Risk in the market seems high at the moment - this rally is good for morale but it smacks of euphoria and relief. I’m not about to make short term forecasts, though.

Perhaps the positive momentum keeps going, economies recover quickly, and we all sail on to new all time highs - but I’m prepared for further volatility should that not come to pass.

In the short term who knows, but in the longer term you can be a little more clear-sighted. Investors that place themselves in markets with favourable long term growth trends allow structural growth characteristics to do more of the heavy lifting for them.

Following on from this look at IT value-added reseller Softcat, I’ve done some work on cybersecurity stocks. It’s one area that the world will need more of in the future - so finding well-run companies with good prospects in this sector makes sense.

Listed cybersecurity plays

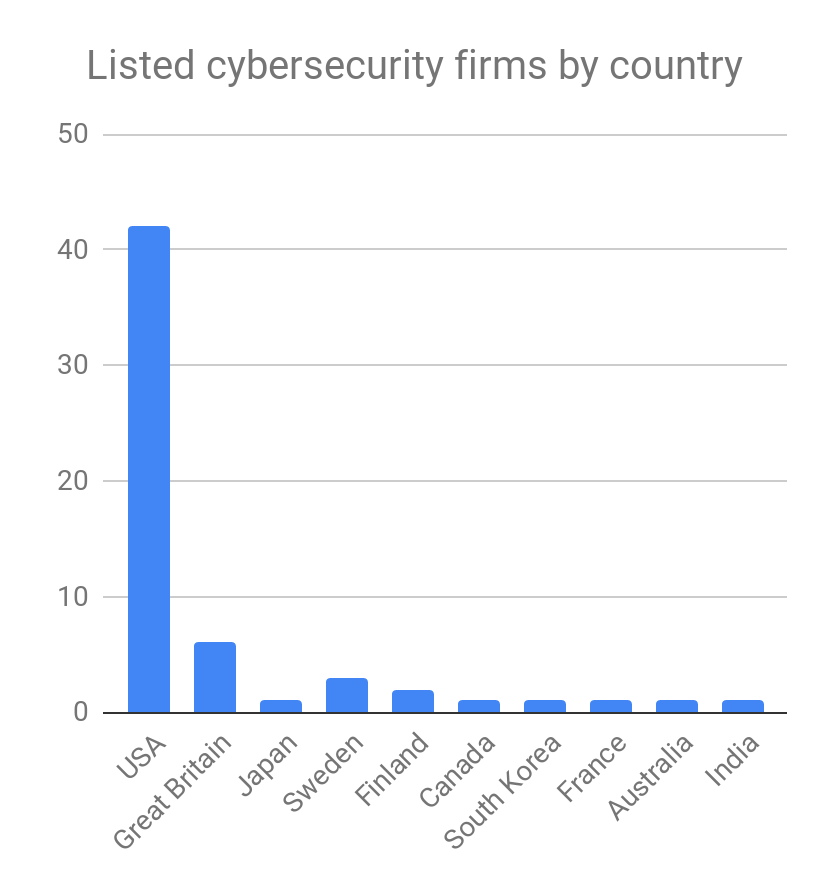

I’ve constructed a 60-strong sample of listed cybersecurity firms. It includes FANGMAN giants Microsoft and Amazon but even when not weighting the set by market cap, the results show a clear US bias.

This is probably not a surprise to many, but the scale is sobering. In looking at UK opportunities, we narrow our options dramatically.

If people want to see the names of the companies in the sample let me know. It’s a question of where to put them (perhaps in a comment?). For the sake of brevity, I haven’t included the list in this article. Some of the bigger names include, in order of market cap: Microsoft, Amazon, Cisco, and IBM, and in the UK: BAE and Avast.

The sample set has an aggregate market cap of a cool £2.8 trillion. Bear in mind though that Microsoft and Amazon alone account for more than three quarters of that market cap, with vast swathes of their business being unrelated to cybersecurity. It’s a tremendous range of market caps, from Microsoft’s titanic $1tn+ valuation right down to sub-$10m micro caps.

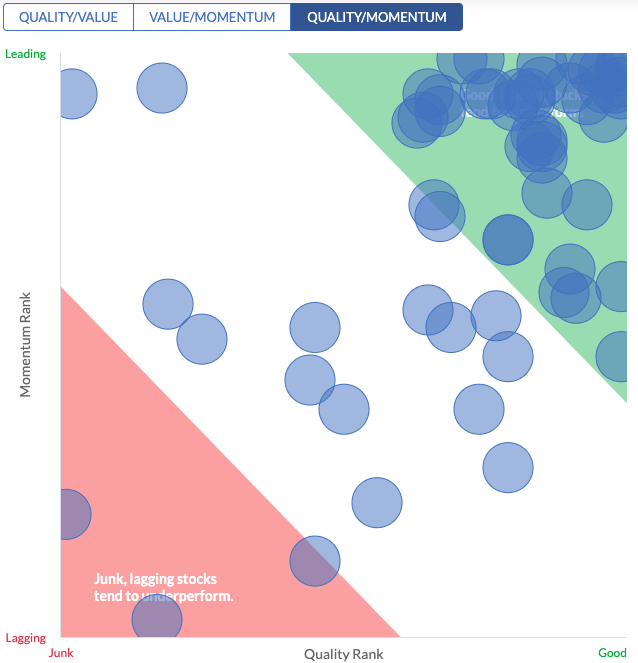

Putting those considerations to one side for now, the clear QM bias of the sample is striking.

Aggregating the data, the high QM factor profile becomes even clearer - nearly two-thirds of the sample are High Flyers, with not a single Contrarian or Turnaround stock in…

.jpg)