Morning all!

Finsbury Food ( Finsbury Food (LON:FIF) ) – 124p – £161.7m – PER 11.5

Preliminary Results For The 12 Months To End June 2018 – LFL Revenue up 2.4% to £290.2m, Adjusted PBT up 4% to £17.2m, Adjusted Basic EPS up 4.1% to 10.2p with the Total Dividend up 10% to 3.3p.

Still not enough here to get me interested – I remain Neutral.

M P Evans ( M P Evans (LON:MPE) ) – 756p – £414.2m – PER 19.7

Interim Results For The 6 Months To End June 2018 – I can’t work out if these results are good or not – Although the flat Dividend is not exactly encouraging.

I am actually going to move this from Neutral to Avoid on the basis I just have no idea how to interpret results – I will cease coverage here.

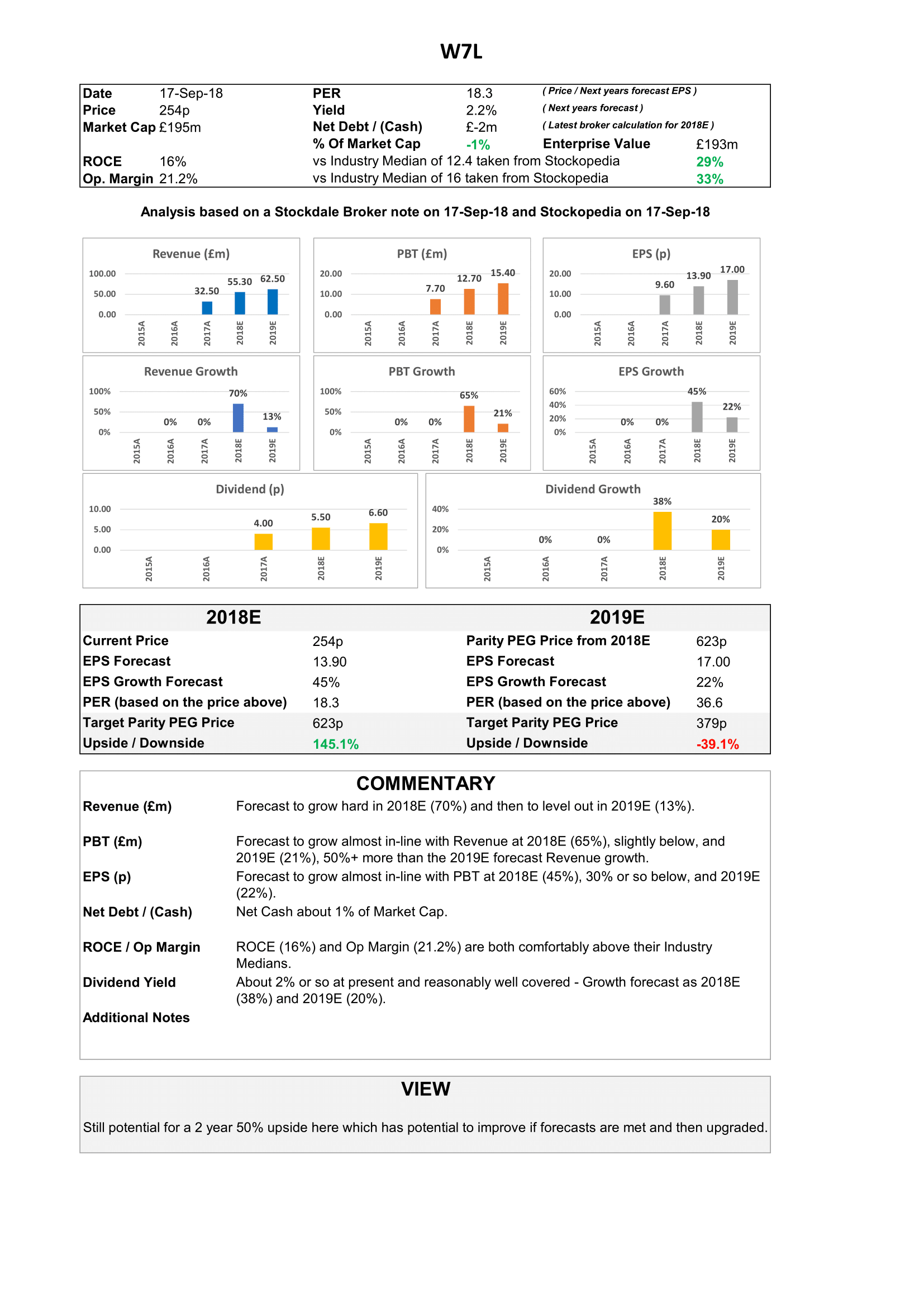

Warpaint London ( £W7L ) – 237.5p – £182.3m – PER 15.1

Interim Results For The 6 Months To End June 2018 – Revenue up 38.7% to £18.4m, Adjusted Profit £2.8m in the half year (before exceptional Items, depreciation and amortisation costs) (H1 2017 £3.1 million), Net Cash stands at £4.6m at 30 June 2018 (30 June 2017: £2.5 million). The Interim Dividend is up 7% to 1.5p. Expecting to be two thirds H2 weighted here – FY earnings expected to be in-line.

I am still long here and on a PER of 15 if the EPS Growth of +55.8% (2018E) and +20.7% (2019E) are achieved then all should be OK – I continue to hold but remain a little wary of the huge H2 weighting.

Christie ( Christie (LON:CTG) ) – 131p – £34.8m – PER 13.9

Interim Results For The 6 Months To End June 2018 – Revenue up 10.0% to £38.4m, Basic EPS of 5.18p (H1 2017: 1.53p per share) and the Interim Dividend up 25% to 1.25p.

I remain Neutral here but will keep an eye out for Broker notes as I am not sure this EPS increase is sustainable in any way.

As always, all comment most welcome!