Background

The main themes dominating markets during July were Greece, China and commodities. Continental European markets, relieved that some sort of agreement was reached with the Greek government in the 29th minute of overtime, managed quite decent returns; the French CAC was up 6.1%, the Italian MIB, +4.8%, The Spanish IBEX, +3.8% and the German DAX, +3.3%. Across the Atlantic the main topic of conversation continued to be about the strength of the economy and the timing of the FED’s first interest rate hike; the S&P 500 was up 2.0% and the NASDAQ, 2.8%. Japan continued its upward trend, with the NIKKEI 225 rising 1.7% and will hopefully gain the 1.5% it needs to break though the 18 year high achieved in June.

China, having gone up like a rocket in the first five months of the year continued to drop like a stick; the FTSE China A All Share was off 15.7% but is some 11.7% above the 9th July low. It will be interesting to see whether that proves support if it is tested again in the coming months. China’s economic and stock market weakness had a dramatic effect on commodities; oil (West Texas Intermediate) dropped 19%, copper, 9% and gold, 7% which in turn hit the shares of mining stocks. Russia, was off 7.7% due to its dependence on oil.

In the UK the FTSE All Share (Total return) Index was up 2.4% with the FTSE 100, up 2.7%, leading the way; the FTSE 250 Mid-Cap Index was up just 1.0%, the FTSE Small Cap, +0.7% and the AIM All Share, with its heavy exposure to resource stocks, was down 0.6%.

JIC Performance

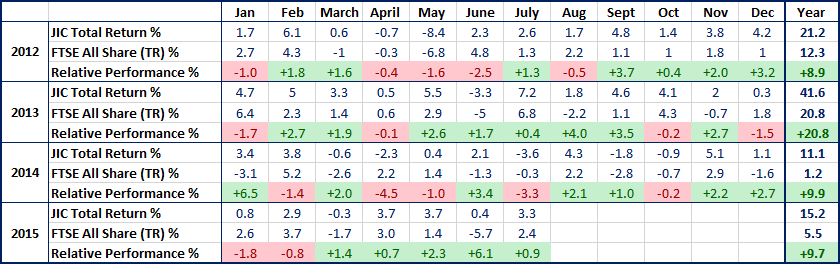

Another good month for the JIC Portfolio rising 3.3% which given it is principally exposed to mid and smaller companies is all the more pleasing. Since January 1st it is up 15.2 compared to +5.5% for the FTSE All Share (TR) Index and since inception 43 months ago is up 119.4% v +44.8% for the Index. As at 31st July the annualised return for the JIC Portfolio was +24.5%.

Monthly Returns for the JIC Portfolio and the FTSE All Share (Total Return) Index since January 2012:

Some big winners and losers over the…