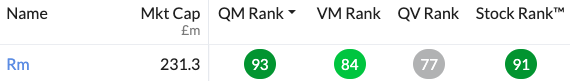

Rm (LON:RM.) is a leading supplier of technology and resources to the education sector - and a small cap that has been earmarked by Stockopedia’s rankings as a promising Quality Momentum (99) and Value Momentum (88) candidate.

With a market cap of just £231m, annualised revenue of £224m and a strategy that involves moving into higher margin global markets, you would think then that there is plenty of opportunity for earnings growth and share price reratings here.

Founded in 1973 as Research Machines in Oxford, RM initially traded as a mail-order supplier of electronic components and then moved on to creating and supplying computers to UK schools. The RM of today has long since moved on from the low margin supply of hardware. Instead, it focuses on providing software solutions and automated exam processes to educational establishments around the world.

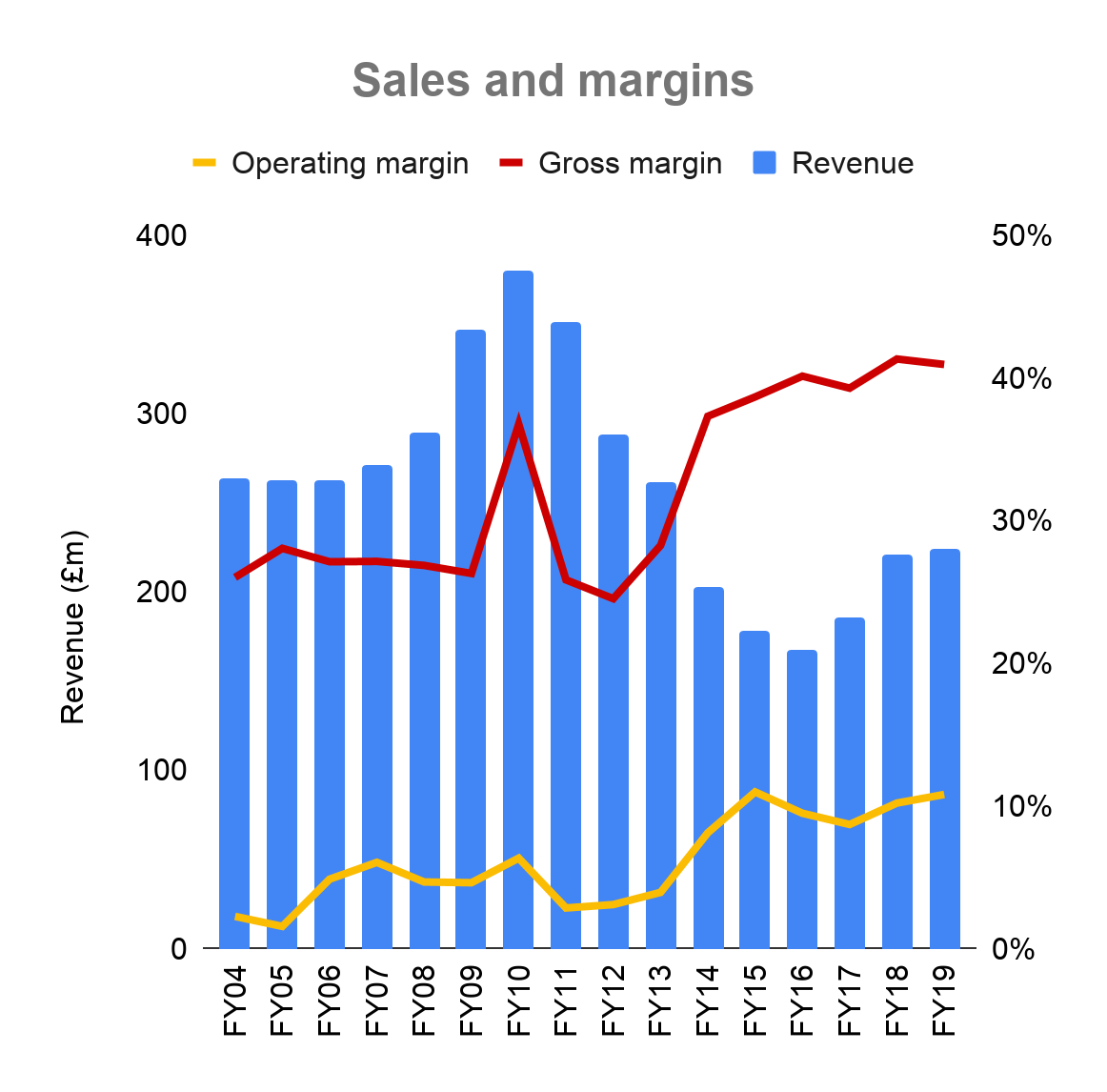

RM’s old core business of providing computers to schools was low margin and capital intensive. Education cuts in 2011 hurt the group badly, prompting a review of its businesses. Hundreds of jobs were cut and non-core divisions were jettisoned.

