We owe a debt of gratitude to James O’Shaughnessy not just for his groundbreaking multi-decade studies into various stock market factors but because of his championing of a rational, systematic, and emotionally-detached approach to investing.

He values process over outcome - and his systems are typically supported by vast amounts of quantitative research. Building a framework of consistent, data-driven processes into your investment routine is one of the surest ways to improve returns over time. We’ve referred to it as 'managing the monkey' before - applying rules-based processes to avoid self-defeating mistakes.

When it comes to managing that monkey, few rival O’Shaughnessy. So, when he discusses the traits he deems most conducive to successful investing, it pays to listen. Here’s a quick review...

1. Successful active investors have a long-term perspective

How many of us are truly long-term investors in this fibre optic age? The data certainly suggests that we are trading more than ever and holding for shorter time periods.

O’Shaughnessy himself says: ‘Successful active investing runs contrary to human nature. It’s encoded in our genes to overweight short-term events, to let emotions dictate decisions and to approach investing with no underlying cohesiveness or consistency. Successful active investors do not comply with nature; they defy it.’

Simply thinking long-term can give you a sizable advantage over other investors. AQR co-founder Cliff Asness calls it the closest you can get to having ‘an investing superpower’.

2. Successful active investors value process over outcome

If an investment goes wrong, that does not automatically invalidate the thought process that compelled you to buy.

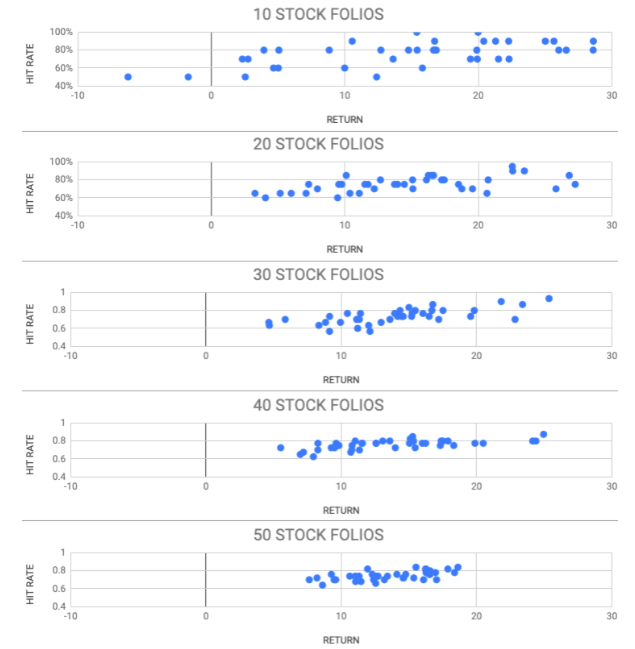

Humans crave certainty but the inconvenient truth is we deal in probability distributions. Ed illustrates this point in his most recent SNAPS post. From that article, I’ve taken the image below - you might have seen it before. Every blue dot in each of the 5 graphics below represents a randomly generated portfolio of 90+ StockRank shares held for the first half of 2019.

The important point here is the dispersion. Each blue dot is more or less identical in terms of Value, Quality, and Momentum characteristics, but even the 50 Stock Folios have a c10% performance range. Regardless of the outcome, though, the process underlying each portfolio was sound and is backed up by years of our own research.

.jpg)