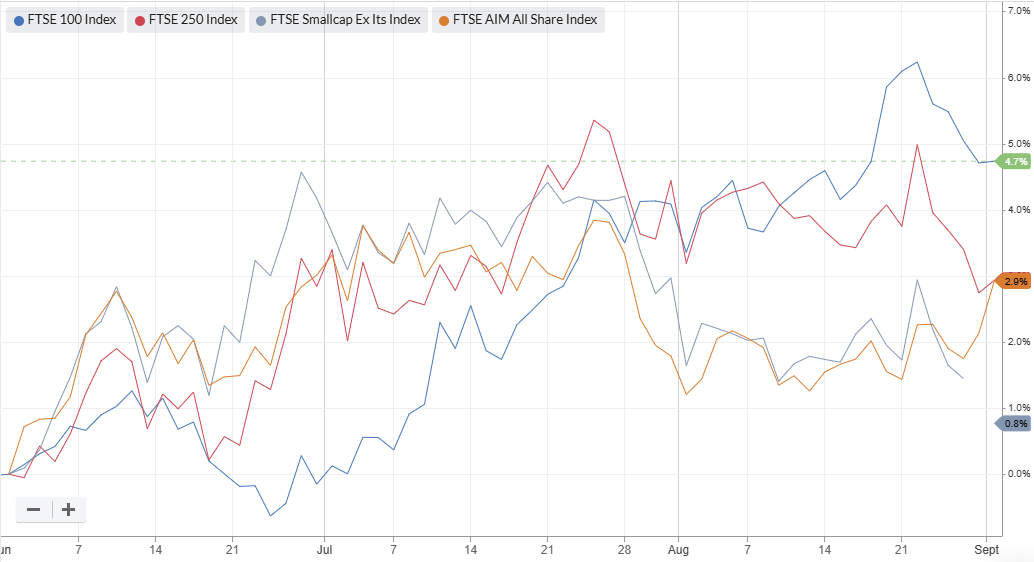

The main UK share indices delivered a mixed but relatively unexciting performance over the summer. Congratulations if your portfolio came out ahead of the market.

Of course, small movements in an index can mask some big swings in individual share prices. As stock picking investors, we want to be on the right side of these moves if we’re to have a chance of beating the market.

To see if I could find a way of highlighting such stocks, I’ve been working on a new screen designed to help me find shares that are currently riding a wave of momentum.

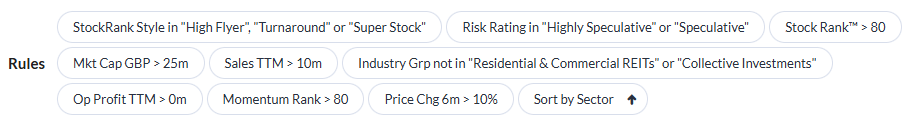

The end result was a screen I’ve named Riding the Rally. This uses the StockRanks plus some simple rules to try and identify companies with positive share price momentum and above-average volatility.

Screen rules: here’s a summary of the rules I’ve used and the reasons for my choices.

Industry Group: I’ve excluded REITs and Collective Investments as they aren’t regular trading businesses and need different types of analysis.

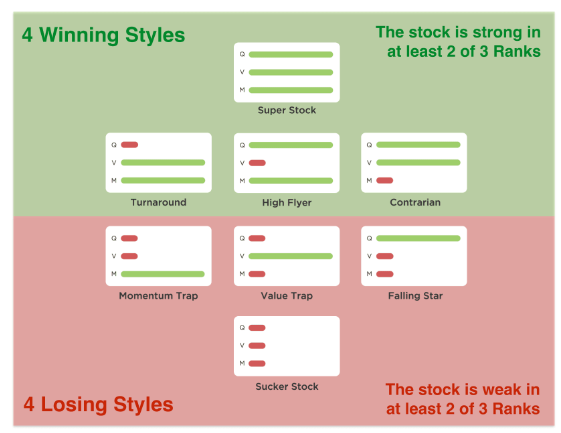

StockRank Style: I’ve restricted the screen to stocks with High Flyer, Turnaround or Super Stock styling. This is because I only want to consider stocks that fit winning, momentum-driven styles:

This is a relatively short-term trading approach that isn’t suitable for quality or value-focused investments. There’s a full explanation of the StockRank Styles here.

RiskRating: volatility isn’t always desirable, but in this case I’m looking for stocks that are likely to see bigger share price movements over the short-to-medium term.

Our RiskRating system classifies the most volatile stocks as Speculative or Highly Speculative – so I’ve restricted the search to these stocks. See here for more on RiskRatings

StockRank >80: I want to restrict my search to companies that are statistically more likely to outperform the market. There are no guarantees, but higher-ranked stocks have done better, in aggregate, since the StockRanks launched in 2013.

MomentumRank >80: the MomentumRank scores shares for a blend of factors that are designed to highlight both price and earnings momentum. This is useful because some stocks rally due to earnings upgrades, while share price growth at others (such as Turnarounds) may be more driven by a re-rating.

I…