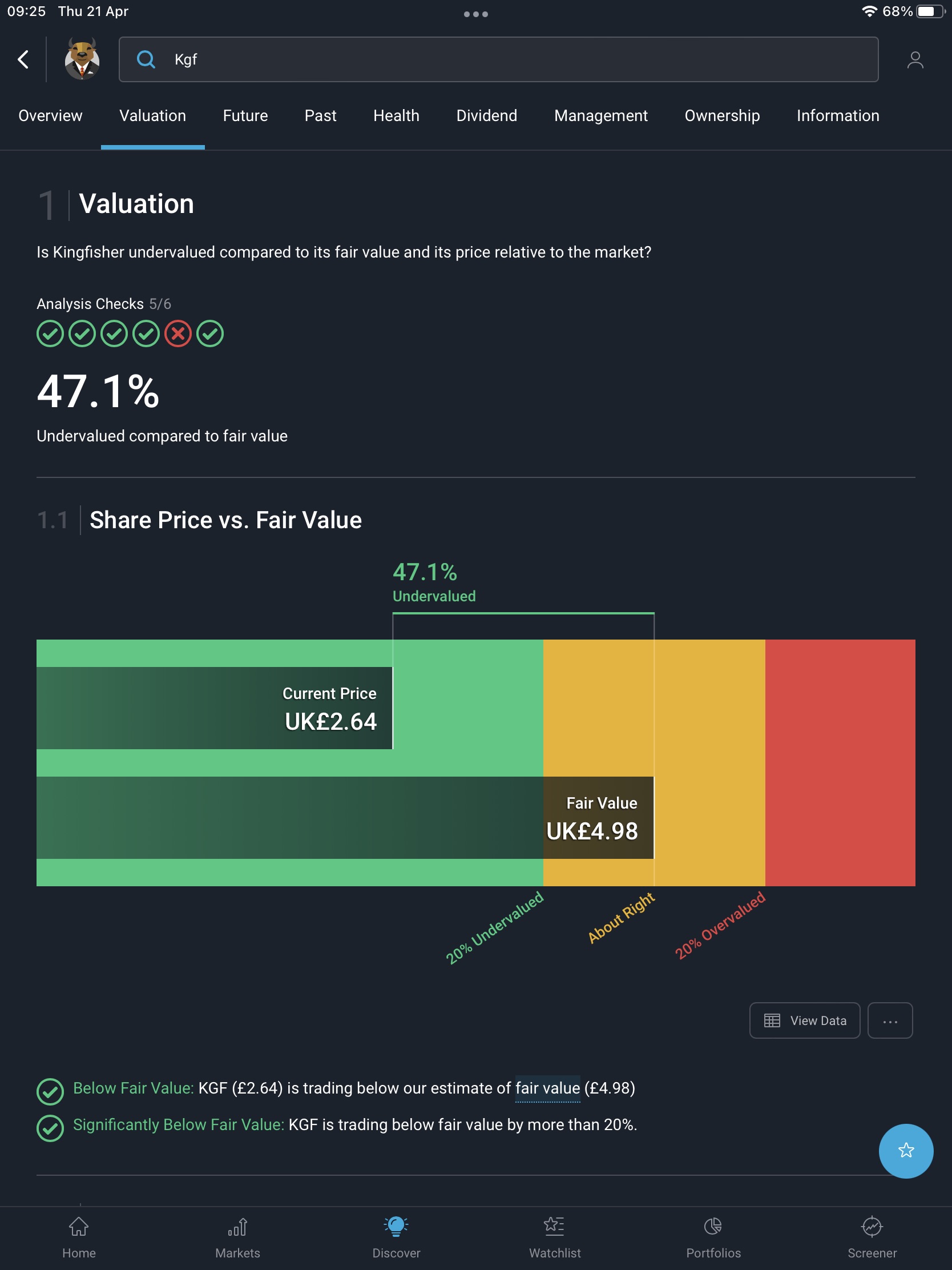

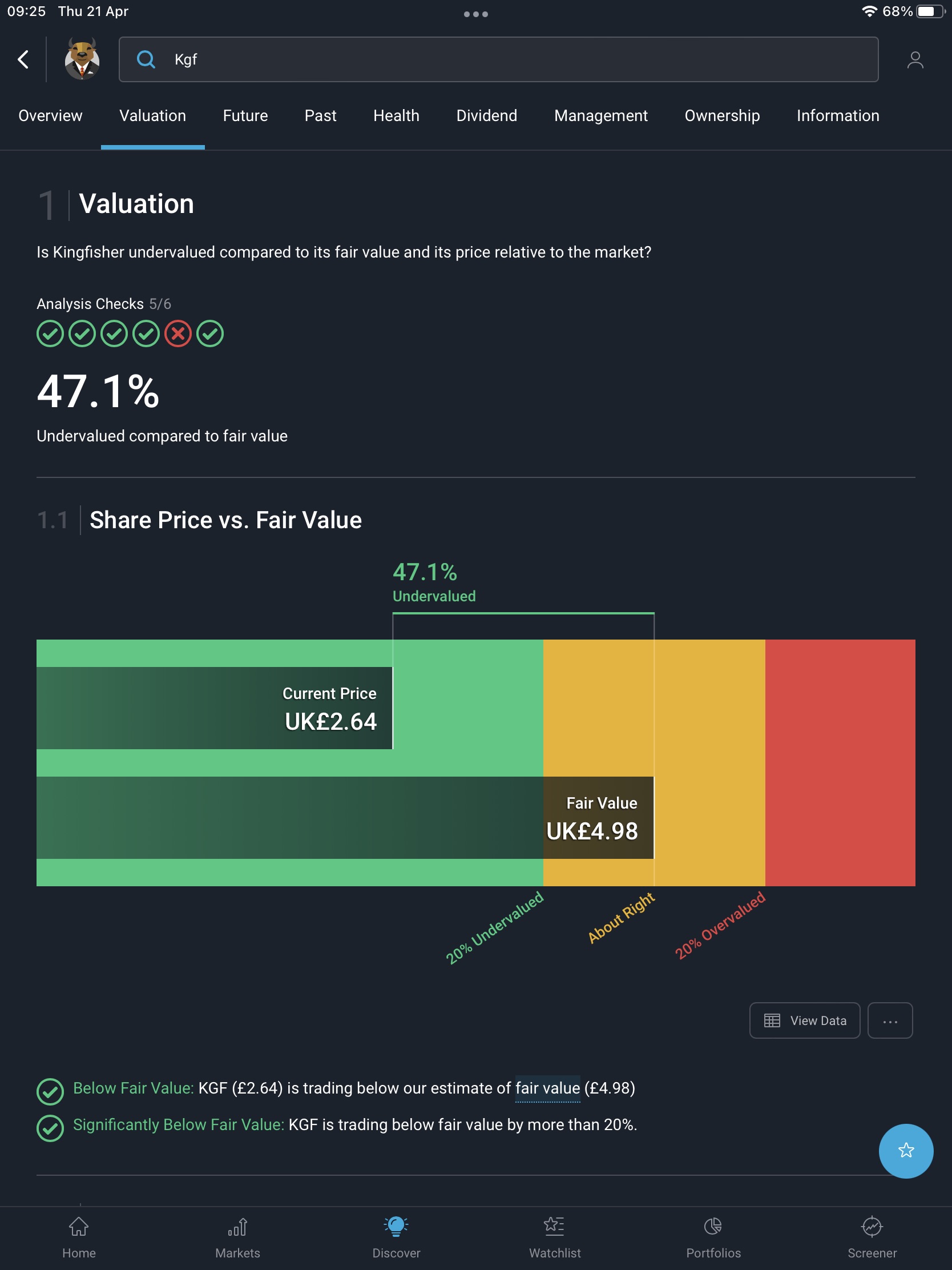

Hi - Kingfisher seems to be a good value out-of-favour stock currently? Anyone spot any reason why I should not buy as a long term hold? - Thanks in advance - Simply Wall St valuation?:

Hi - Kingfisher seems to be a good value out-of-favour stock currently? Anyone spot any reason why I should not buy as a long term hold? - Thanks in advance - Simply Wall St valuation?:

It does look fundamentally good value having had some pretty poor momentum, thus Stockopedia has it labelled as a Contrarian play, although it could be a value trap perhaps?

Things to consider there are 5% short positions in it which have been taken out this month. There is also a degree to which they were a beneficiary of lockdowns & people sprucing up their home space as a result. This is reflected in forecasts which show that their earnings are expected to fall back to their fairly flat trend. That because this tail wind has obviously gone away added to which we have a slowing economy, rising interest rates a cost of living squeeze so people may be more likely to put off DIY jobs or may have done most of what they needed to do during the pandemic - perhaps? In addition one would think that housing transaction might slow at some point soon which they also benefit from.

They have also seen some more earnings downgrades recently which could be the start of a trend given the above or a precursor to a profits warning see Gear4Music today. FWIW the Score on my quantitative system had declined recently on the back of the earnings downgrades & consequently it was sold from the portfolios that I run off the back of those. Meanwhile the technical trend is firmly negative albeit very oversold in the short term.

On the more positive side it is not overly indebted, discount to book, seems well managed and there was a reasonably sized directors purchase recently, albeit by a Non-Exec. Finally I guess it could attract a bid from a VC (see Morrisons & Asda recently) or a US competitor to expand their geographic footprint given the low valuation & market position.

Not sure if any of that helps & I guess it might depend on whether you are looking to hold long term or for a trade, but as ever you pay your money and take your choice - good luck with whatever you decide to do.

Jamie

Kingfisher (LON:KGF) has been on my watchlist for some time as a possible long-term buy and hold candidate. Trying to learn from past mistakes of jumping in too quickly, may wait to see if SP drifts towards low 200's. Their share buyback of up to £300m seems to be in full swing, I wonder what the effect will be once that's completed.

"To date, Kingfisher has purchased 22,727,166 ordinary shares in aggregate for cancellation from GSI in connection with the fourth tranche of the Programme. Kingfisher also previously purchased 22,599,655 ordinary shares in aggregate for cancellation from Credit Suisse International, 22,396,233 ordinary shares in aggregate for cancellation from BNP Paribas Exane and 24,215,979 ordinary shares in aggregate for cancellation from Barclays Capital Security Limited in connection with its execution of the first, second and third tranches respectively, of the Programme."