A couple of weeks ago I received the following questions from one of our long term subscribers: “Now that Stockopedia is so successful, do you feel that you are influencing the market as a whole?” “Does the availability of high-grade information to private investors cause them to all move together under your guidance?“ “Are you increasing the volatility of the market?”

I hear these kinds of questions time and again, and until now I’d mostly disregarded them. We’ve always punched above our weight, but as a niche player our market impact was intuitively low.

But over the last 12 months our subscriber base has grown by more than a third, the readership of the blogs has grown to all time highs and the StockRanks have continued to perform stunningly well.

Given these facts, and the fact that I use the StockRanks myself as my core investment process, I feel some responsibility to answer these questions.

The Study

Part of the Stockopedia service is a suite of portfolio tracking tools. I would say that less than half of subscribers use them but they serve as a good proxy for the proportional weight of money moving into certain shares.

To help answer these questions for the community, I’ve aggregated the last 3 months of buy and sell transaction data from the portfolio systems.

I’ve limited the search to London Stock Exchange securities. While do have a growing army of international investors on the site, from Canada to Oz, as a UK founded site, the majority here are British.

I’ve also excluded some portfolios that are clearly marginal or erroneous. We do have quite a number of fund managers using the service, and their portfolios are normally £200m+ in value which skew the results. I also excluded all the outlier transactions which could have been entered by fat fingers. While the resulting data set is not perfect, it’s good enough to answer quite a few questions.

The Results

1/ Breadth

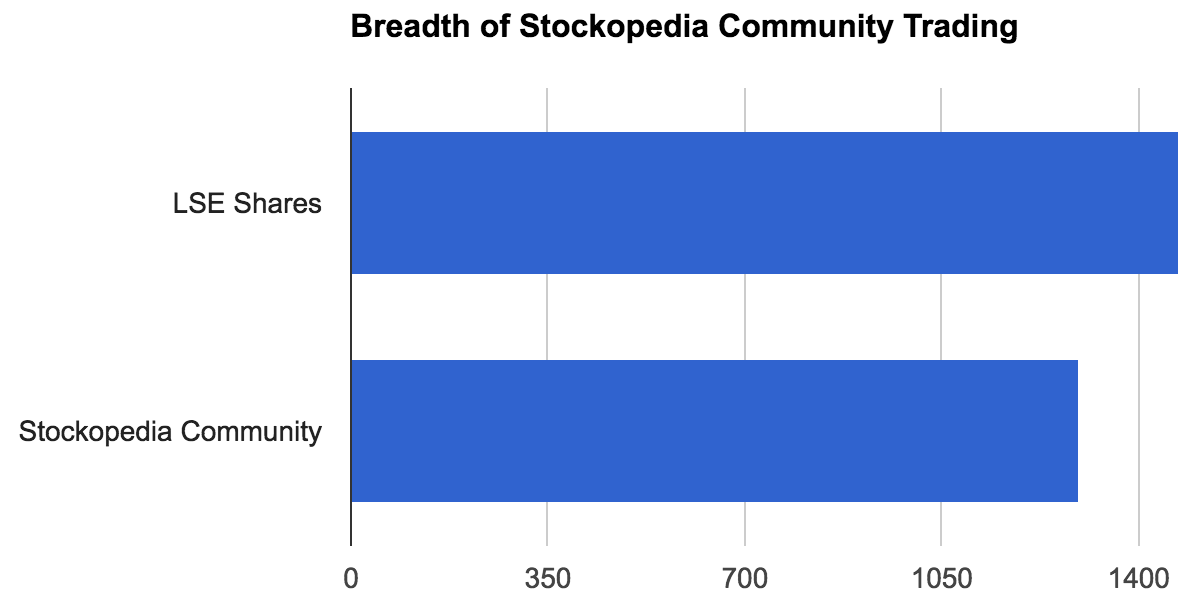

The first surprising result is quite how many different shares are traded by the community. If you exclude all collective investment vehicles, dual lists and other odd listings there are 1472 common shares on LSE. The community traded 1294 of them. That’s 88% of the market’s shares in a single quarter.

2/ Concentration

Of course there are hundreds of these…