Purplebricks Group (LON:PURP) has taken the stockmarket by storm having listed at 100p in December 2015 the share price is now over 400p. The company has 270.6m shares giving it a market value of £1.087bn.

The business model is as a hybrid estate agent with a "local property expert" combined with an online estate agency service. This is meant to provide "the best of both worlds" and differentiates the group from other online estate agents. This model means that the group prices its services above that of online-only agents but substantially below traditional estate agents. Home owners don't have to deal with home buyers directly and can obtain the advice of the local agent.

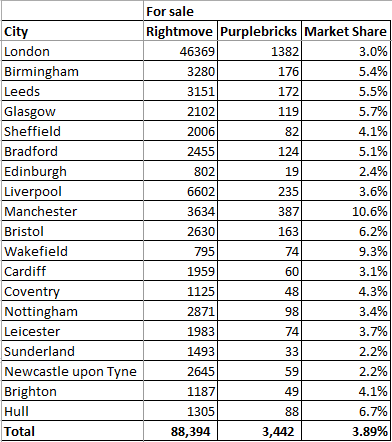

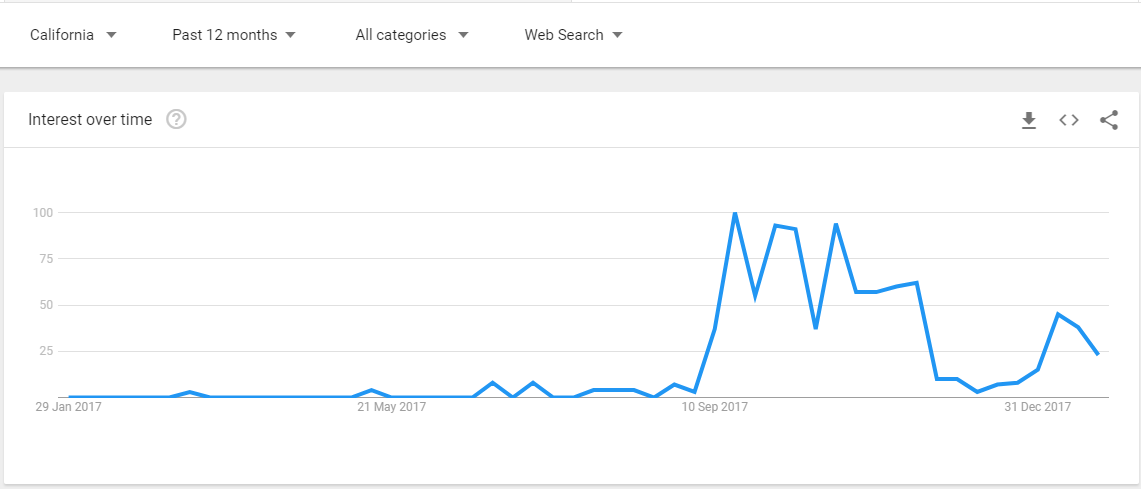

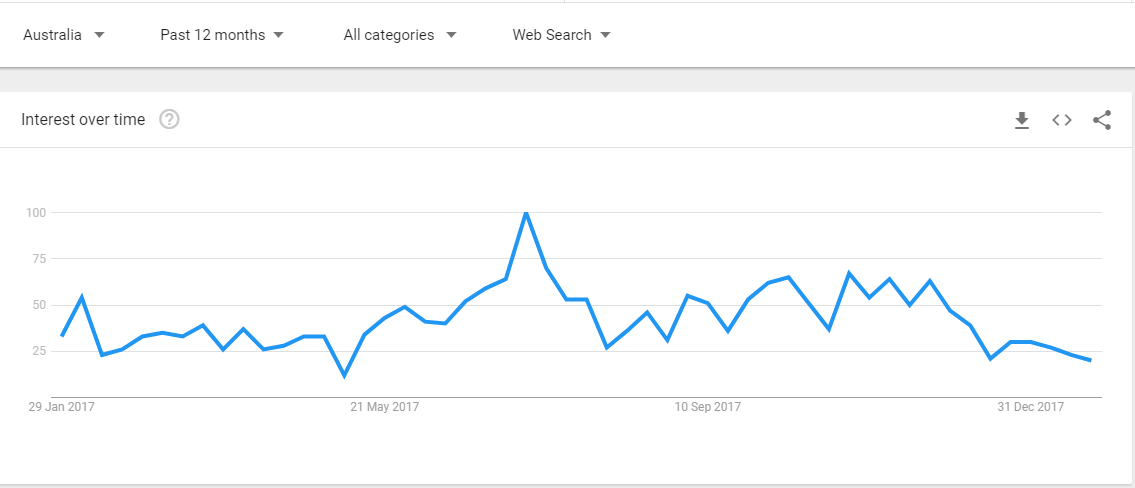

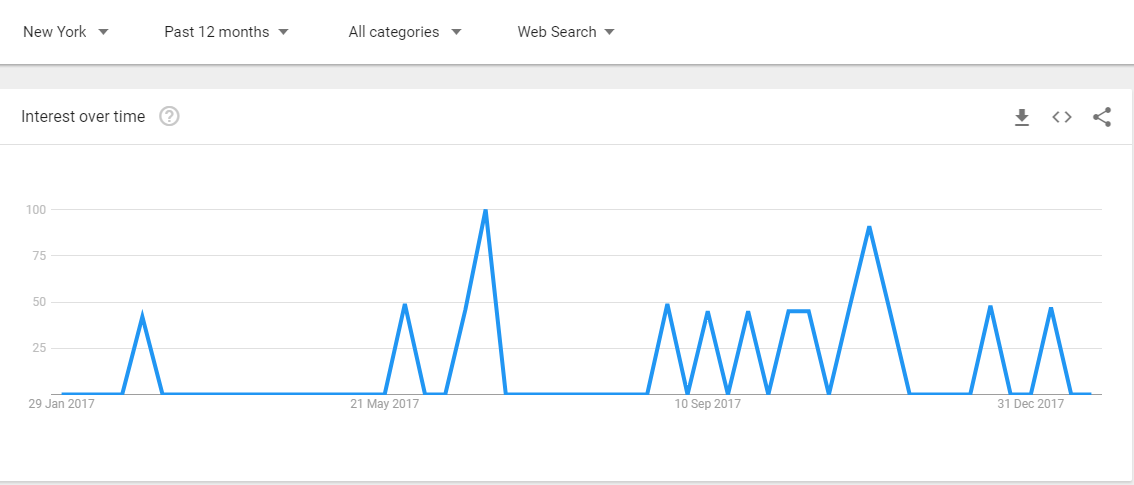

Purplebricks has run an extensive advertising campaign in the UK and built up market share ahead of online rivals. Looking around the UK and the Purplebricks for sale sign has become increasingly ubiquitous. The group has also moved into Australia and plans to expand in the United States.

In the six months ended October 2016 the group generated revenue of £18.7m with nearly all of this from the UK. At first glance the circa £1.2bn market value looks pretty punchy.

Long-term success is not a given with expansion in the US yet to be proven. In my view, Purplebricks is essentially a service company with it advertises client property on portals such as Rightmove in the UK. In the long-term the group appears to have few means to generate high returns and see off the competition. Looking at the four competitive moats:

Intangibles - Yes Purplebricks has a strong brand but that is only due to an advertising campaign. A new entrant could simply advertise to get people to sign up. The group does have a first mover advantage. But we have seen countless examples where the first mover has fallen by the wayside.

Cost advantages - the main advantage is spreading the fixed admin cost and the cost of marketing. Marketing costs are a barrier to entry to, for example, in the price comparison sector. It is perhaps the biggest barrier to entry in this area.

