As announced, I would like to keep you updated on a regular basis about my DGI portfolio which I started this year. The whole thing is not designed for short-term speculative gains, but a marathon.

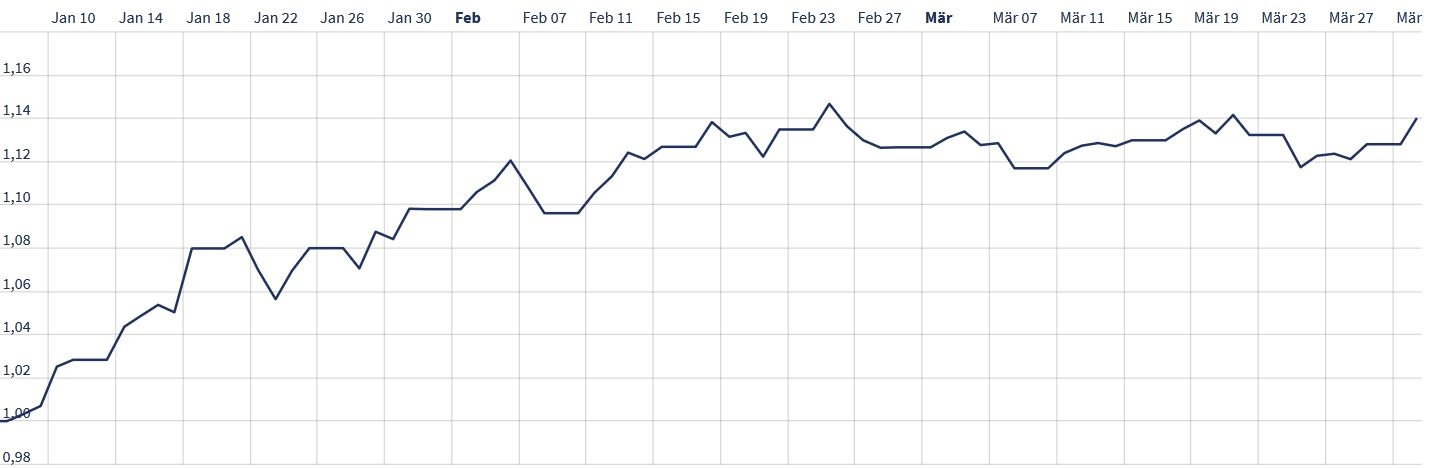

The first quarter is behind my new Quality Dividend Growth Portfolio. And my selected securities are doing well. My depot gained around 14 percent until April 1st. And even if my main goal is not the price gain, but a regular income stream of steadily rising dividends, it is nice to see green numbers everywhere.

From January to March, dividend income amounted to 167€ after tax and comes from six companies. The average dividend yield so far is 2,66%. Illinois Tool Works and Loomis have not yet distributed. At ITW, I was behind the ex-div day with my purchase on January 7th, so I did not receive the payout in early January. I will receive the first dividend there at the beginning of April. Loomis will pay in May.

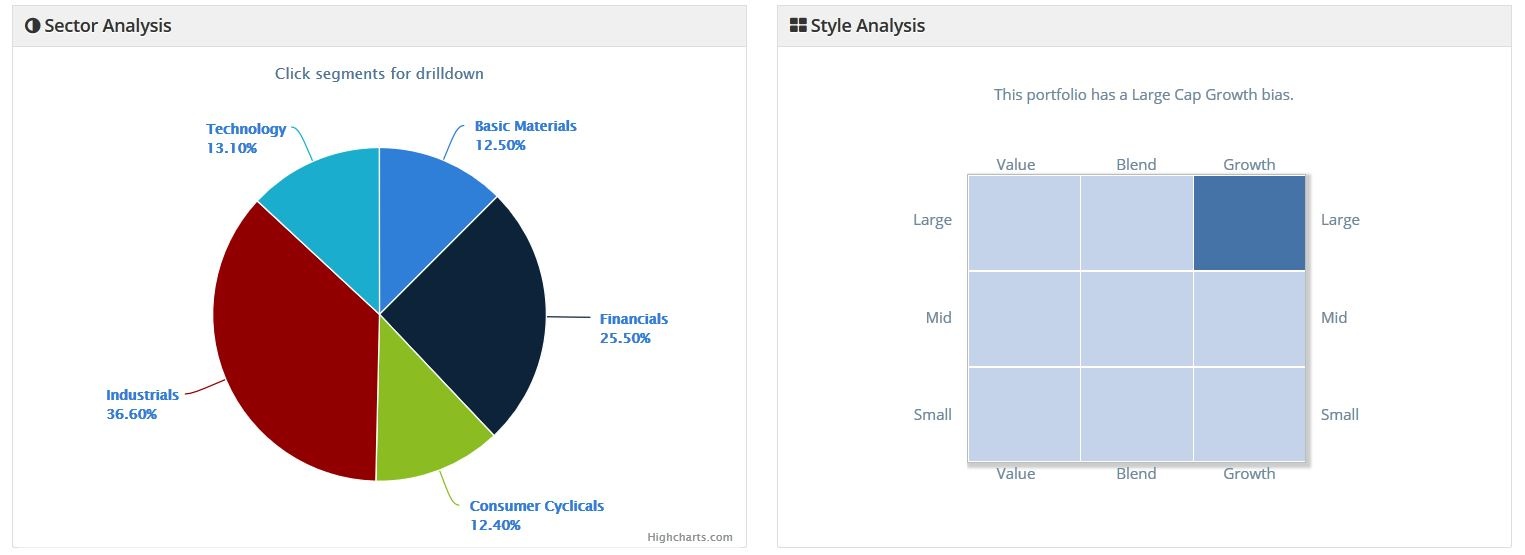

In addition to the dividends paid, I also use my monthly savings rate to gradually acquire further good quality Dividend Growth shares. So I will strike in the next few days at the US company Fastenal. Fastenal resells industrial, safety, and construction suppliesand offers services including inventory management, manufacturing, and tool repair. Sometimes the name is just program. ;-) The company is financially healthy, has little debt and has been able to increase the dividend in the past five years by 14% in average. For 2019 are again round 7,34% advised. Currently the dividend yield is 2,38%.

If you want to know more about my investment approach, you can look at the origin post. It can be found here: https://www.stockopedia.com/co...

Disclaimer/Disclosure: This is no investment advice. This post is just for entertainment and the exchange of experiences. I am long on stocks mentioned above.