jjis

Blogger, Fund Manager, Private Investor

- Joined 21 Oct 2011

- 377 comments

- 42 posts

Biography

Worked in the City of London for over 20 years as a Fund Manager for a number of top institutions. In my career I managed billions of £'s across a whole range of different funds from Distribution funds, Investment Trusts, OEIC's / Unit Trusts & Pension funds. I was also involved in the management of Income funds more generally. In March 2009, I quit the City and escaped the rat race to earn my living from my own investments. Since then I have been managing my own income funds.

I focus on UK stocks with a value / yield / quality bias and select from the whole market down to about a £50 million market capitalisation, although on occasions I stray into micro cap if I feel the investment case is compelling. This is because of liquidity considerations & the fact that I have VCT holdings which give me micro cap exposure. I also invest in Investment Trusts and ETF's for overseas markets or exposure to other asset classes, but again with the aim of achieving an income as well as diversification. I'm now trying to give something back by writing more regularly on my Blog / website - but can't make any promises about how regularly I will write here on Stockopedia, so check out my site. Compound Income

Investment strategy

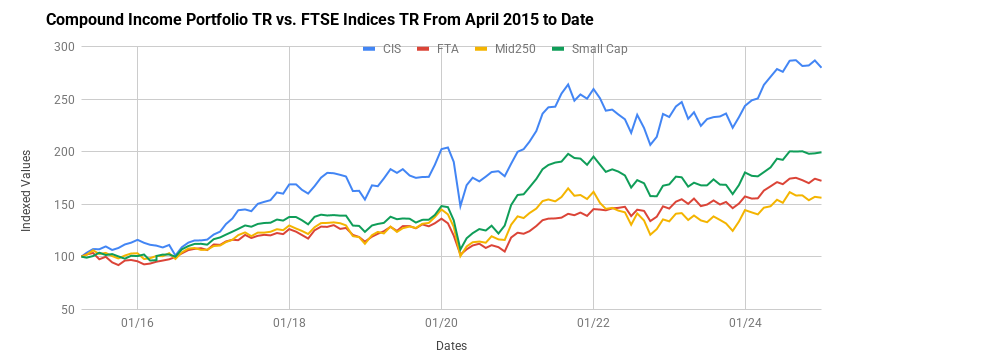

I follow a Quality, Value, Yield & dividend growth based strategy by focusing on valuation, yield, dividend cover and growth, business characteristics and financial security. I developed the Compound Income Scores based on these factors, which has produced the performance shown in the graph above over the 10 years that it has been used.

In addition I pay some attention to momentum factors, especially earning revisions and price momentum and utilize quantitative techniques to help identify new ideas and monitor the portfolio which is re-balanced monthly.