When it comes to stock market truisms, the idea of ‘buying low and selling high’ sums up what many of us would recognise as value investing. It means buying cheap and waiting for a recovery.

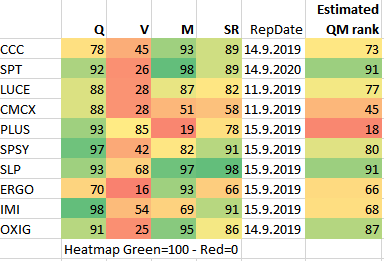

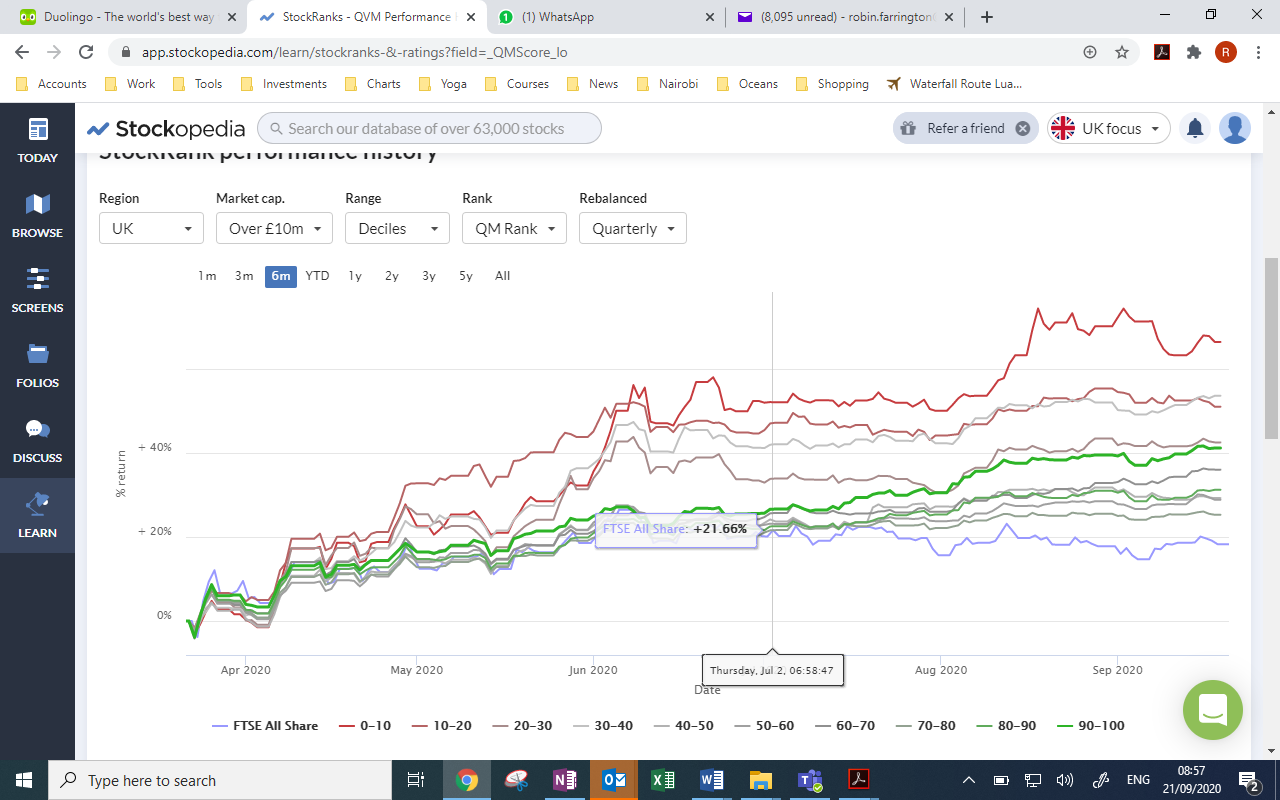

But over the past 50 years, another path to investment profits has earned a growing reputation: momentum investing. Momentum is the art and science of buying stocks when they’re rising and then selling at even higher prices. This strategy has had a strong run over the past decade... and with the help of another key factor, it’s also played a role in driving the best performing shares through the 2020 Covid-19 crisis.

Buying shares on the up

No-one knows precisely when momentum emerged as a stock market strategy. But back in the 1970s and 80s, a man named Richard Driehaus was using it to build a reputation as one of the best money managers in America. Driehaus and his firm Driehaus Capital Management live on, and he’s now known as a father of momentum investing.

He was once quoted as saying: “I would much rather invest in a stock that’s increasing in price and take the risk that it may begin to decline than invest in a stock that’s already in a decline and try to guess when it will turn around.”

This kind of view is at odds with traditional value investing and in recent decades financial researchers have paid attention to understanding it. Momentum has become its own discipline, with drivers and behavioural triggers that many agree on. But the researchers also found flaws...

With value, everyone generally agrees that it needs patience and sometimes doesn’t work at all. By contrast, a typical momentum strategy would buy the fastest rising stocks and hold them for between six and 12 months before the effect reverses. But the ever-present risk is that momentum can crash suddenly. It can get battered when markets turn south, which is exactly what we saw at the height of the financial crisis.

Mixing up momentum

To try and neutralise this crash risk, some of the best financial thinkers have mixed momentum with other factors to try and smooth out the returns. One example is US fund manager James O’Shaughnessy, who played a major role in showing how momentum and value can achieve outperformance when used together.

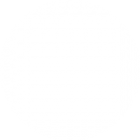

Others have suggested combining momentum and quality - and it’s here that…