Hi, I'm just looking to gauge your opinions on the maximum number of different stocks to hold in your portfolios.

20ish seems reasonable to me, providing they are diversified, but how/where do you draw the line?

Thanks

Hi, I'm just looking to gauge your opinions on the maximum number of different stocks to hold in your portfolios.

20ish seems reasonable to me, providing they are diversified, but how/where do you draw the line?

Thanks

Hi pjohn.

Some thoughtful responses here and I would agree with the sentiment that you need to find what works best for you. How much unemcumbered capital do you have? Do you expect/hope to have? Where are you in your life cycle - early days with high expenditure commitments on family and mortgage etc., or in retirement living off investment income and thinking about estate management? What’s your attitude to risk/stress level when things go bad? How much time do you want to spend managing the portfolio? How good a stock picker are you (and as you go along, be honest about just how good a stock picker you really are!). What is your intended strategy - short term trading of a few positions to scalp some trading profits or buy and hold (possibly forever) companies that you are prepared to research and get to know really well.

Having held shares for over forty years I’ve oscillated between the extremes of owning just one share (a gift from my late father in British American Tobacco (LON:BATS) in the early 1980’s ) to my current position of having over 200 individual shares (as well as a range of funds, both active and passively managed in addition to a spread of Investment Trusts, ETFs and even as of last week a discretionary Macro Fund (basically an investment in a short/long spread betting account following global market indices run by a full time manager)).

Much of the academic theory and the word of sages such as Warren Buffet talk of “diworsification” - state that going beyond a certain number of holdings (20 or so does seem to be a magic number for many) will dilute the benefit of your best ideas without achieving an additional benefit of spreading risk. It will also give you a headache trying to keep track of everything and as Wilkonz comments you probably just end up with an expensive tracker fund. One observation I will make is that it is so much easier now with the internet newsfeeds and software such as Stockopedia to keep track of everything - although I may have 200 stocks, I probably look at no more than 10 or so a day as and when they report or there is some relevant breaking news. This was simply not possible (at a reasonable cost) 20 years ago. It’s also so much easier to keep track of dividends and CGT liabilities for tax purposes than it used to be (not so long ago every dividend came as a cheque in the post that had to be paid into the bank and manually logged to calculate the year end tax liability). From a practical point of view there is probably a minimum size holding to consider - at say £10 per trade in and out (plus stamp duty if applicable) of a position - it may not make sense to invest less than say £1,000 per trade, possibly a lower threshold if you are prepared to buy and hold longer term, but otherwise I haven’t had an admin issue with a large number of individual holdings.

I can accept the inefficiency arguments but going back to the original comment, I find my approach works for me. I’m retired, have a fairly good sized pot of capital; limited financial commitments and a reasonably frugal lifestyle; interest in the markets and individual companies but don’t want to be a slave to watching the screens every minute of the day; a strong aversion to large (downward) swings in value in a particular holding but content to go with the flow of wider market ups and downs with the view that long term the direction of travel is upwards. I’m an excellent stock picker - until I’m not, which is often - so while I like to take the occasional punt with a “story” stock, I’m long enough in the tooth not to bet the house on it. I’ve found using the Stocko factor based approach is beneficial - until it isn’t. Somehow, losing 30% on a punt in a speculative oil and gas explorer is less irritating than when an apparent Super Stock issues a profit warning and tanks - it doesn’t itch so much if you have enough of them that the occasional loss doesn’t whack the total portfolio value.

All told, I suspect my approach is quite unusual (extreme?) but it works for me. Let’s face it, it is basically an index tracker and I should’ve saved a whole heap of time by investing in a global tracker fund 40 years ago (if such a thing existed then). But where‘s the fun in that?

Best of luck.

Gus.

I am on HL. I am retired, so I have the time to log my share prices into a spread sheet every evening, and apply a manual stop loss.

My experiences of stop losses lodged with the dealing platform have not been positive - I was once stopped out of Compass (LON:CPG) (far from a small cap) by a huge swing at market open, so I prefer to execute all of my trades myself.

