Morning all!

EasyHotel ( easyHotel (LON:EZH) ) – 74p – £108m – PER 37.2

Interim Results For The 6 Months To End March 2019 – Revenue up 52.6% (to £7.26m), LBT of -£0.12m (£0.09m PBT last time), Basic EPS down from 0.1p to -0.1p, the Interim Dividend is up from 0.07p to 0.08p. Confident of meeting FY expectations.

Looks like some decent H2 weighting is required to see that forecast 50%+ increase in Net Profit (and EPS) – Still not for me at present.

Netcall ( Netcall (LON:NET) ) – 57p – £81m – PER 34.3

Trading Update For The 12 Months To End June 2019 – Looks like a bit of a warning.

As always with this company I think it's best to wait and see actuals – So that's what I will be doing, especially after a TU (what looks like) profit warning.

Spectra Systems ( Spectra Systems (LON:SPSY) ) – 124p – £57m – PER 18.3

Trading Update For The 12 Months To End December 2018 – Profits to exceed market expectations.

I said this last time and my view hasn't really changed - "Still quite like this but still just too hard for me to judge – Just Never know where those new contracts are coming from (but they seem to keep coming) – For this reason alone I have to remain on the sidelines".

Telford Homes ( Telford Homes (LON:TEF) ) – 303p – £230m – PER 11.5

Results For The 12 Months To End March 2019 – Revenue up 12% (to £354.3m), PBT in-line at £40.1m (£46m last time) due to lower margin build to rent, Total Dividend same as last year (17p), pipeline of 4,900 homes (4,000 last time), FY 2020 PBT expectations unchanged.

Still remain wary of this sector but will keep an eye out for Broker updates here – Could be tempted to finally dip a toe in here.

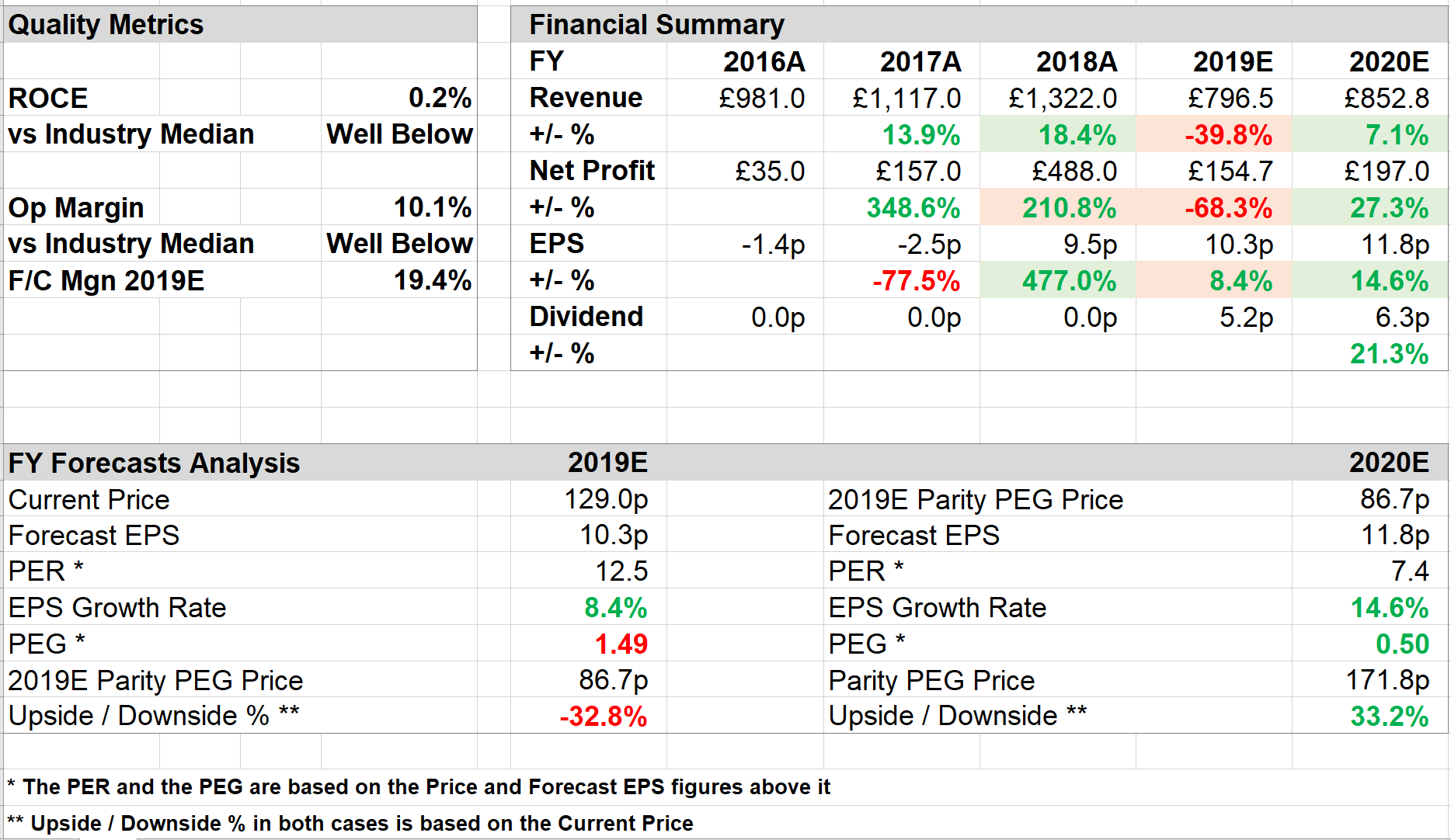

XLMedia ( XLMedia (LON:XLM) ) – 51p – £106m – PER 5

AGM Statement – Business continues in-line with management expectations, intention is to continue buy-back programme…