Hello All,

I recently joined Stockopedia a few months back and as a complete beginner I’ve found most of the material in these forums very interesting, there’s a lot to read and get my head around.

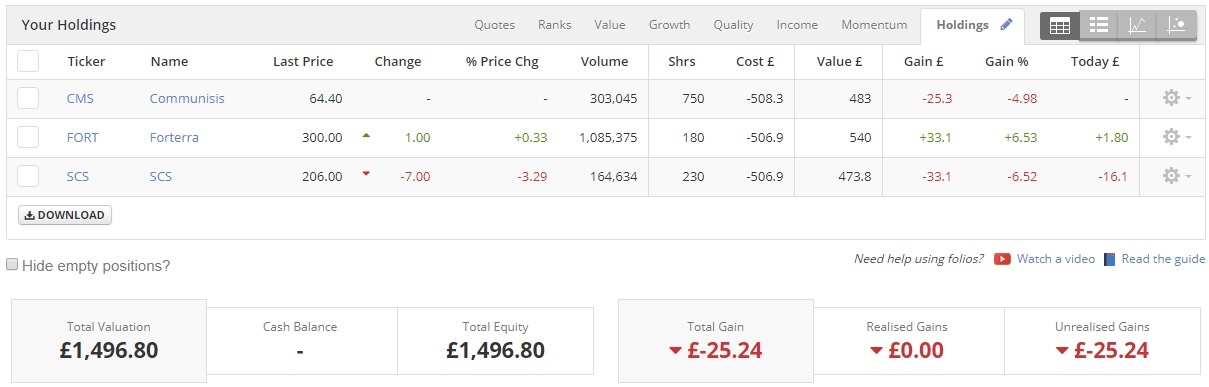

I don’t get the time to contribute as much as I’d like and to be honest I’m not sure I’d have much to offer but just wanted to give an update on my beginners’ portfolio for anyone else out there who’s just starting.

Currently use Barclays Investment ISA to trade. It costs £6 per trade plus stamp duty reserve tax at 0.5%

The goal was to buy a different share every month at £500 worth + fees in a different sector each time to help with diversification. I did have a 10% stop loss on each share but I've removed that now and i'm not sure it's the best course of action, prices seem quite volatile and i'm worried i could get sold out when i don't want. Since i work all day and don't have time to check or sell i need stop losses, i'm still debating what to do here.

Here’s where I currently stand:

Energy –

Basic Materials – Forterra – bought at 276.89p

Industrials – Communisis – bought at 66.64p

Consumer Cyclicals – SCS – bought at 216.68p

Consumer Defensives -

Financials -

Healthcare -

Technology -

Telecoms -

Utilities -

Forterra is performing very well i think, up almost 8% since i bought it, i have no benchmark to compare it to but i bought it in February and i'm pleased so far.

The others not so great with SCS giving me my biggest loss and completely negating all the gains from Forterra.

The biggest lesson learned for me here is diversification, i look forward to the coming months to see what i'll find and how it will affect my portfolio.

Trivia: I also have my first ever ex date coming up with CMS next month.