Should investors dismiss the idea of quality investing?

As Ed highlighted in his 2025 StockRanks review, the quality factor underperformed (again) last year.

High profile exponents of the quality approach such as Terry Smith and Nick Train also endured a torrid time in 2025, underperforming both cash and most equity benchmarks.

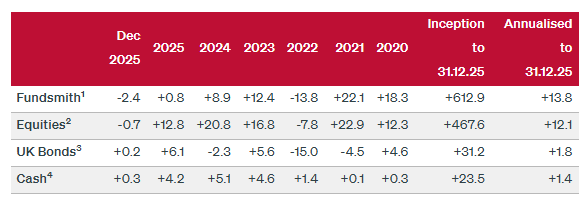

Smith’s flagship Fundsmith equity fund has lagged its chosen equity benchmark for the last five years. In 2025, the fund’s accumulation units generated a return of just 0.8%:

Source: Fundsmith factsheet 13/01/26. Equity benchmark is MSCI World Index.

It’s always easy to demonise well-paid active fund managers who underperform the market. As this classic investing book asks, Where Are the Customers’ Yachts?

I don’t plan to wade into the debate about active fund management costs today. But I think it is fair to say that Terry Smith’s efforts probably have paid for some of his customers’ yachts – at least those of his long-term customers.

By the end of 2025, Fundsmith had delivered an annualised total return of 13.8% since the fund’s inception in November 2010. That’s comfortably ahead of both the fund’s MSCI World Index benchmark (12.1%) and the FTSE 100 Total Return index (7.7%) over the same period.

To put this in context, an investment in Fundsmith of £10,000 in November 2010 would have been worth £70,277 at the end of 2025.

That compares to £56,004 for the MSCI World Index and £30,614 for the FTSE 100.

Why quality ‘should’ still pay off

Critics of Smith will suggest that his early success was due to good timing and the broad re-rating of many quality stocks during the low interest rate era. These factors certainly helped, in my view.

However, I can’t help feeling that a strategy focused on buying shares in high quality companies with growth opportunities and holding them for a long time still makes a lot of sense.

One reason for this is highlighted by this quote from Warren Buffett’s late partner, Charlie Munger:

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns.

Companies with high ROCE that can reinvest at high rates should create value above their cost of capital. In theory,…