Welcome to the latest in our new series of short-format Stock Pitches. Graham recently looked at microfinance firm ASA International – today I’m going to look at a quite different business, FTSE 100 home improvement retailer Kingfisher (LON:KGF).

Image: Kingfisher plc

The Pitch

Kingfisher owns UK retailers B&Q and Screwfix, plus similar businesses in France and Poland operating under the Brico Dépôt and Castorama brands.

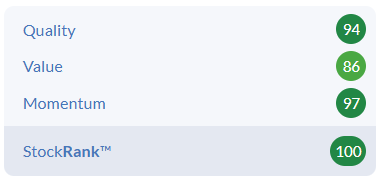

This mature and unglamorous business currently boasts a rare StockRank of 100. Kingfisher has also outperformed the FTSE 100 over the last year and is a member of Ed’s 2026 NAPS portfolio.

Recent trading has been ahead of expectations in difficult markets. Broker forecasts have edged higher since the summer. Changes made by CEO Thierry Garnier appear to be delivering much-needed operational improvements and positioning the group for longer-term growth.

The Big Picture

Kingfisher is associated in many investors’ minds with B&Q DIY stores and similar retail businesses in France. These are rightly seen as mature, slow-growing businesses. However, CEO Garnier is using the company’s scale, store networks and brand strength to expand market reach and grow profits ahead of sales:

Trade: Screwfix is popular with trade customers and has long been one of the group’s fastest-growing brands. B&Q’s own Tradepoint offering is also growing fast. Total trade sales rose by 12% in H1 and now represent 28% of group sales. Garnier says that trade customers “visit 3x more often and spend 3x more per visit”. This trade strategy is being applied across all Kingfisher’s geographic markets.

Online: ecommerce revenue rose by 11% in H1 and now accounts for 20% of group sales. Kingfisher stores carry large product ranges which have been expanded further through the addition of a third-party marketplace. Selling online attracts buyers who would not visit stores, while the stores themselves can be used for order fulfilment.

Advertising: online sales provides a treasure-trove of customer data. This is being used to develop a “retail media” advertising business for suppliers and vendors. Kingfisher’s medium-term target is for ad revenue to reach “up to 3% of ecommerce sales” – potentially c.£85m based on current sales. Garnier describes this as a “highly profitable income stream”.

Efficiency: Kingfisher’s large scale and portfolio of own brands…