Thought I’d do a brief write up of the sessions I attended on Friday & Saturday at Mello 2014. These are based on the bullet point notes I made at the time which were the things that stood out to me rather than an attempt to capture the full nature of each talk. Summary & opinions of course are mine not the speakers. Looking back I realise I asked a lot of questions, I hope people felt they were good ones and didn’t feel I unduly monopolised proceedings!

First a big thanks to David Stredder for organising the event which was a big success in my opinion. Being midlands-based it was definitely a positive factor having it in Derby (which was a 1hr drive for me). As someone whose day job means I’m unlikely to ever make an evening event in Beckenham it was great to meet a few familiar usernames in person.

Speakers

Paul Scott – Morning Briefing

After a brief look at the morning’s news Paul gave us an honest account of his market history. I won’t repeat it here but the key takeaways for me were:

- Avoid combining leverage and illiquidity – need the ability to be completely out in 24hrs [edit: added

combining for clarity]

- Avoid 100% losses by focus on balance sheet strength.

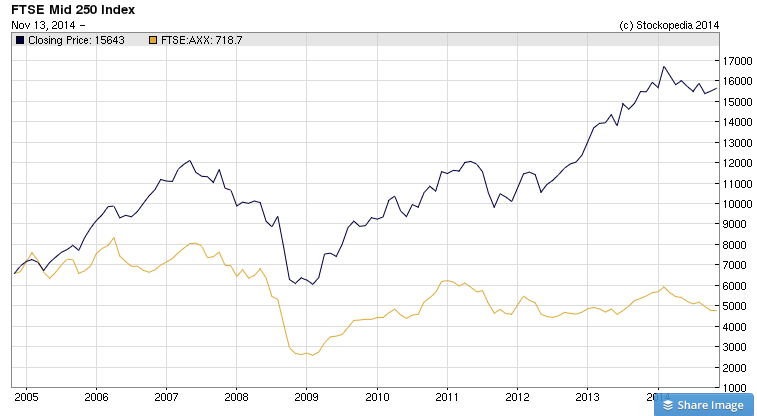

Andy Brough – Small and Mid-Caps Are Where It’s At

Andy spoke about his strategy splitting stocks into 3 categories A,B,C. The A stocks were his ideal holds:

- It's about getting an increasing stream of dividends from increasing earnings.

- Biggest gains have come from finding winning business in growing sectors and holding long-term.

- Look at where inflation is its where pricing power is. [This was interesting concept to me that I hadn’t thought about before – the inflation reports are freely available information, inflation represents sectors that are raising prices so outside of commodity businesses (e.g. petrol retailing) this represents which sectors have pricing power = revenue growth = positive operational gearing = earnings growth = positive returns in general. So assuming you don’t overpay for that growth and can pick good stocks in those sectors it allows you to focus where you are ‘swimming with the tide’ not against it.]

- Top stocks - James Fisher and Sons …