Edit to "how the screens work", below, clarifying what happens if less than 25 candidates.

It is generally considered good practice in statistics/machine learning to split samples into training and test data sets. This is to avoid over-fitting and/or data mining where a result or model derived from one data set has poor performance when applied to out of sample data.

Why is this relevant for screening? I thought that we could treat different regions as different samples. Assuming that regions don't have distinct characteristics and performance is determined by a common underlying behavioural set of responses from humans, then screens that perform well across all regions are more likely to be tapping in to those factors.

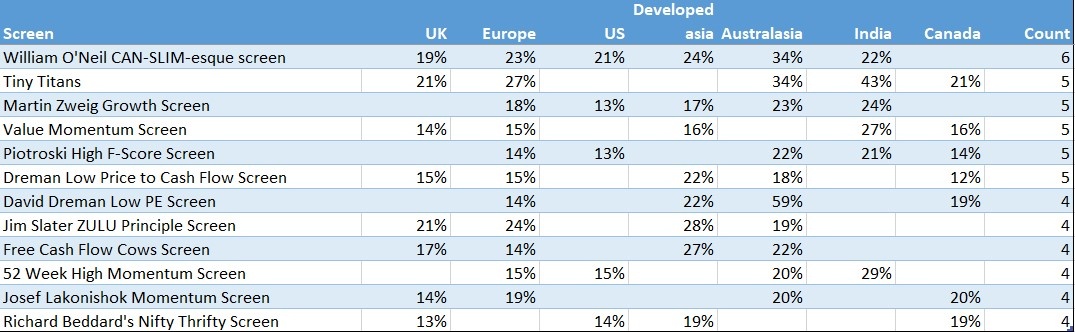

Definition of 'works': Appears on first page of https://www.stockopedia.com/sc... (vary region)

Below are the results ordered by count of region appearances in 'works', tiebreaker by average across regions (when it appeared). Cut off is >= 4 region appearances. The percentages are the annualised performance. For individual regions there will be strategies that have performed better. My question is "did they just get lucky?"

CANSLIM* edges into first place making the list in 6/7 regions, closely followed by Tiny Titans, Martin Zweig Growth, Value Momentum, Piotroski High F-Score & Dreman Low Price to Cash Flow each with 5/7 appearances. 6 of these 7 screens have a valuation criteria (PE, PS, PEG); CANSLIM does not. 5 of these 7 strategies have a relative strength criteria. 4 of 5 have an EPS growth criteria. 3 have quality criteria (including F-Score as quality).

I was surprised at regional variability, which undermines my assumption that the regions can be considered as homogeneous. If I had a full subscription I would pull off the annualised return for each strategy, with the max drawdown for further analysis.

*In my opinion CANSLIM can be considered as a Weinstein strategy + fundamentals. It is the closest here to a Minervini strategy, who adds more momentum criteria (trend template), specific entry criteria and also emphasises position sizing.

Caveat section below, recycled and edited from a previous post (very green), which prompted me to look further into consistency of performance ... if it seems familiar skip it!

Edited:

How the screens work is explained here: https://www.stockopedia.com/co...

The screens are only selection criteria, they buy…