Over the past 30 years a number of investors and academics have been categorical about the power of investing in small companies. As a result, the size effect - the notion that small stocks outperform large stocks on average over time - has become an investing truism. But is that fair?

An interesting feature of the size effect - or the small-cap effect - is that it hasn’t always had the same level of scrutiny as return drivers like value, momentum, quality and even volatility. So in many ways it has had a free pass.

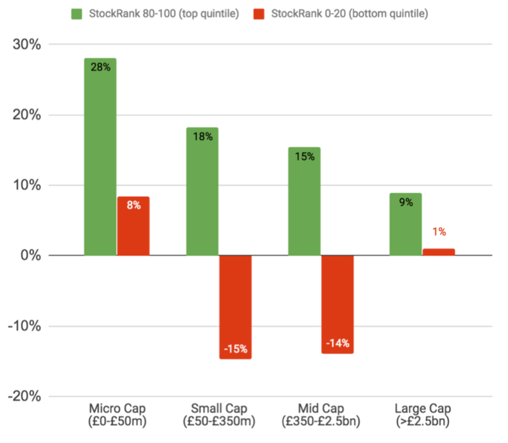

This is interesting because research suggests the size effect may not exist in the way many think it does. And where it does exist, it needs to be combined with other factors to get the most out of it.

Charting the history of the size effect

The size effect was first revealed in a study by Rolf Banz back in 1981. He’d looked at US stocks over 40 years and found better returns in smaller firms. To his credit, assessments of his findings - like this one from Alpha Architect - agree with what he saw in his own tests.

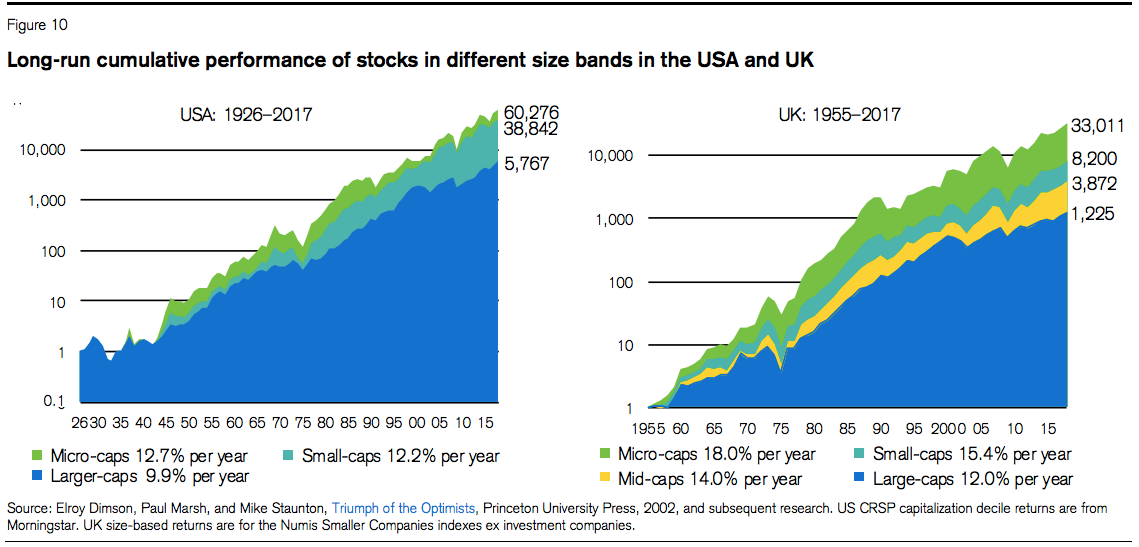

More recent work, like the studies by Elroy Dimson, Paul Marsh and Mike Staunton, see the size effect as an important anomaly. Their long run charts show that micro-caps and small-caps have outpaced large-caps in the UK and US over several decades. But there have also been spells in between when the reverse was true.

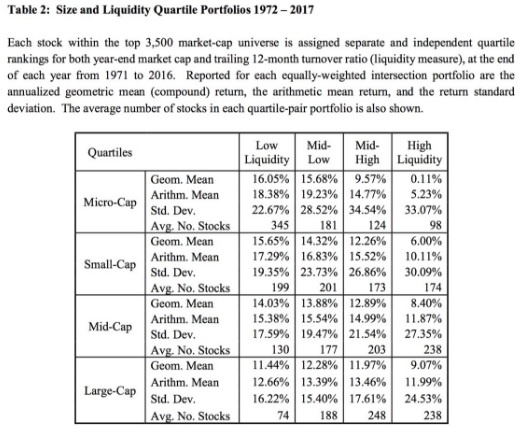

Other studies have found that the size effect only works in January, that it only works in micro-caps and that it’s actually a proxy for liquidity. In fact, some studies suggest the size effect completely disappeared just after Banz published his paper.

Against this backdrop, a general view has prevailed that smaller companies are an attractive asset class, especially for individual investors.

Some believe that investors with smaller pots of capital can get in and out of small-caps much more easily than larger institutions. Because of that, small-caps attract less professional research, which is an advantage for those prepared to do their homework. But above all, there’s a sense that shares in smaller companies can deliver much, much greater gains than those in larger firms.

Why investors love small stocks

It’s the observation that smaller…