We have almost completed the surge of trading statements that come out of UK-listed companies in January and early February. Not many appreciate how much the January trading statement season really sets the tone for the year. There’s a saying that “so goes January, so goes the year”, which sums up the idea of the January Barometer - that if stocks rise in January it’s a positive omen. So with the FTSE up 6% in January, a marker is set.

In this piece, I will review some of the announcements that caught my eye in the last few weeks, and I hope you will share some more in the comments. This is especially of interest in the light of the research work we’ve published lately on the predictive power of “ahead-of-expectations” announcements, big price jumps on trading statements days and repeating “ahead” announcements.

Calm before the storm?

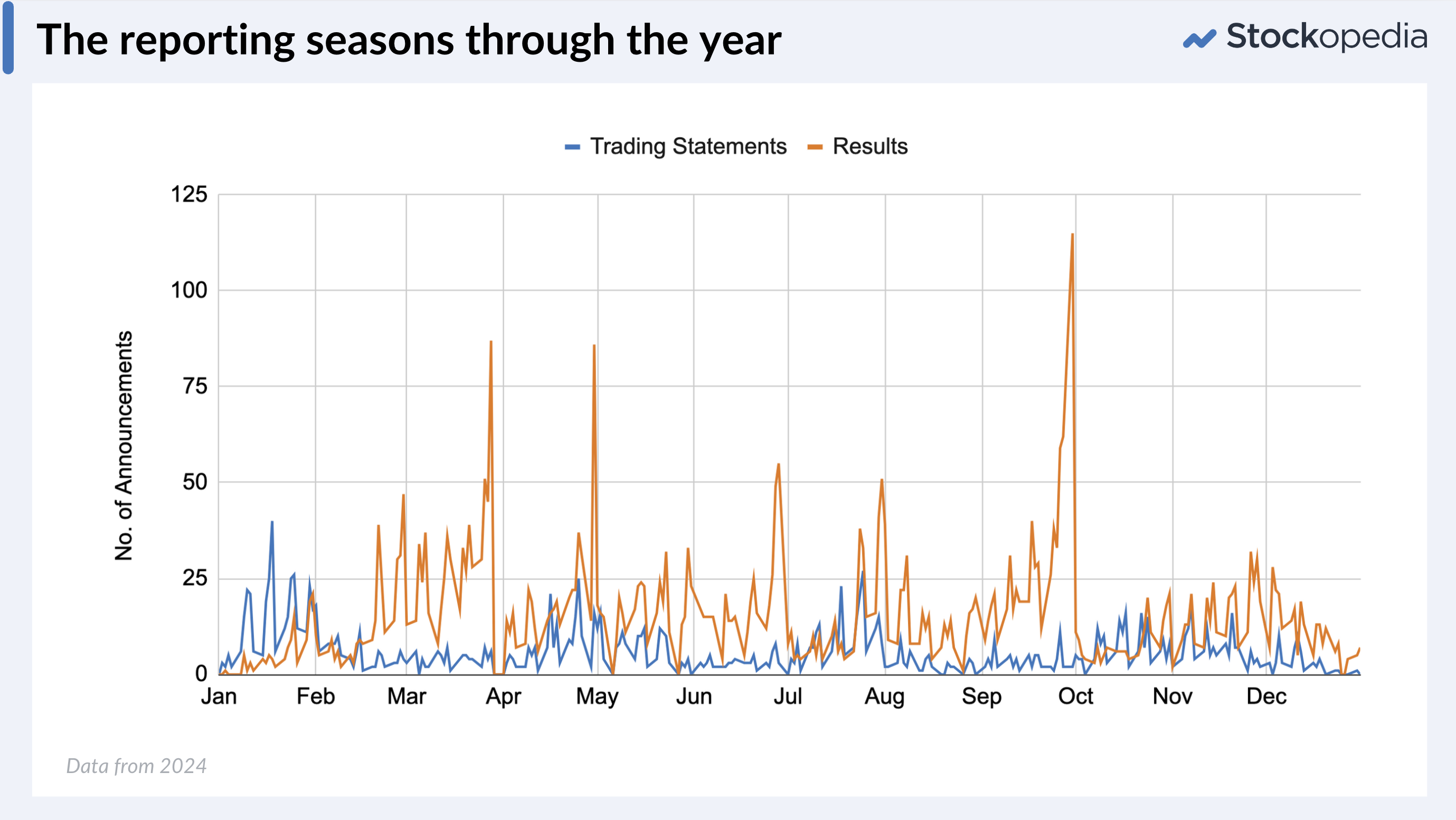

The Daily Stock Market Report team has done an outstanding job covering hundreds of trading statements this month. If you look at the chart below, you can see that trading statement season typically lightens up by early February (blue line), before a giant wave of year-end final results hits the wires (orange).

Not every company releases a trading statement, but those that do often state whether they are trading “above”, “inline”, or “below” expectations triggering big share price moves. But results too can surprise on the upside or the downside. Warpaint slightly missed its revenue numbers last week and has been hammered with a 24% share price decline. Results season will bring plenty more surprises, so get ready as it kickß off in earnest by the 21st February.

Trading statements with “big jumps”

A few weeks ago, I outlined the power of announcement-day price “jumps” to predict share price increases in the direction of the jump. We saw some big movements in January. There are too many to list, so I thought I’d pick out a few that caught my eye.

All the charts above are 3-year charts - which helps to see whether share prices have continued momentum or are in recovery mode. I’ve linked to DSMR comments where I can.

- Trustpilot – One of Graham’s standout selections over the last couple of years which jumped 17%…