You can clearly see this story playing out below, with a spike down in 2011 followed by declining revenues but increasing margins as the company set about becoming more profitable and expanding into higher margin software services.

So it looks as though RM is evolving into a more profitable, higher margin company. It certainly talks a good game of higher margin integrated products, growing intellectual property and international expansion.

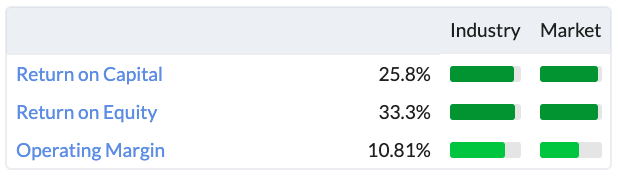

This, you’d think, would allow for a much larger and more profitable company. The company’s return on capital figures suggest it is finding smart ways of investing its capital

Upon closer look though, I do have some concerns which I go into below.

Is RM at an inflection point or does it flatter to deceive?

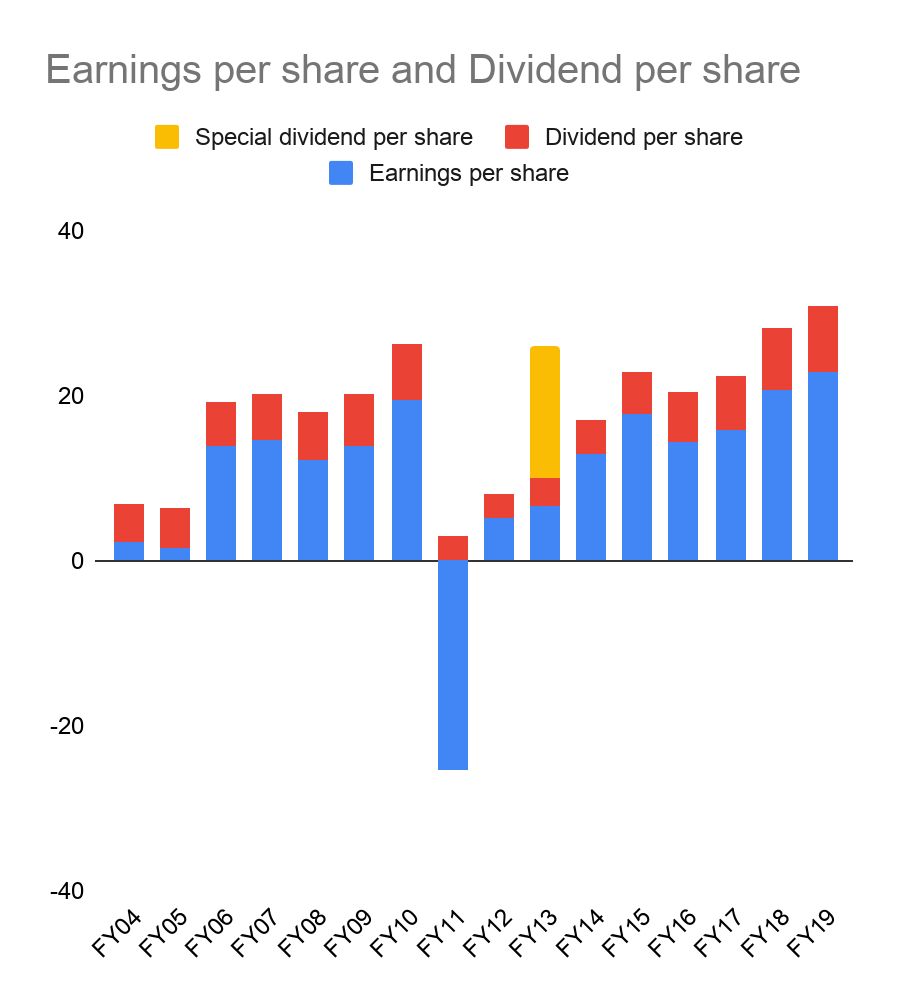

With the exception of 2011 the group has a solid history of making dividend payments to shareholders.

RM’s FY19 results show 23p of earnings and an 8p dividend - not bad when shares are trading at c280p. However, the update is a mixed bag with lots of moving parts.

The company’s own performance graph in its 2018 accounts shows…

.jpg)