At Stockopedia we take the view that human behaviour can be hopelessly at odds with picking shares. All too often it’s instinctive to eye-up exciting, popular but ultimately expensive ‘story’ stocks. Despite being pushed by supposedly expert market analysts, their hefty price tags and questionable quality often lead to disappointing returns. By contrast, a huge amount of research finds that groups of good quality, cheaply priced and improving stocks tend to outperform the market.

With that in mind, fifteen months ago we built a portfolio of 25 shares using screening rules that aimed to find solid companies at attractive valuations. While it wasn’t exactly scientific, the aim was to find out what could be achieved (and learned) by leaving emotions at the door and trusting entirely in a rules-based strategy.

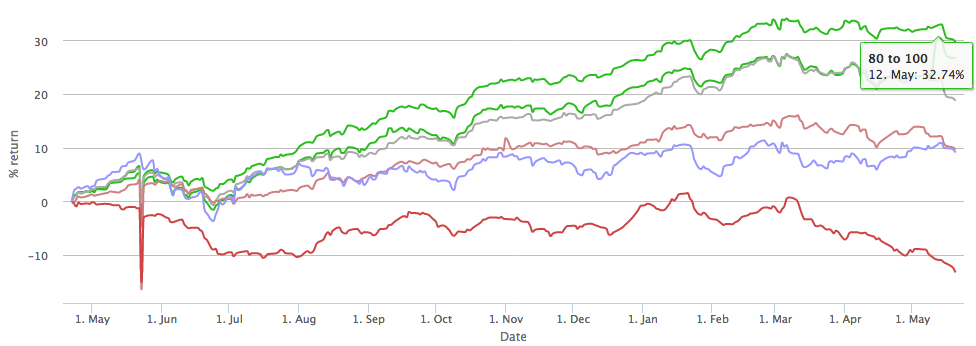

In a period when many smaller stock have soared, the largely small-cap biased 25-strong portfolio has achieved a 32% return excluding dividends. That matched the surge in the FTSE SmallCap index.

Building the Systematic Value screen

One of the features that Stockopedia is well known for is the live tracking of more than sixty guru-inspired investment strategies. These are the methods used by some of the world’s most influential investment thinkers - from Edward Altman to Martin Zweig. Each has a different approach but most fall into one (or a combination) of three categories - Quality, Value and Momentum. In combination, these key drivers of stock market returns are the hallmarks of some of the world’s most successful investing strategies...

The Systematic Value screen set out to find good quality stocks at cheap prices by bringing together two heavyweight guru strategies: Joel Greenblatt’s Magic Formula and Joseph Piotroski’s F-Score. Individually, these screens have performed fairly well over the past 15 months, with returns of 24% and 15% respectively.

Greenblatt’s Magic Formula is itself a strategy that aims to find good, cheap stocks. It does it by using a combination of two financial ratios to rank the market. The first is Return on Capital, which looks at how good a company is at making a profit from its assets (that’s the quality part). And the second is Earnings Yield, which takes a company’s Operating Profit and divides it by its Enterprise Value (that’s a measure of its cheapness).

But as Greenblatt conceded when he wrote his bestselling The Little Book that…