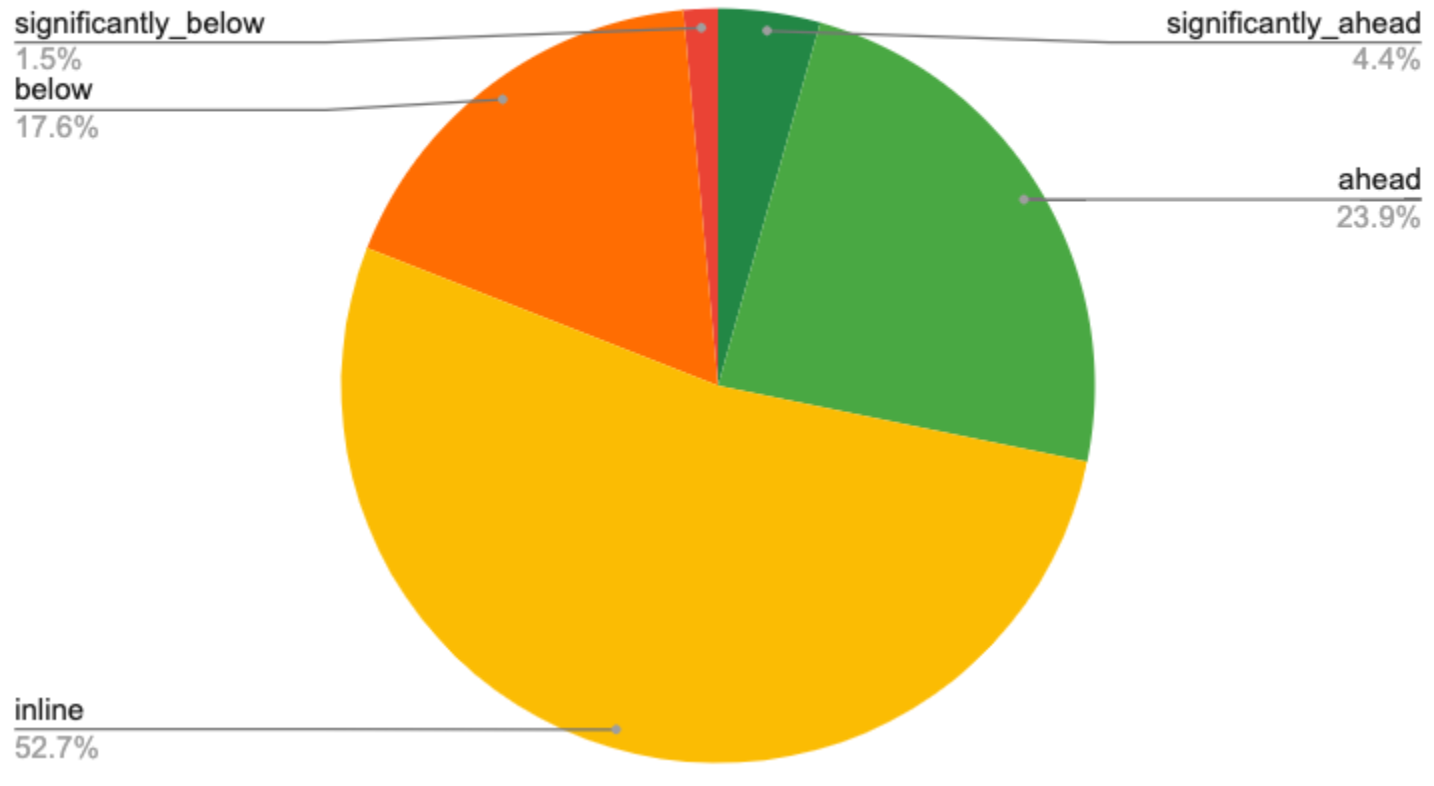

Recently, I’ve been digging into the power of three words in trading statements - “ahead of expectations” to predict future share price returns. Last week, we dug into the “jump” - the share price response to a trading statement that indicates expectations could be wrong. And today we're going to zero in on the “drift” - the strange phenomenon which sees share prices continue to rise in the direction of the initial surprise.

This “post earnings announcement drift”, or PEAD, is known as one of the most shocking anomalies in the price behaviour of stocks. In fact, one academic called it “the most damaging to the naive and unwavering belief in market efficiency”, and there is now more than 50 years of research into this phenomenon. But despite all this research, and the fact that it’s common knowledge among professionals, still the drift persists.

What’s so exciting is that we, as private investors, are best placed to capitalise on it. We can deal in small trade sizes that institutions can’t, and get on board a share that’s benefiting from the drift. But it’s easier said than done. It’s psychologically tremendously difficult to buy shares that are on the rise.

So in this piece, we’re going to investigate the mechanics behind the “drift” to give ourselves the courage to get on board.