Trading costs also have fallen, some platforms now are free and others are fairly cheap, I now pay £3 per trade with IG, so it is more flexible, I don’t worry about buying smaller amounts.

Thanks for the above. Completely understand about leaving it in automated hands. I've been tweaking my strategy by adding some momentum stocks, but have largely been unsuccessful. Maybe I should be riding it all out anyway, patience being a virtue.

I have found automated stop losses will take you out of many shares, if that's what you mean by automated. I have stopped using them now. Reviewing shares and deciding I find better, why sell a share if the price just dips down?

I use a stockranks based approach but for some of the small caps, liquidity can be a problem. I mostly limit the size of an individual holding to no more than the lesser of 10 * EMS and 1/10 of average daily volume so as to reduce the risk of being unable to sell on bad news.As a result, I have a total of around 40 stocks.

nb. The pedant in me has to point out that your post title should be "Number of stocks in portfolio." If I have a thousand shares in each of three companies, I hold three thousand shares and three stocks.

I was thinking something similar Nick - I have about 40 but I have the time to watch them and I am still learning and this reduces the risk of me making a catastrophic mistake. As I get more confident I will consolidate this into a more manageable number.

Thanks everyone for your postings, it's really helpful to read different perspectives on this topic.

Served me well mate. I think I'd have been out of it by now if I hadn't. Every loss was a lesson though. I've wrote them all down to remind myself of where I went wrong lol.

I think you will also find that market makers on occasion will dramatically drop a share price to shake out a lot of stop lossers and build shares in a growth/momentum share. Happened to me with BooHoo got stopped out at £1 (I had bought at 29p grrr) then hesitated to get back in as the price bounced and greatly exceeded my sell price, all within an hour!!

Hi pjohn005,

you need to find what works best for you.

I endorse that sentinment as well.

Finding out what works best for you can be a long, painful and expensive process, but it doesn't have to be. There isn't a magic number of stocks or degree of diversification that guarantees success. I have owned up to 75, currently down to 45.

What I have learned is that I cannot cover all of the market so I now concentrate on International Fund Managers and US Tech companies. The tech companies are mainly hardware as the software side is a whole different area. You need to establish where your interests (make sure they are profitable ones!) lie.

My top 10 holdings constitute 63% of my portfolio value - so a large number of holdings does not guarantee diversification. I am rarely a trader, my average hold is probably getting on for 10 years.

The Terry Smith axioms:

1.) Buy Quality Companies

2.) Don't Overpay

3.) Take A Long Rest

are probably as good a guide as a newcomer and most of us more grizzled characters could have.

Whatever path you choose, good luck.

Bonitabeach

20ish seems reasonable to me, providing they are diversified, but how/where do you draw the line?

Define "diversification".

Most peoples' idea of diversification is something along the lines of picking stocks from different sectors. However, the idea of 20-ish stocks as sufficient to diversify away idiosyncratic risk comes out of the Efficient Markets Hypothesis which I doubt many people here subscribe to. If the purpose behind your diversification is managing such risk then you need to go through the mathematical process of ensuring that the stocks you pick are properly uncorrelated.

Normally people talk about running relatively concentrated portfolios (say 15 to 30 stocks) because that's what they believe they have the time to understand. Well, I've been investing for 35 years + and I reckon most companies are beyond my ability to analyse. In fact I think most companies are too busy for their managements to understand. Looking at the numbers twice a year and keeping an eye on any updates isn't a massive overhead. Spending lots of time obsessing over price moves, media articles and other peoples' opinions is.

In fact I think there's a real danger in concentrated portfolios of investors being far too hair-trigger. Let's face it - if (say) 5% of your personal wealth is bound up in the fortunes of one company you're going to be very interested in everything to do with it. Personally I don't have the time or skill or rock-hard nerves needed to manage that. And, anyway, the massive gains tend to come from buying good companies and holding them for a very long time. To do that you've got to be able to ignore volatility.

Take my longest held holding - the humble builder's merchant James Latham (LON:LTHM) which I bought back in 2005. It's bumbled along at a CAGR of about 12% a year ever since and is now up seven times on my original purchase price. At one point along the way it halved in price, there have been several major falls. As part of a concentrated portfolio I would probably have sold it many years ago but as part of a very diversified one it's simply sat there and grown. Mostly I don't even notice when shares fall significantly for market driven reasons (as opposed to profit warnings, which I do take notice of).

Anyway, I never hold less than 60 positions, sometimes significantly more. I don't worry about diversification in terms of sectors or correlation and I don't worry about markets jiving about. Overall I've outperformed every single UK index comfortably over the last twenty years (although, frankly, the returns on some of those have been abysmal). I'm not a particularly good investor - although I am happy piling cash into the market when there's a correction - but this is the power of equity reinvested for compounding returns. It's the closest thing to a free financial lunch anyone will ever get.

You'll need to figure out for yourself what works for you - don't just blindly accept truisms like "too much diversification can damage your returns". It may, but too little can do so as well, and do so much more quickly. But if you have something in your portfolio that keeps you awake at night - sell it. Life is too short to spend worrying about something so irrelevant to actually living.

timarr

Hi timarr,

I could easily have written the same thing. It's scary how similar our approaches are! The absolute minimum number of shares I'd hold these days is 60 and probably more like 80. The idea that such diversification means you have a closet index tracker is wrong, but that's EMH for you!

But to be honest, that's just a reflection of where I am in my investment lifetime having been financially independent for a few years now. I'm not sure it's necessarily the best approach for people in their 30's or 40's, for instance. Back then I used to hold less than 30 but had some index tracker funds too.

The problem I have with discussing holdings in a "portfolio" on a BB is that it doesn't mean much because everyone has their own definition of what their "portfolio" is and it could be very small percentage of their total investment pot. For example, only the other day I read someone on the SCVR state they had some very large percentage of their portfolio in Boohoo (LON:BOO) only to then subsequently state that they had a much larger portfolio run by an investment manager. So in reality their exposure to Boohoo (LON:BOO) was much less than they had originally stated.

With regard to pjohn005's original question, it's impossible to answer without having much more information about their personal circumstances.

All the best, Si

For a relatively simple sounding initial question, this is turning into an interesting discussion.

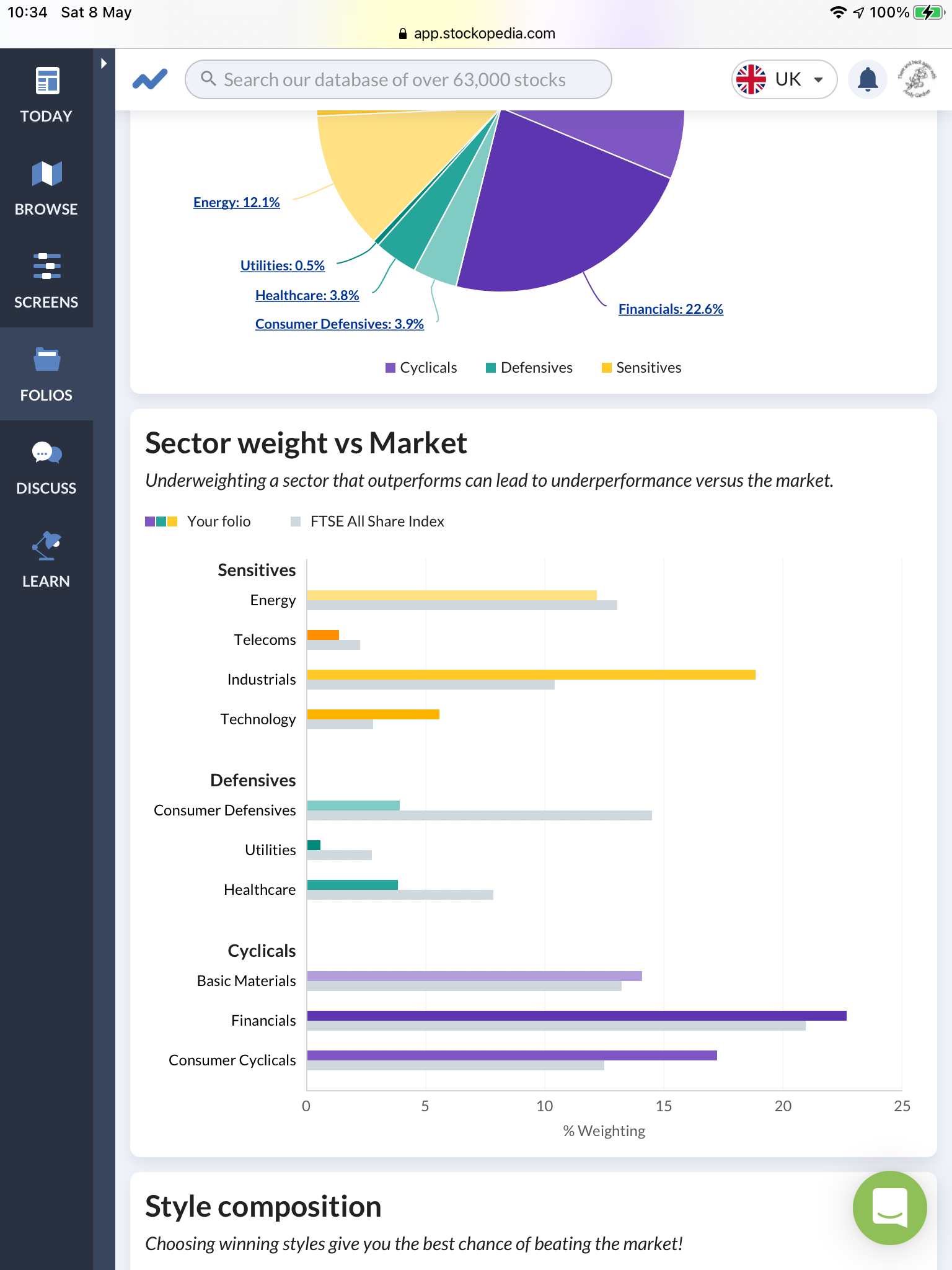

Having admitted (reference earlier post on this thread) to owning 200+ shares and effectively creating an expensive U.K. tracker fund, I’ve compared my share portfolio (excludes OEICs and other collective investments apart from ITs) composition to the U.K. all share. It looks as follows:-

Although some of the allocations are quite close to the relevant FTSE sectors, I’m clearly overweight in Industrials, Technology and to an extent Financials (albeit that I think ITs count as Financials even though they’re typically invested in a wider range of sectors). Similarly, I am light in Consumer Defensives, Utilities and Healthcare sectors, the last two of which I don’t really have much of an empathy for (although for this reason I do hold some Healthcare focused ITs). Consumer Defensives generally don’t seem to offer a particularly good risk:reward to me at the moment. A separate analysis shows me that my average Stock Rank score is in the mid-70’s whereas presumably the FTSE All Share is more or less by definition about 50.

By both analyses it would appear I haven’t unwittingly created a U.K. index tracker after all (or at least if I have it’s not a very good correlation) as it’s clearly skewed to particular sectors and has a higher average Stock Rank score than the wider market. Whether I’ve added any “alpha” or not remains to be seen.

Gus.

It's worth reading this article I wrote quite some time ago... "How many stocks to own in your portfolio"

I would agree that this market maker tree shaking to profit from stops seems common, be wary of unexplained moves down in small caps on low trading volume, they're often followed by strong moves to new highs on larger volume.

This is exactly what happened to Sylvania Platinum (LON:SLP) last year in July. The price fell from 50 to 37.5 (25%) over a couple of weeks for no apparent reason, and subsequently trebled to around 138 in 10 months. Classic tree shake, as you pointed out at the time.

Great article Ed. Although I respectfully disagree about James O'Shaughnessy's book 'What Works on Wall Street'. It was a monumental piece of research, and a fascinating read, but the conclusions IMHO were out of date by the time the book was published.