Switching costs - Property sales are a one time transaction and as such there isn't a long-term relationship.

Network effects - This is probably the most important competitive moat and Purplebricks doesn't appear to benefit from…

paraic84,

I think Purplebricks (LON:PURP) will have slightly different seasonality to other agents. H2 which is to 30th April should be stronger because peak houses will be marketed March April and Purplebricks (LON:PURP) get their fee up front. Whereas traditional agents will have peak income on chain completions later in the year.

The point is that if my (admittedly limited being only top 20 cities) analysis is correct that the slow down has not appeared in the results yet since these are to October and the slow down happened post reporting period.

Their own guidance for UK revenue is only +10% for H2 on H1 so this wouldn't seem to be great given the seasonal affects that should favour H2.

ratioinvestor,

I think the current strength of Purplebricks (LON:PURP) is related to Woodford buying. I note the statement that his third fund Woodford Income Focus has been buying:

https://woodfordfunds.com/words/insights/wiff-november-2017/

we have been able to free up a small part of the portfolio to opportunistically capture some long-term capital growth potential for the fund, in stocks which are misunderstood by the market and which are therefore profoundly undervalued. As such, we introduced three new positions to the portfolio during the month, in the form of Allied Minds, Prothena and Purplebricks.

The cynic may argue that this decision may have more to do with year end mark- to-market reporting of the other Woodford funds that have big holdings in these stocks and have been performing badly this year.

Long term it is business fundamentals that matter more and to me these are little competitive advantage, questionable behaviour regarding reviews, portal management & advertising, and high market & regulatory risk.