When it comes to stock market returns, dividend yield is one of two components that determine what you might expect to achieve from owning a share (the other being a change in its price). But yield can also tell you a lot about the nature of the stock and what the market really thinks about it.

A lot of what’s written and reported about dividend yield tends to treat it in isolation: from news stories in the press through to investment books and even entire dividend strategies.

This does make some sense, of course, because dividends are a major source of returns over time. But there is a bigger picture to think about. To pay dividends, companies need stable earnings that are preferably growing. And over time, earnings growth is also a major contributor to rising stock valuation (which ultimately drives share prices).

This means that dividend payouts and capital gains are two sides of the same ‘return’ coin. They are intertwined. Even if you insist on prioritising dividends, ignoring questions like whether a company is capable of growing its earnings, can eventually leave you exposed to ‘dividend traps’.

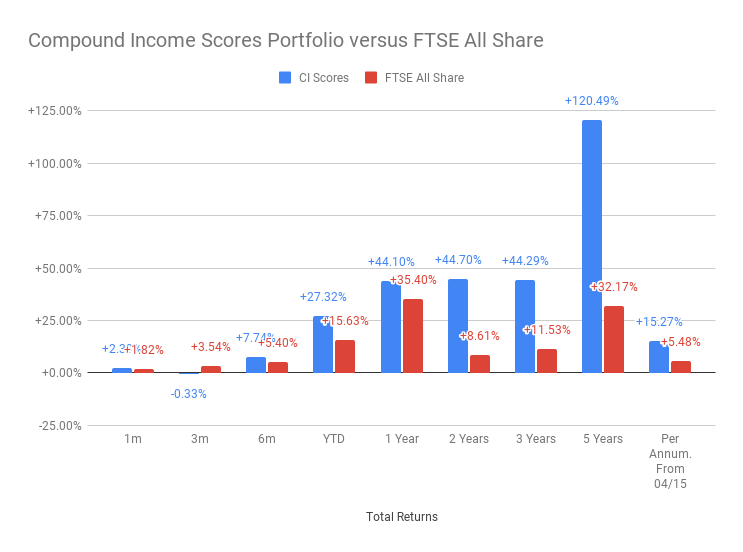

What’s preferable is to approach capital gains and yield together, and focus on what’s known as total return.

In this article I’m going to explore the role of yield in investing, how it contributes to total return and how you might choose to use it in your own strategy.

Understanding the appeal of high yield

First, here’s a primer on what yield is and how different variables can influence it...

Yield is used as a measure of return in a variety of different asset classes. With shares, it’s a measure of the cash returns (dividends) that companies make to their shareholders. They pay dividends from their net earnings, or net profit. This is the same profit pot that they can either retain or reinvest in themselves, or use to fund share buybacks.

To calculate a dividend yield, divide the company’s dividend-per-share by its share price and multiply that by 100.

For example, if a stock is paying 10p per share in dividends and has a share price of 500p, then the dividend yield will be 2.0% (10 / 500 x 100 = 2).

Paying dividends can be a sign of maturity in a business, but it’s not always defined by size. It’s…

.JPG)