I attended the Mello Bloomberg investor event last night and what a good event it was; some excellent speakers and “refreshments" afterwards in Bloomberg's high tech office in Finsbury Square.

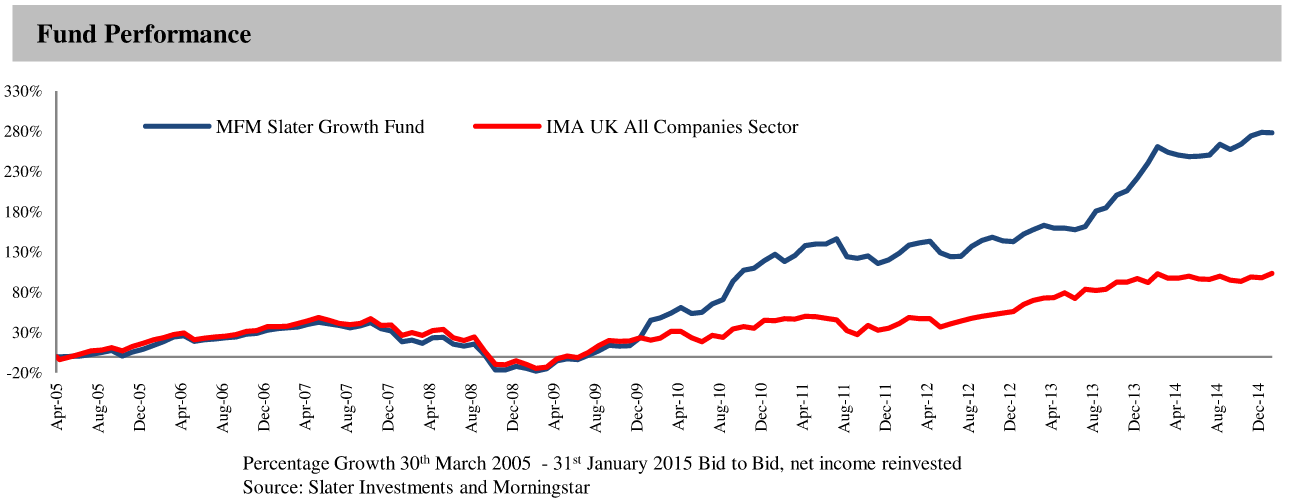

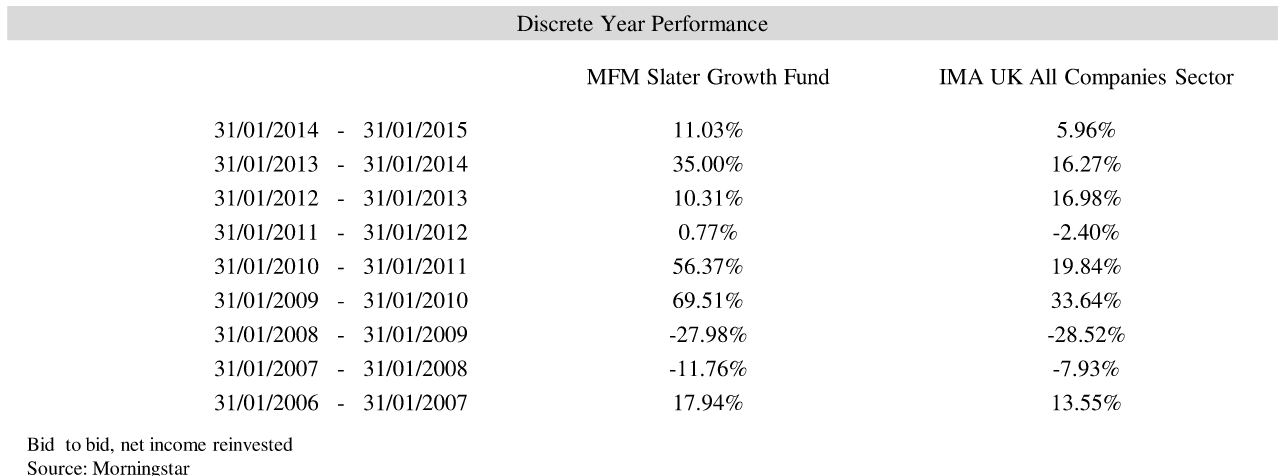

The first speaker was Mark Slater, the manager of the Slater Growth Fund, who has a superb record over the near 10 years since launch of the Fund in March 2005. It is up some 280% v around 120% for its benchmark, the IMA UK All Companies Sector.

Cumulative performance to 31st January 2015:

The Slater Growth Fund is one of those that I benchmark myself against; if I can't beat him I might as well give up and invest in his fund. I often have a glance at his Portfolio to find ideas to follow up. Since launching the JIC Portfolio in 2012 it was up some 89% over the three years to 31st January compared to 65% for the Slater Growth Fund; I need to keep that performance going! He described his investment approach and made some excellent observations, notably that he believed private investors had a distinct advantage over institutional fund managers; private investors can move more quickly and are also able to run more concentrated portfolios. He said that if he was managing a private portfolio “personally there was a strong argument for having only 5-10 holdings!"

What Slater looks for in an investment:- Low PE relative to growth; unashamedly he is a GARP man thinking that pigeonholing oneself in either Value or Growth is fine but not for him. Ideal company might be on about 15x forecast earnings and a PEG Ratio (PE Ratio/earnings growth) of 1.0 (i.e. 15% earnings growth).

- Strong cash flow; it's all very well looking at earnings per share but they can be, and often are, manipulated. Cash flow per share is the real measure of the strength of a company. It's okay if a growing company has a short period of poor cash flow providing it is investing for growth but he would want to understand why and expect it to be positive over 5 years. Free cash flow is very important; it's what pays the dividends.

- Positive recent trading statement; he likes investing in companies that…