It's been quite an eventful year in markets. Most of the market-moving headlines came from across the pond with the Trump tariff tumble in April this year and the huge AI investment theme that's turned heads - bubble or not.

Against that backdrop, many investors have given up on UK shares. We continue to see a drip drip of delistings, either to relist in the USA or to takeover bids. And there’s very little IPO activity to refill the hopper. It all feeds the same narrative - that the UK is shrinking, unloved, and best avoided.

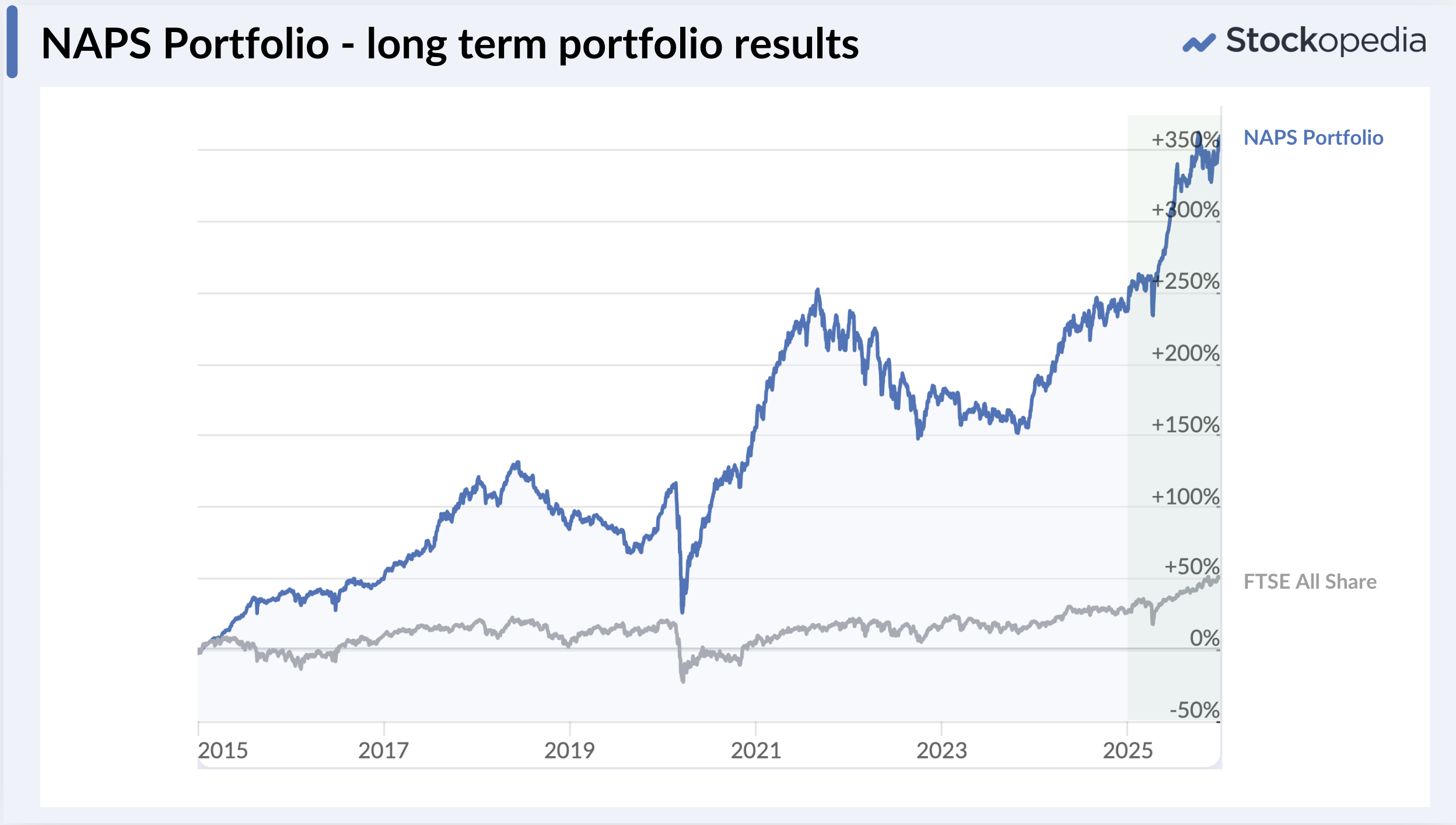

Nonetheless, this sort of environment is manna from heaven for a value investor. And it's in this climate that my own systematic UK Model Portfolio, the NAPS, has had another remarkable year with a 37% capital return. This return has dominated the UK indices and the S&P 500 once again.

So in this piece, now something of an annual tradition, I want to share three things.

- First, we’ll dig into what’s driven the excellent results over the past year.

- Next, we’ll step back and revisit the core investing principles.

- Then, we’ll lay out the 2026 portfolio rules and the current candidate stocks.

I can’t predict what will happen in 2026, but I do think we all need a reminder that having the courage to apply sound Value Investing principles pays off - wherever you invest in the world.

If you prefer to watch rather than read, I will be running a deep-dive NAPS educational webinar on the 22nd January. The NAPS is a great “starting system” - but the real value comes if you understand why it’s worked, where it breaks, and how you might sensibly adapt it to your own needs. Please do join then. I will run over the 11-year history, all the principles, and the new portfolio. You can sign up here at this link.

The headline: NAPS returned 37% in 2025

The 2025 NAPS portfolio delivered 36.8% capital appreciation, with approximately 3.5% of dividends on top. That puts it firmly into the “standout year” category. The FTSE 100 rose 20% with the All Share close behind, while the FTSE Small Cap rose 6.5% and the AIM All Share 6%. It's worth noting that the S&P 500 was up 16%.

What’s striking is how this…