Incredulous Invisible Hand

Key macro/market trends to watch:

- All about economic resumption as we emerge from lockdowns, surfing on a central bank liquidity wave

- UK FTSE 100 and Euro STOXX 50 catching up to a strong S&P 500

- Banks finally wake up, belatedly and helped by the ECB

- Commodities: Copper is making a move higher

- Government bonds enter downtrend

- US, UK investment-grade corporate bonds strong so far in June

- Leading themes: Value marks a long-overdue resurgence – but can it continue?

- Risks: Continuing US protests, but the markets don’t seem to care.

Could we really see a V-shaped economic rebound?

The impressive stock market rally that has seen the US Nasdaq 100 index surge to a new All-Time High has clearly been fuelled to now by the huge surge in central bank liquidity, with the US Federal Reserve injecting unparalleled amounts of money into the financial system, not to mention the supporting acts of the ECB and Bank of England.

Chart 1: Federal Reserve balance sheet has surged > 50% this year

But with lockdown fatigue pervasive throughout the developed world, and economies recovering as lockdown strategies are gradually abandoned, there seems now to be the belief of a sharp V-shaped economic recovery also being priced into stock markets.

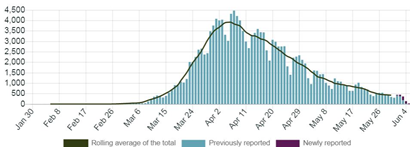

If we look at official UK government statistics on the daily number of lab-confirmed cases in England, we can see that the number of new confirmed cases has indeed collapsed despite the surge in testing (Chart 2). This seems to back up the Government’s stance of opening up the economy – even if the R0 rate of transmission is not much below 1.

Chart 2: Daily lab-confirmed COVID cases in England by specimen date

This comforts me that the risk of a huge 2nd wave of infection in the UK is low, and thus that the risk of renewed lockdowns in the short-term are correspondingly low.

This is crucial for anyone to believe in any sort of V-shaped rebound in economic activity. Let it be said that most professional investors do not believe in this: the recent Bank of America fund manager survey found that 25% of investors view this rally as a new bull market, while 68% see this as simply a bear market rally, with the stock markets due to fall anew.

But…