Following Ed’s New Years update on his NAPs strategy, I will give an update on my own version of a high Stockranks based strategy. I have been applying this now for over 3.5 years, more or less from the time that the Stockranks were first launched. So quite possibly I have been using a rules based Stockranks strategy longer than anyone.

The basic strategy is pretty simple. Buy stocks with the very highest Stockranks (which also score highly on the Screen of Screens) and sell them when they go below a certain level. There has been a bit of tinkering with the rules over time. The most important change has been the lowering of the sell threshold from 90 to 80, which means that stocks tend to be held for longer with less churn overall. This year I have gone a stage further and if it drops below 80 but the stock is showing signs of momentum I will top slice and maintain a position until the momentum peters out.

Other tweaks include incorporating PEG by creating a rank from to low to high and combining with the Stockrank based score so selections are weighted to low PEG stocks. I have also taken inspiration from one element of the NAPs approach, namely the bid spread, and similarly weight selections towards tighter spreads. Unlike NAPs, I am not overly concerned about diversifying across all sectors, although I do try to avoid having more than two stocks in the same industry peer group. Finally, I make reasonable attempts to avoid suspected fraudulent listings. Maybe all these tweaks make for a secret sauce with a more complicated recipe, but the main ingredient is a high Stockrank, which remains unchanged.

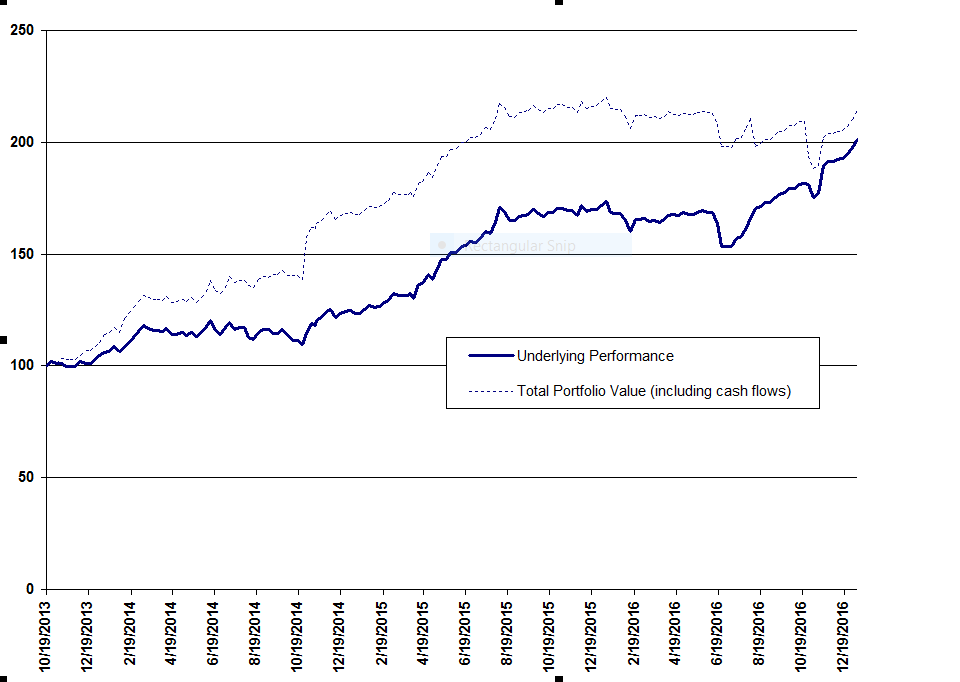

So how is it all working out? I am no longer maintaining my blog's fantasy portfolio, but what I can show is the indexed change in the total valuation of my (and my wife’s) UK trading accounts for every week since 26 October 2013 (index = 100).

This chart includes dividends and all trading and other costs, so this is a good reflection of what kind of returns are achievable in the real world. However, there has been some movement of cash into my accounts, mainly over the first couple of years, as well as a couple of big cash withdrawals over the last year. I don’t think these have had…