Update July 2019: Part 2 of this Series is now available covering the addtional 133 IPO placings

Topline

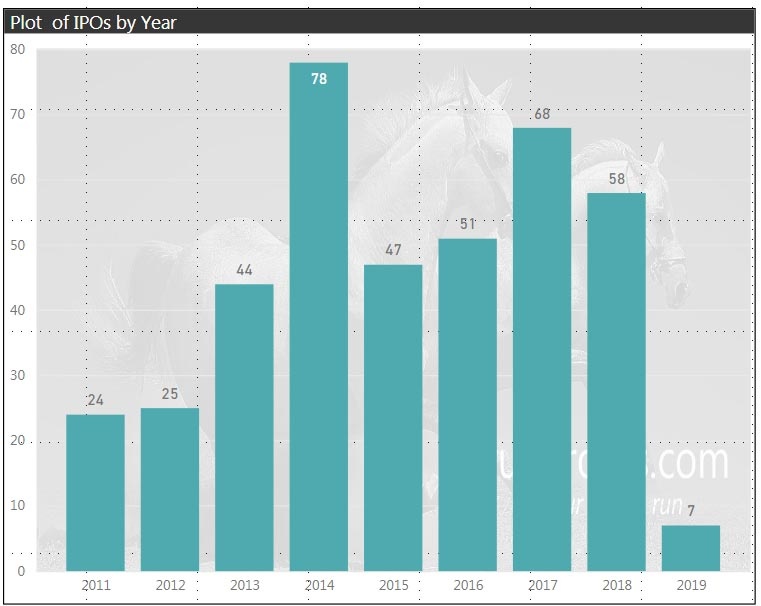

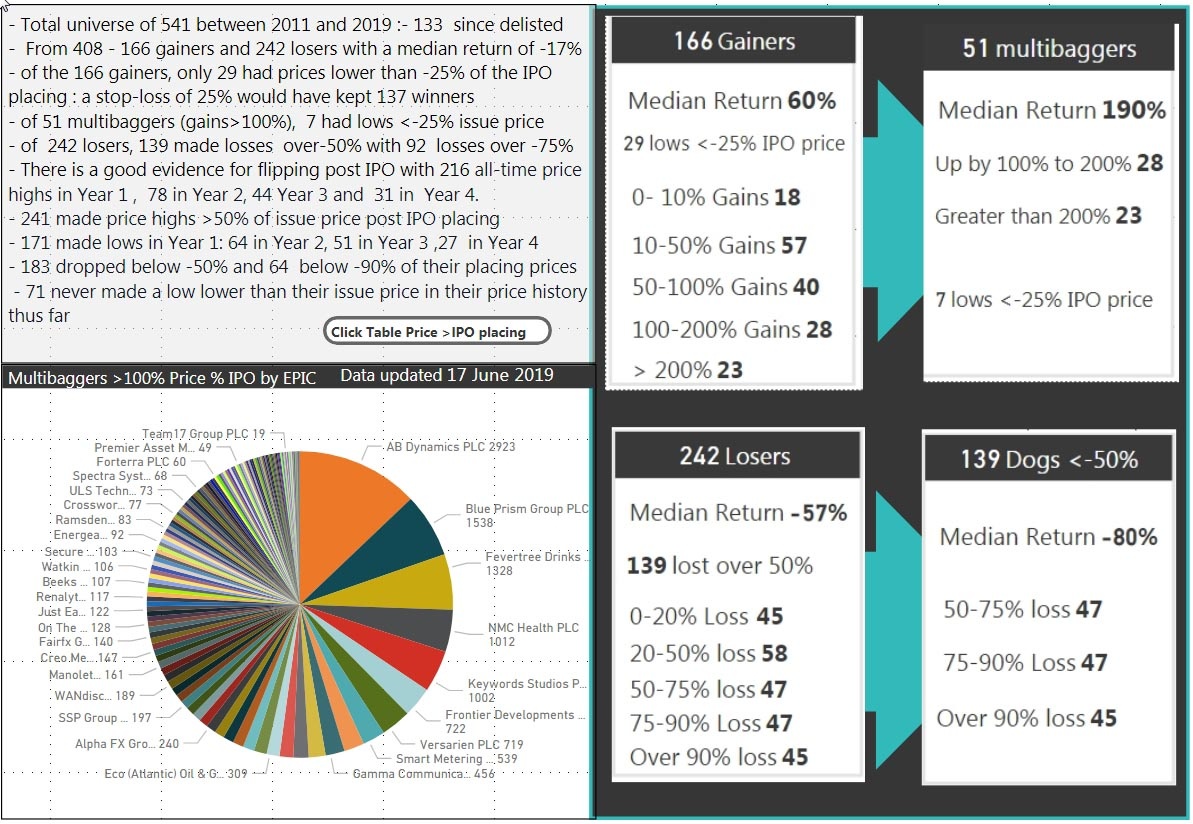

408 IPOs from 2011 to 2019 were analysed quantitatively: the median return was -17% with a 60:40 split of losers to winners over the time period. This fits with published academic studies of IPO performance of -8 to -23% . A deeper analysis of the numbers gives more insight on opportunities and the role of stop losses in converting trades into very profitable investments some which yielded several thousand percent returns. A furhter 133 placings were not excluded as they were nto amenable to the datamingin processes used. These are dealt with separately in Part 2 of this series which should be read in sequence.

Introduction

To IPO or not to IPO? that is the question. Whether it is more profitable to risk the slings and arrows of a placing or to wait and see how the market receives it? These days I tend to ignore the barrages of broker emails and don’t get carried away by FOMO: I prefer to give a placing some time in the market before taking a position. Intuitively this feels right (I've had a few knocks in the past) but I decided to go beyond heuristics and take a deeper look at the data to see if being more systematic was of merit. Does it make sense to get in early at the placing price? How do IPOs tend to behave post the placing and in their formative years? The initial results surprised me so I did a bit more digging before drawing any firm conclusions. This article is the first in a series looking to unpack some of the insights and devise actionable trading and investing strategies. The full version of this article with an interactive report of the data allowing DYOR analysis is published on runprofits.com. ( Stockopedia data is only included in this summary article and not elsewhere )

Background to the Study

- 530 companies in the period 2011 to 2019 abstracted from a London Stock Exchange list off over 3000 IPOs and placings

- avoided the GFC and the extreme volatility in its aftershock so ruled out listings before end 2010.

- further whittled down by another 130 or so which didn’t appear in the datamining:…