Market Musings 090623: Economic Pessmism v Market Optimism

Stock markets climb the wall of worry

Monthly Vox Markets Macro Video (with Paul Hill)

Macro Investing Masterclass with Chris Watling & Edmund Shing

Weekly Podcast

Everything you need to know about the Nasdaq’s performance year-to-date

Drivers of the stellar performance of the Nasdaq 100 this year

Can the trend continue?

What smart investors should be doing right now

Summary

Plenty of reasons to be pessimistic

But stock markets seem to contradict this, reaching new highs

Focus on mid-/small-cap stock now - confirm large-cap momentum or not?

Economic concerns now in Europe

But inflation is coming down, probably to come down faster

Sectors/Themes: Global semiconductors, Circular Economy

Contrasting Perception and Reality

As is quite frequently the case, the outlook for the global economy looks somewhat grim. Bad news abounds:

The ongoing Ukraine conflict is the biggest war in Europe since WW2;

Inflation rates have reached multi-decade highs over the last few months, squeezing households;

Central banks in US and Europe have been forced to aggressively raise interest rates over the last year, causing problems for both corporate and household borrowers as mortgages and loans become much more expensive;

US regional banks remain very stressed due to deposit flight, driving lower availability of loans to companies and households;

Commercial Real Estate markets are suffering given more expensive financing rates, and with office building demand under pressure from the Work From Home trend;

Global recession has been expected for some time now. In particular, the US Leading Economic Indicator points clearly to impending recession.

Source: Conference Board

Inflation rates in the developed world remain higher than is comfortable for central banks, even after central banks have raised interest rates quite aggressively over the last 12 months or so to levels not seen in 15+ years.

But stock markets reflect optimism?

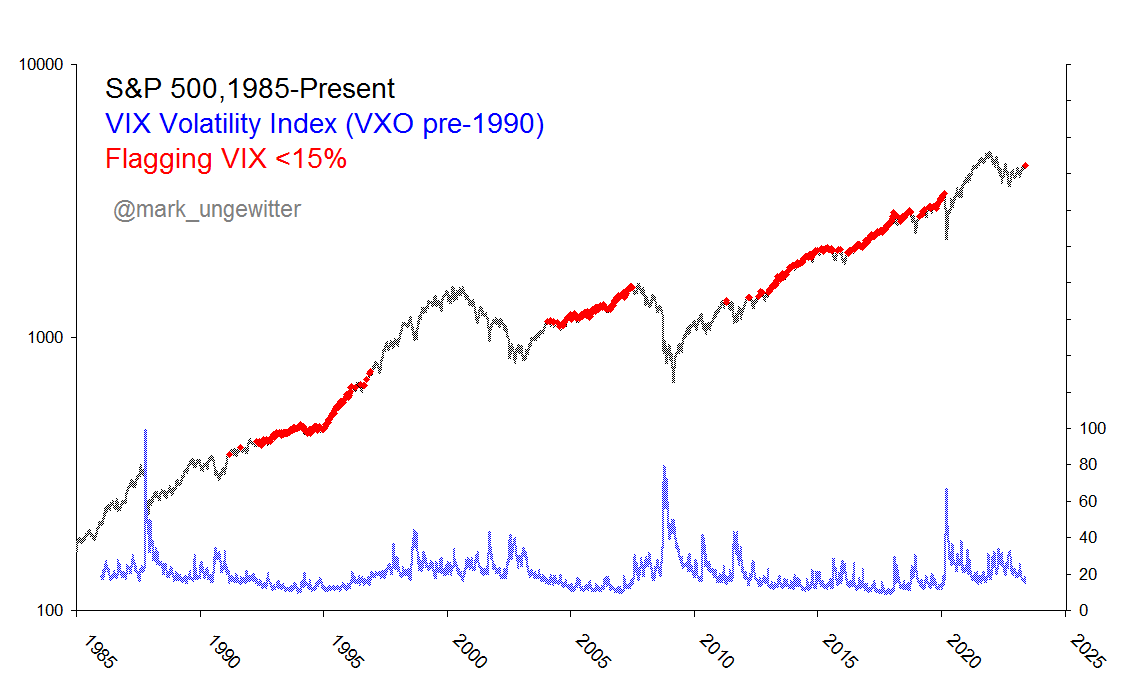

And yet, despite this barrage of pessimistic news flow, stock markets around the world seem to tell a different story.

A number of stock markets around the world have hit multi year highs including the Japanese Nikkei 225, the French CAC 40, the German DAX and even now the…