(Please note that I have a long position in GAW.)

You might say Games Workshop is an overnight success 40 years in the making. Great companies often have a unique asset and Games Workshop has this in spades, with its 40 years of world-building and wargaming.

Three years ago, its shares were around the 600p mark. Today they are closer to 6,000p after its recent trading statement sent the stock to another all-time high. Net profit has also increased at pace, up from £13.5m in FY16 to £65.8m in FY19 - but can this growth continue?

One of the key catalysts has perhaps been a change in management, with Tom Kirby stepping down and Kevin Rountree taking the reins in 2015. This change has occurred in tandem with a number of helpful initiatives such as more frequent product releases, an invigorated licensing business, redesigned trade terms and a more active and engaged online and social media presence. Perhaps most promisingly, though, management says that its success comes from ‘remaining true to [its] long-term strategy.’

It’s not just a case of new management breathing fresh air into a business, though. Much of Games Workshop’s current growth and profitability can also be attributed to longer-term infrastructure projects that have enhanced efficiency and productivity. More royalty income and trade outlets have also driven growth.

Games Workshop has been careful to grow and mature as a company in line with its trading growth. Management has commented previously about the importance of this conscious shift in culture towards a more commercial, global mindset. It appears to be bearing fruit.

I know this is a popular stock with retail investors, so any comments or additional insights are welcome.

Signs of a moat

Games’ colourful brands (Warhammer and Warhammer 40,000) command a level of affection from its customers that few other profitable, listed companies enjoy. This translates into a valuable degree of pricing power across its expanding range of products. This strong brand identity and loyal fanbase might be a long-term economic moat that can see the group prosper over time.

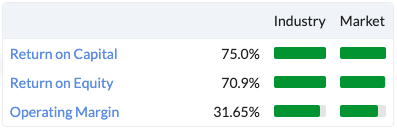

The group’s Quality Rank of 98 and its return on capital figures certainly suggest it is worth a closer look:

And the management team does appear to think in terms of long-term moats. In fact, in language befitting a wargaming company, GAW has…

.jpg)