When I first started subscribing to stock market tip sheets in the 1990's, the concept of “New Year Naps" popped onto my radar. Many tip sheets would choose a handful of favoured stocks (naps) for the year in a special section of their January edition. I thought the phrase and practice was an odd idiosyncrasy until I started to spot racing tipsters and bookies refer to naps when considering racing certainties.

It seems that the origin of the phrase 'a nap hand' comes from the traditional English card game called “Napoleon". In the game each player is dealt five cards and declares how many tricks they think they can make. A “Nap Hand" is a declaration that you can take all 5 tricks - so it's only ever used when you've got very strong odds. I've never played or heard of the game Napoleon but apparently it used to be quite popular. The phrase 'nap hand' seems to have been adopted first into horse racing and from there eventually into the tip sheet tradition.

But we don't do tips…

Now, before we publish some Naps, we need to make some disclaimers. As most readers will know, the entire philosophy behind Stockopedia.com is not to 'tip' stocks. Why don't we tip? Firstly and most simply - we don't believe we need to. The history of stock market returns shows that simple rule-based stock picking models have been far more consistent and effective than human forecasts.

The history of human forecasting is riddled with failure. Left to our own biases, we tend to project what's just happened, so our forecasts often lag reality rather than predict the future. Those that want to read up on the appalling accuracy of human forecasting should read Sin 1 (the folly of forecasting) in James Montier's excellent Seven Sins of Fund Management.

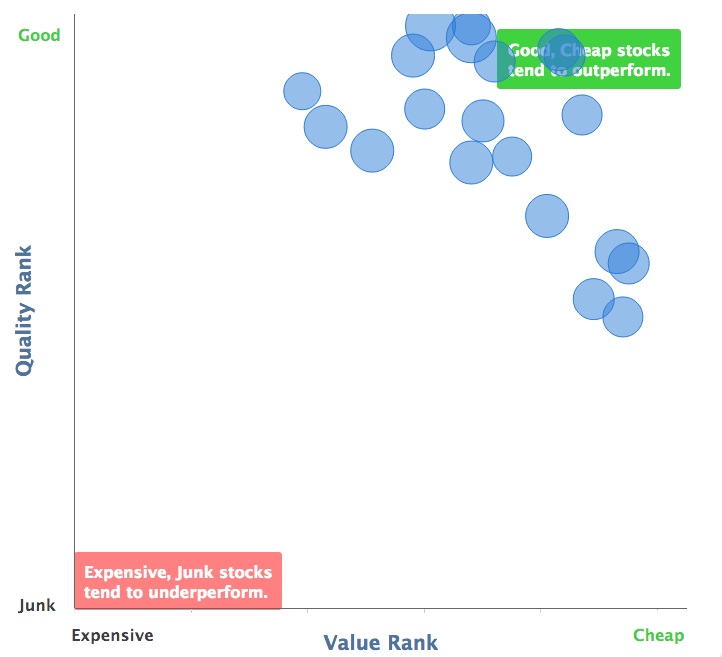

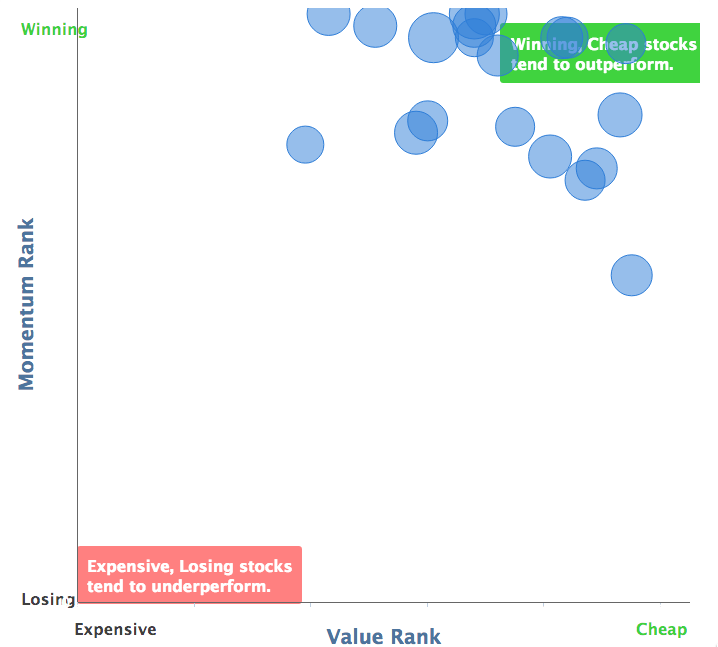

In contrast, for the last 80 years or so since Ben Graham began his work on classic bargain investing strategies, simple checklist based approaches have been shown to be far more consistent at beating the market. Put simply, statistics trump stories in stock market strategies, and that's where we put our bets at Stockopedia.

More importantly, we believe everyone is capable of making their own investing decisions. Rather than mirroring the 'broadcast' approach that most financial publications take, our philosophy is to put the best possible tools…