Just over 2½ years ago I attended the Mello investment conference up in Derby; a whirlwind of inspiring lectures, company presentations and face-to-face meetings with management. At the time a number of companies caught my eye, many of which I labelled as being just a little too expensive to invest in, while a few felt like good ideas more suited to private ownership.

A few weeks ago I unearthed the conference brochure with original Stockopedia figures for all 36 companies. About the right size for a diversified portfolio and, more usefully, a great opportunity to see if these at the time figures correlated in any way with future performance. The key question then that I want to address is whether we could have used any piece of data at the time to help us separate the winners and losers. After all this is at the core of what we, as investors, try to do with tools such as Stockopedia.

Editor's note - we have managed to dig out the original conference brochure from the Mello 2014 event. You can download it here.

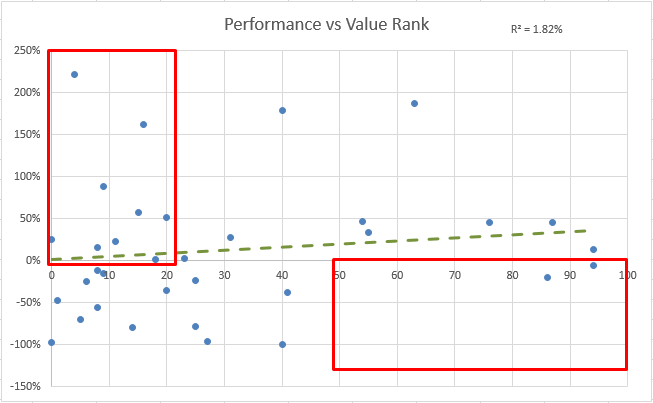

Obviously this isn't a statistically rigorous analysis, with so few data points, but that's never stopped anyone before. I've tried to keep the statistics to a minimum by fitting only a simple linear regression model (i.e. a straight line) to the data and calculating how closely the points fit this line. In broad terms a higher value of R2 implies a stronger correlation with performance in the graphs that follow.

Oh and it's worth remembering that the last 2½ years are just a slice of the current bull market and hardly representative of any other market condition (such as a proper bear market). So on the basis that all of my analysis might be bunk let's move onto the numbers.

Value Rank

Value investing has a long and glorious history and I started out as very much the value investor; unwilling to pay a high price for shares and concerned with identifying overlooked value. So has value paid off?

While there is no direct correlation between Value Rank and performance I've highlighted the two areas which seem most interesting. In the top half of the ranks, where only a quarter of the companies sat, there are…

.png)