As promised a few weeks ago, this week I want to provide an update on my International SIF virtual portfolio.

I’m going to make some changes in response to reader feedback in August. Plus I’m going to review the five stocks that are up for eviction this month.

Strategy changes

After receiving a fantastic response from readers in August, this week I want to share with you a summary of your comments and the changes I’m planning.

Geographic changes: Most comments related to the folio’s geographic focus. There was a strong preference for US stocks, with Europe in second place. This is no surprise, as the US is generally the most popular foreign market for UK-based investors. The reasons for this are fairly obvious -- the US market is broad, deep, and very liquid. Company reporting is consistent and reliable and there’s no language barrier.

However, Stockopedia also has a number of subscribers who are based overseas in countries such as Australia and India, where local web services are more limited.

A number of readers suggested multiple regional portfolios. Although this would be interesting, I just don’t have time to do this at the moment. So I’ve come up with a compromise solution that will hopefully satisfy a majority of readers, without excluding anyone.

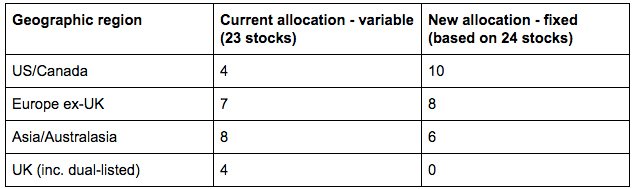

I’m going to change the geographic allocation of the folio so that it’s weighted more heavily to the most popular foreign markets. I’m also going to exclude all UK stocks, as there’s no point in duplicating the stocks I hold in the main UK SIF fund.

Here’s a comparison between the current allocations and my new fixed allocations. I’ll gradually migrate to the new allocations as stocks are bought and sold:

Costs, dividends and total return: A number of readers suggested I should include total return, not just price returns.

I’m a big fan of total return and include this in my UK stock write ups. However, tracking dividends on overseas stocks is a bit more complicated, in my experience. And transaction costs vary widely on foreign stocks.

For these reasons, I’m going to continue to ignore dividends and costs. I’ll focus on price return only for international stocks.

More detailed analysis: So far, my analysis of the foreign stocks chosen for the portfolio has been pretty limited. I’ve…