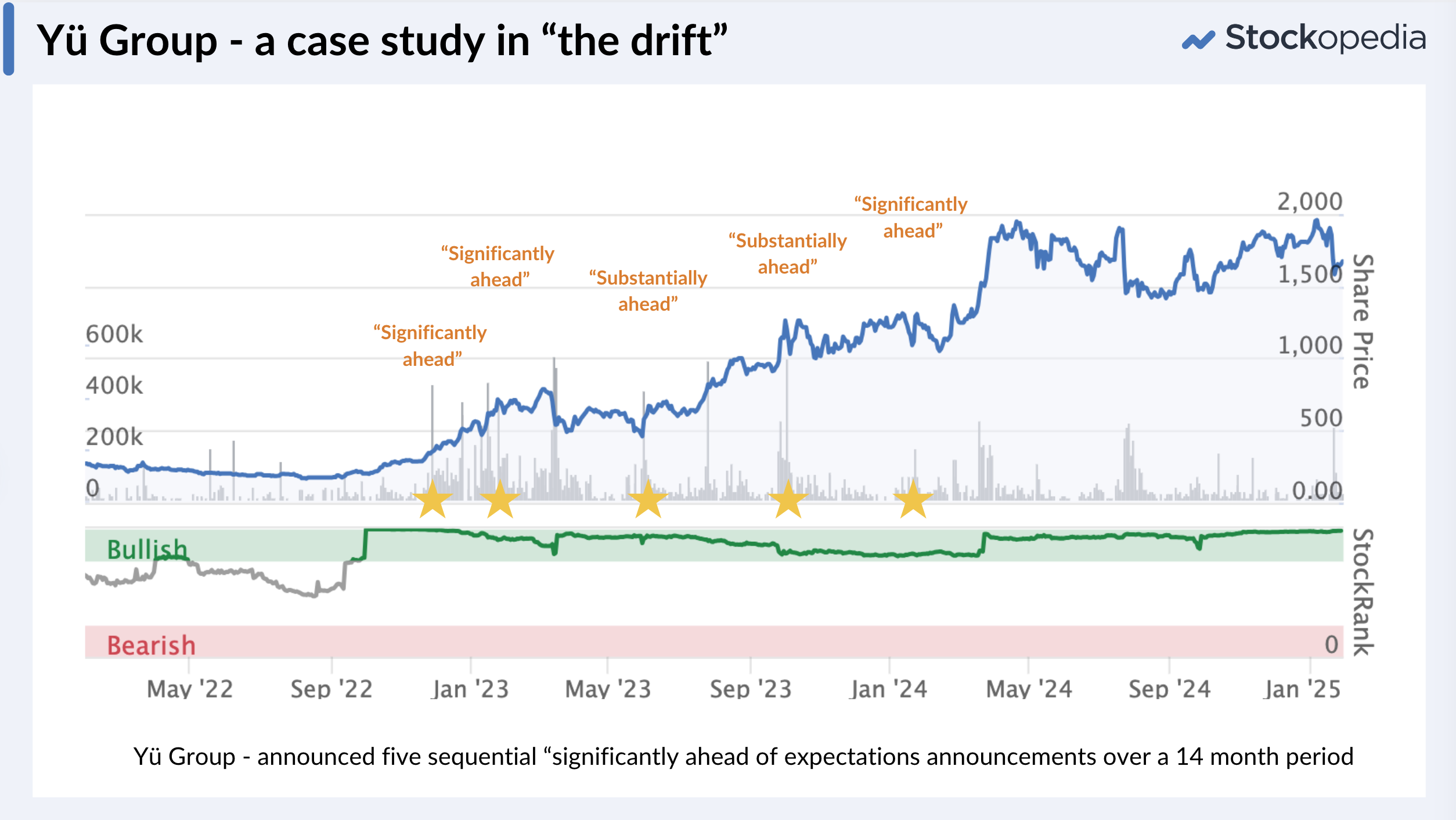

A Case Study in the “drift” - Yü Group

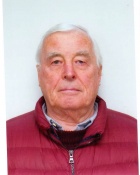

Before we dig into the weeds, let’s start with an example - using one of the UK stock market’s biggest multibaggers of recent years as an example. Yü Group - the energy provider to SMEs - has ten-bagged since its low in August 2022. Its story is instructive.

Yü Group took off at the end of 2022. It announced terrific results in September 2022 with revenues up 96% and the market started to take notice. The StockRank shot up to 98 which brought it into all the key Stockopedia screens. But then, on the 28th of November 2022, it announced that it was significantly ahead of expectations. A jump and drift ensued, powering the share price higher.

Soon after in January 2023, it announced again that it was significantly ahead of expectations. The shares were now above £6 having been trading below £2 only 6 months earlier. It was at that price…