Summary of Part 1 and Part 2

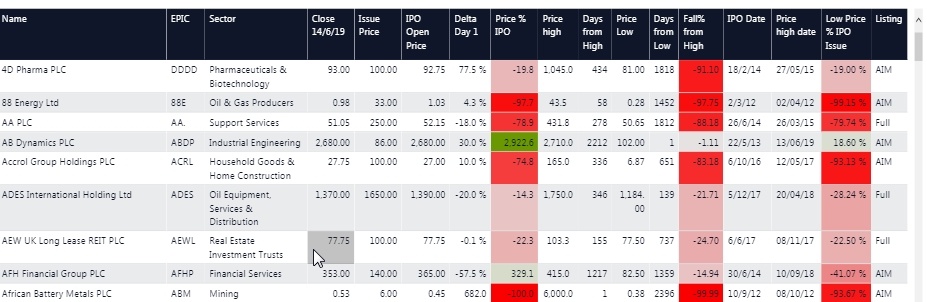

From a quantitative analysis of 541 IPOs floated on the UK market between 2011 and early 2019, the data shows the following:

- 67% have lost money to date with a median loss of -57%: over 10% delisted with a total loss

- 33% were in profit: with a median return of 60%

- 8.5% (46) were bought-out where 60% returned a median profit of 31% while the remaining were sold at a loss of -25.5%

- Year 1 performance post-placing tends to be overwhelmingly profitable even for shares that go on to delist.

- Evidence shows that the annual listing cost of £200K+ on AIM is a major driver for delisting when liquidity and share price performance is poor

- IPOs with strong growth and long-term potential rarely sell-off and tend to outperform over the period studied: the converse is true for those which delist

Given the typical profitability and chance of total loss, the data shows that IPOs do make good trades with a 25% stop-loss from the IPO placing price yielding profits in Year 1.

Post Year 1 a stop-loss of 25% retains 80% of the longer-term winners and retains the 10% that go on to make high returning investments with a median profit of 190%. The same stop-loss removes 93% of the losers and 100% of the total losses.

A pdf download of this article is available at https://runprofits.

Introduction

Part 1 of this series featured a quantitative analysis of 408 IPOs listed between 2011 and 2019. There were a further 133 IPOs which eluded the datamining processes used in Part 1. Part 2 takes a look at these 133 missing IPOs: almost half had delisted, one third were bought-out while others had changed names, changed markets, gone back to private companies or were frauds. 25% of the 133 yielded a profit while 75% were a loss. These results amplifiy those from Part 1 and confirm the underperformance of IPOs and the risks of total loss of capital owing to delisting.

The costs and effect of being listed are cited by C suite executives as exacerbating difficult trading conditions resulting in delisting. These are broken down further with insights on returns and the aggregate view of the total 541 along with observations on IPOs in general

A pdf download…

.JPG)