TL;DR:

RTC Group is a recruitment consultancy that has been through some tough times and yet finally seems to have turned the corner with new management, improved focus and the recent award of a substantial new contract with key customer Network Rail.

Introduction

RTC Group listed on AIM back in June 1998, as ATA Group (est. 1963), but its interesting history begins in 1992. This was when Bill Douie, Clive Chapman and Graham Chivers clubbed together to take the best bits of the old recruitment consultancy off of the books of the liquidator and turn them profitable again. This went pretty well, in the go-go 90s, with ATA hitting the Virgin Atlantic Fast Track 100for four successive years (1993-96) and each division (Engineering Technology, Sales, Advertising Selection and Training) becoming profitable.

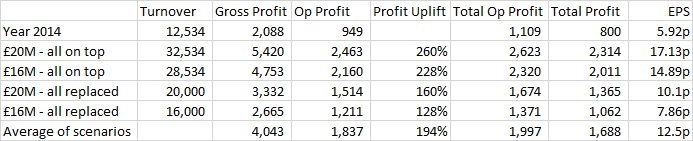

A company in fine fettle then and yet, for various reasons, this pre-admission success has never been recaptured in all of the years since. Divisions, such as Training, have been shuttered or sold off while other businesses, such as Ganymede Solutions, have been acquired to add some profitable vim to the group. This activity, it seems, is now bearing fruit as Ganymede has been awarded a huge contract with Network Rail (£80-100M over the next five years) against stiff competition. This could easily be transformational for RTC Group but can they handle it?

One reason to believe that they can is that the executive board has been transformed by the arrival of Andy Pendlebury in 2007. Initially joining as a non-exec the chairman quickly convinced him to take the hot-seat with a (sorely needed) mandate to turn the group around. As such he came up with a 5-year plan to create a focused recruitment company, with improved management and profitability across the board, and by all accounts he seems to have succeeded thus far.

Why did it all go wrong?

This is rather a multi-dimensional question given how the share price has fallen unrelentingly since admission (with one major recovery) and the company has repeatedly failed to deliver shareholder value; there's more afoot here than just the knock-on effect of a global recession or a single bad decision:

Reading through all of the available financial statements what strikes me is that RTC Group is more than just a cyclical business: it's a service company that operates at the mercy of its…