor and Stockopedia user have over other market participants? And how to leverage those relative strengths into outperformance?

Thanks

There's one source of outperformance that I believe you missed:

- better information

- better analysis

- better behaviour

By 'better behaviour', I am of course referring to behaviour in the context of the one central thing that investing involves - dealing with the future. The reason investors get things wrong so often is that we accommodate change badly - we are naturally resistant to it, preferring past certainties to future uncertainty, and consequently react rather than anticipate. We compound the problem by closed mindedness due (for psychological reasons) to being overly protective of our beliefs & prior judgements. This leads to a failure to absorb & interpret new information with an open mind.

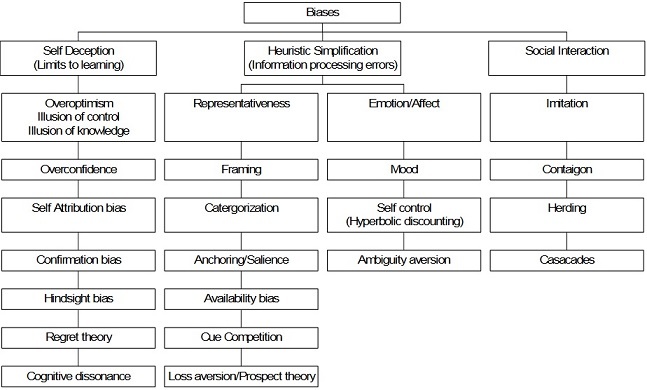

James Montier (GMO, previously DKW) published a handy taxonomy of biases that highlight the numerous behavioural ways that we delude & fool ourselves: