We are currently in a bull market. It has been a bull market for quite some time. Looking back, bull markets tend to eventually end. When this happens, by what trigger, and what course it will take, are all unclear (at least to me).

My question to you, fellow presumed investors, is how do you intend to prepare for an eventual bear market?

Do you intend to:

A) Continuously invest now and throughout any bear market.

B) Short the market when you think it will turn down/after it has started to turn down.

C) Increase the proportion of your savings that you hold cash (like Warren Buffett, although he has size constraints that individual investors do not), or alternatively in bonds?

D) Move investments into less cyclically affected shares or markets.

E) Do nothing as "this time it's different (TM)", and bear markets will never happen.

Or something else?

Please share what you intend to do, and whether you intend to do so before a bear market or if you think you will act after it begins? Also feel free to share what approach you took during the last bear market, and how that worked out.

Disclaimer: I am not saying I want a bear market to happen, I do not wish to upset anyone and I am not trying to influence anyone's financial decisions. I just want to have a nice pleasant discussion on the matter and for people to share their strategies.

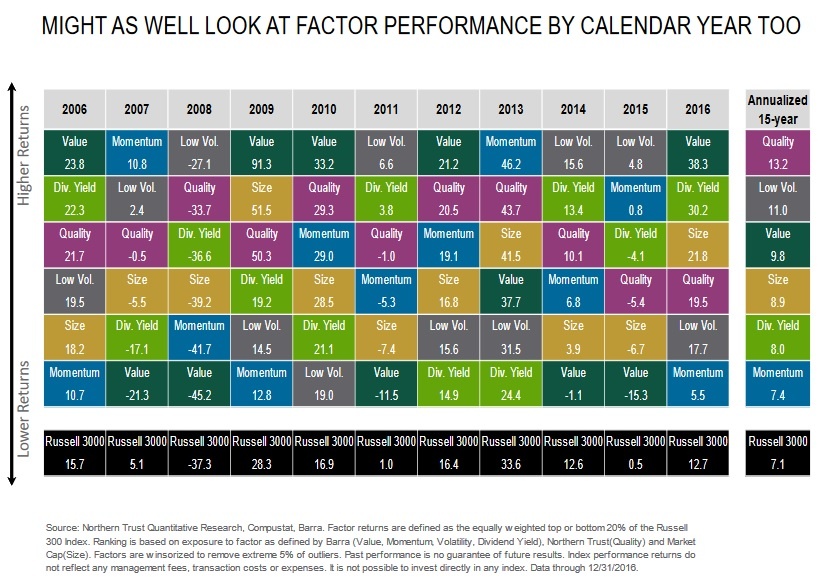

I'd agree with gus's observation - when markets go down, everything will go down - value, growth, small, large, high quality, low quality, low risk, high risk, high momentum, low momentum.

Sure some factors will decline more severely than others, but it will be little consolation if the market drops 20% to be 'only' down 15%. Take a look at the performance by factor in the last bear market of 2008 (US stocks, Russell 3000):

So for me the the choice is binary:

- switch to cash &/or

- take out an index hedge (via one of the CFD providers)