It's increasingly common knowledge that actively managed funds significantly underperform the stock market. The level of underperformance varies in different market cycles but on average it is of the order of 3% per year. Given this, is there really any point in paying attention to what fund managers are buying?

Well the latest cutting edge research shows that there is. Fund managers are actually way better stock pickers than these numbers suggest. By separating the wheat from the chaff in their bloated portfolios you can find their very highest conviction ideas... ideas which dramatically beat the market, by up to 20% per year !

So what are a fund manager's 'best ideas'?

In hunting for their best ideas the first place to look would be amongst their top 10 holdings, but this would be naive. A fund's performance is normally assessed relative to a benchmark index like the FTSE 100. If a fund underperforms this index the investors often pull out their money and the fund manager can lose his job.

So to manage this career risk, the cautious fund manager often weights most of the stocks in his portfolio similarly to the benchmark, with proportionally larger weights in the stocks weighted more heavily in the benchmark. It's only for his very best ideas that he'll deviate these weightings most substantially.

Indeed a ground breaking 2005 research paper called "Best Ideas", Randy Cohen, Christopher Polk and Bernhard Silli researched this common sense idea. For every fund in the market, they calculated the deviation or 'tilt' of each holding from the benchmark weight. Portfolios constructed using the top 25% highest conviction positions held by fund managers showed anywhere up to 23% excess annual returns depending on the technique used!

How can you maximise the returns from high conviction fund manager ideas?

We won't go into the precise technique used in the paper as it's beyond the scope of this article, but there are several key findings from the paper which can significantly improve the results from cloning best ideas:

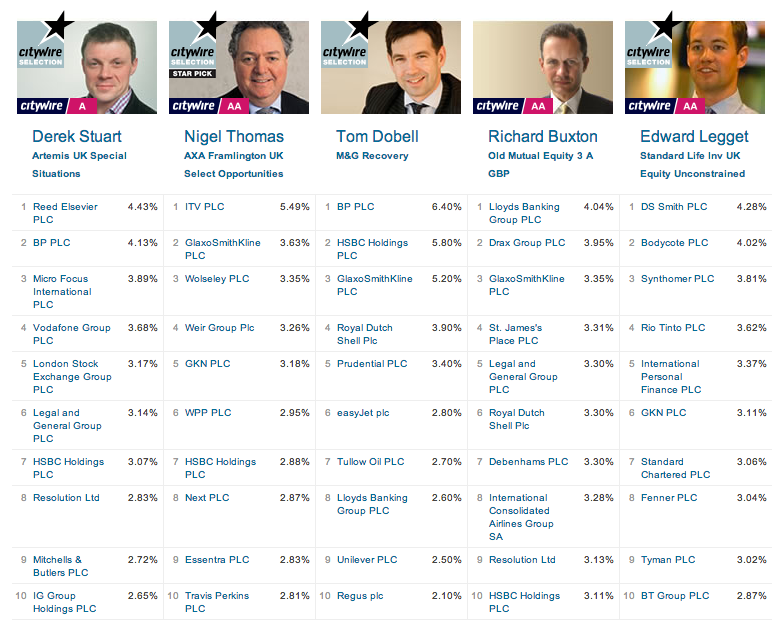

- Stick to each manager's top pick - The stock with the very highest 'tilt' for each manager outperforms the rest of their picks. Descending down the rankings through the second, third & fourth best ideas 'monotonically' reduces returns. When assessing the strength of a fund manager's idea it's worth bearing this in mind. Anything outside the top five best ideas is unlikely…